Alphabet (NASDAQ:GOOGL) stock heads into the year’s final stretch having just come off its best quarter in 20 years. The stock gained 38% in Q3, representing the shares’ biggest gain since the second quarter of 2005.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The surge is down to two big developments: a favorable outcome in Google’s antitrust case and growing success in its AI initiatives. The company has been pushing back on the idea that AI is undermining its core search business; it has been integrating AI more deeply into search through AI Mode and expanding multimodal search with tools like the Nano Banana image editor. Meanwhile, Gemini AI has taken off, claiming the top spot on Apple’s U.S. App Store charts in mid-September.

Citi analyst Ronald Josey believes that due to the “greater adoption” of Google’s AI products and services spanning both its core Search and Cloud businesses, CapEx at the tech giant is about to increase. “With GenAI demand continuing to outpace supply and Google’s product velocity accelerating, we are raising our CapEx projections on Google for 2026E and beyond,” said Josey, who ranks among the top 1% of Street stock experts.

The analyst now expects 2026 CapEx to reach roughly $111 billion, up from around $86 billion in 2025, and now forecasts a five-year 2024–2029 CapEx CAGR of 26%.

Gemini’s growth and AI adoption seem to be gaining pace as token usage rose from 480 trillion per month in April to 980 trillion in June. Cloud demand is also surging, with new GCP customer counts up 28% quarter-over-quarter and deals above $250 million doubling year-over-year. Gemini itself reached 450 million monthly active users – and Josey estimates it likely surpassed 500 million by September – with daily requests up 50% in Q2 and ongoing adoption of AI-Overviews and AI Mode. Around 60% of generative AI startups are on Google Cloud, and 9 of 10 AI Labs rely on it, underscoring the strong demand for Google’s AI offerings.

And this momentum appears to have carried into Q3. Notably, Google Cloud secured a six-year, $10 billion AI infrastructure contract with Meta, while its backlog rose 17% QoQ to $15.8 billion – outpacing AWS, which added $6 billion in Q2.

All the while, Gemini is increasingly at the center of Google’s offerings, “powering more of Google’s product halo.” In Chrome, it’s creating an AI-driven browser experience with AI Mode integrated directly into the address bar. On YouTube, Gemini fuels features like Veo 3 Fast Integration, Speech to Song, and Ask Studio. Google is also testing a standalone Gemini app for Windows, enabling users to access Gemini beyond Chrome and Search. Josey sees all this as a clear sign that Gemini’s capabilities are expanding, the result being growing user adoption.

“Net-net,” the 5-star analyst summed up, “Google’s CapEx is enabling an accelerated product development cycle that should lead to continued growth. While Search competition remains elevated, we believe Google is executing better.”

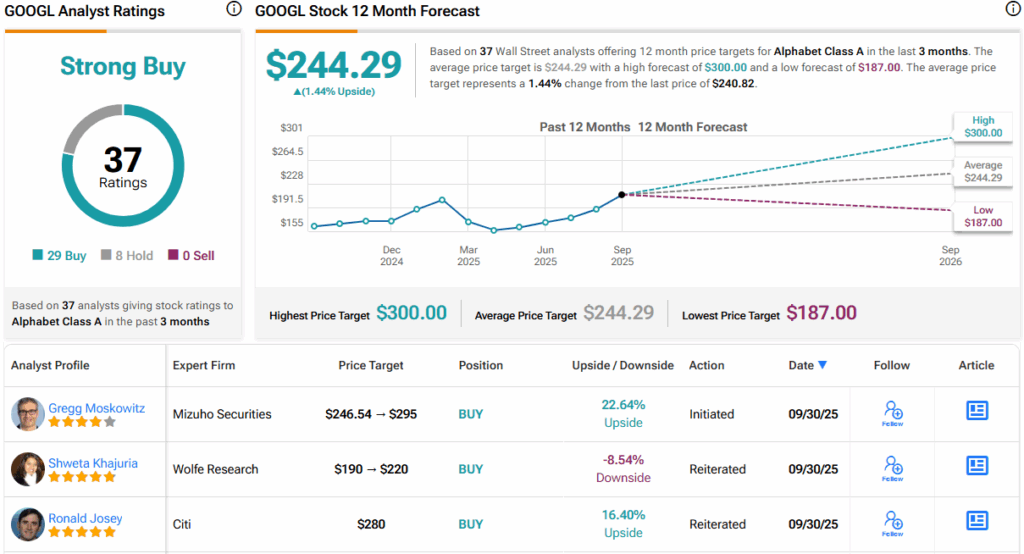

To this end, Josey maintained a Buy rating on GOOGL shares, backed by a $280 price target. There’s potential upside of 16.5% from current levels. (To watch Josey’s track record, click here)

Elsewhere on the Street, the stock claims an additional 28 Buys and 8 Holds, for a Strong Buy consensus rating. However, going by the $244.29 average target, shares appear fully valued right now. It will be interesting to see whether analysts boost their price targets or downgrade their ratings shortly. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.