Last week was an uncharacteristic week for Nvidia (NASDAQ:NVDA), this year’s soaring AI star. Shares fell 8.5%, mostly due to Super Micro Computer guiding for a slight drop in systems revenue in the September quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But what’s that got to do with Nvidia? Well, the company is an OEM customer that uses Nvidia’s GPUs so could this signal that the chip giant is about to experience a downturn too?

Not really, says Morgan Stanley analyst Joseph Moore, who believes the direct ramifications are “fairly minor.”

“While we aren’t close to the SuperMicro situation, it has been clear for some time that OEMs are limited by their ability to procure inventory,” the 5-star analyst explained. “While allocations of GPUs are likely up sequentially in the September quarter, most OEMs drew down inventory in 2q as the GPU shortage became more pronounced, so the bar to grow OEM revenue is higher without a repeat of that inventory sale in 3q.”

Moore also makes the case that Nvidia’s allocations are first going toward hyperscale customers and other service providers, while also favoring its own internal businesses including DGX servers.

“That said,” he goes on to add, “it does provide a reminder that triangulating October quarter NVIDIA numbers from supply chain is an imprecise equation.”

We’ll soon get an idea how that is going when Nvidia reports July quarter earnings on August 23.

Moore’s suggestion to investors is to not “overthink.” The analyst is expecting a “solid beat and raise quarter, with uncertain magnitude, but with visibility extending through CY24.”

While Moore notes that “triangulating” data from various supply chain sources into profit forecasts might lead to overly optimistic predictions, he claims that based on the insights gathered from multiple industry insiders and cloud clients closely connected to Nvidia, confidence remains “very high.” Any near-term constraints in the supply chain will only strengthen the conviction in potential future growth, signaling to Moore that it’s “really just a question of whether we see the upside now, or later.”

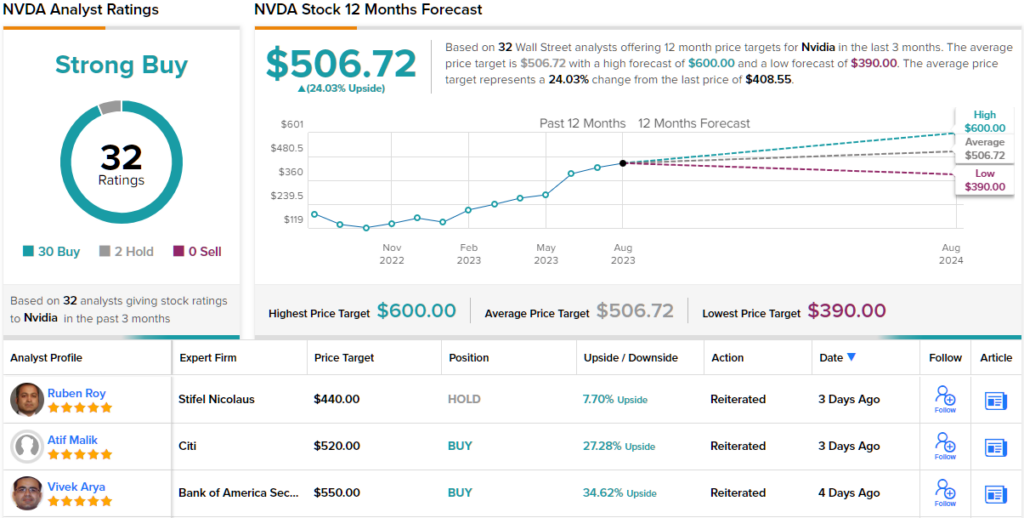

All told, then, Moore maintains his Overweight (i.e., Buy) rating for the shares while his $500 price target leaves room for one-year returns of 22%. (To watch Moore’s track record, click here)

Overall, it’s clear that Wall Street likes what it sees here. The stock has 32 recent analyst reviews, breaking down 30 to 2 in favor of Buys over Holds to back the Strong Buy consensus rating. The stock is selling for $408.55, and its $506.72 average price target suggests that it has room to grow 24% in the year ahead. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.