Apple’s (NASDAQ:AAPL) big iPhone 15 unveiling event is now behind us, and it appears to have gotten a lukewarm reception from investors. The launch of the latest iteration of the tech giant’s flagship product plus various other updates failed to ignite a rally and Apple stock now sits 11% below the all-time high notched at the end of July.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While many walked away from the ‘Wonderlust’ event disappointed, Morgan Stanley analyst Erik Woodring says the event generally met his expectations. And although some were surprised by the lack of a price hike for the iPhone Pro (although Apple did raise the Pro Max’s entry price by $100), that is not an issue to Woodring.

“In our view,” says the analyst, “the biggest takeaway is that Apple continues to synthetically drive iPhone ASPs (average selling prices) higher, despite no change to like-for-like pricing, which helps to offset the risk to iPhone shipments in China that we now embed in our model.”

The net effect of these changes is “largely neutral,” as the rise in iPhone ASPs sufficiently counter the expected drop in units. As such, Woodring now sees FY24 iPhone revenue of $221 billion, amounting to a 9% year-over-year increase and 9% above the Street, total FY24 revenue of $420 billion, also up 9% y/y and 3% higher than consensus, and FY24 EPS of $6.93, representing a 14% y/y uptick and 5% ahead of the consensus estimate.

That said, while the event has not altered Woodring’s positive stance, for the group of growing Apple bears that view China as a “re-emerging, paramount risk” not yet factored into the share price, the event has done little to persuade them to change tack.

And even though Woodring concurs with the idea the near-term risks to Apple’s stock are “skewed negatively (China, GOOGL DoJ trial, seasonal performance),” taking the longer-term view, Woodring remains decidedly upbeat, although only recommends backing up the truck once a more serious pullback takes place.

“We believe that over the next 12 months, the upside to iPhone, Services, and gross margin estimates will offset any potential multiple compression such that Apple can outperform peers, although we wouldn’t be aggressive buyers until the stock dipped into the $160-170 range,” he summed up.

Conveying his confidence, along with an Overweight (i.e., Buy) rating, Woodring gives Apple stock a $215 price target, suggesting shares will climb 23% higher over the one-year timeframe. (To watch Woodring’s track record, click here)

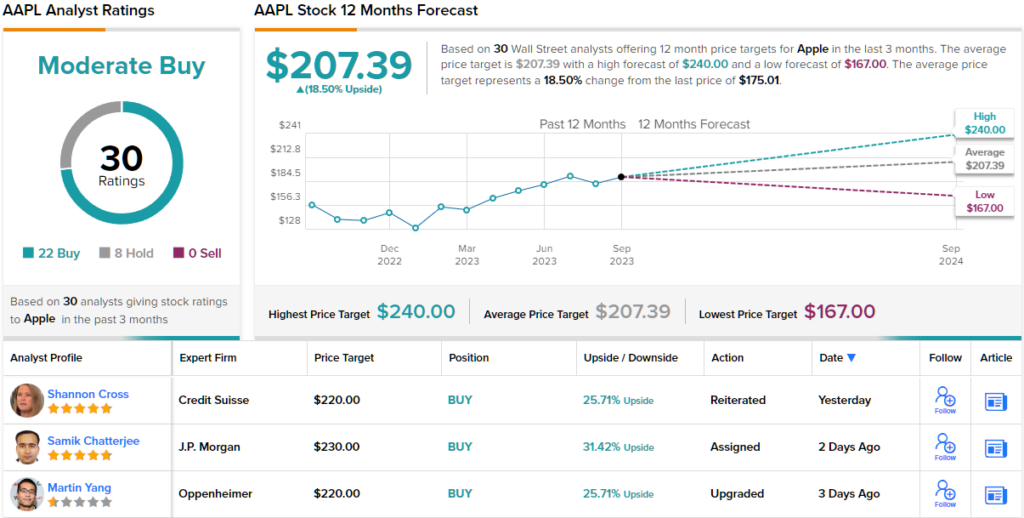

Elsewhere on the Street, the stock garners an additional 21 Buys and 8 Holds, all coalescing to a Moderate Buy consensus rating. At $207.39, the average target implies shares will deliver returns of 18.50% in the months ahead. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.