Until not very long ago, Intel (NASDQ:INTC) was persona non grata for AI-minded investors, but that sentiment has reversed now. The stock has been a big winner recently, gaining 76% since early August buoyed by a series of strategic investments from the likes of chip giant Nvidia, Softbank, and the US Government.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But it turns out the company isn’t done padding its coffers – according to a recent Bloomberg report, the struggling chipmaker has also approached Apple as a potential investor. The article offered few additional details, noting only that Intel reportedly reached out to Apple, the two companies have discussed ways to collaborate more closely, and that the talks are still in early stages and might not lead to any outcome.

Is such a rumor plausible? “Sure,” why not,” says Bernstein’s Stacy Rasgon, an analyst ranked amongst the top 3% of Street stock experts.

So far, the company has raised nearly $16 billion through recent – though somewhat dilutive – funding rounds. Investors have speculated that the company’s ongoing effort to attract additional investors is intended as a vote of confidence, and that the Administration may be encouraging this, particularly following last week’s Nvidia announcement. Apple, with its substantial cash reserves and potential need for alternative advanced manufacturing capacity, appears to be a natural candidate. Rasgon thinks Qualcomm, Broadcom, Tesla, and the major hyperscalers could also be seen as potential investors.

But a product deal here appears less likely. For years, Apple has been gradually shifting its PC products away from Intel’s x86 architecture and has now fully transitioned its entire PC lineup to its own in-house Arm chips, making a return to x86 seem improbable. Similarly, Apple’s other product lines – such as phone and tablet processors and modems – are unlikely to move away from TSMC. “Perhaps there is something on the datacenter side (some sort of custom x86?) or packaging deal that might be possible, though those feel incremental at best,” the 5-star analyst speculated.

In any case, the question is whether money “all by itself” actually helps Intel? The answer, according to Rasgon is “not really.” The analyst’s take is that although additional funding is certainly beneficial, money is not Intel’s most pressing concern right now. The company has sufficient cash to fund operations and holds assets that could be liquidated if necessary, so it is not facing an immediate cash shortage. Instead, the funds would likely be used to expand manufacturing capacity, which is clearly a priority for the Administration. “But more than money,” Rasgon adds, “Intel needs customers to fill that theoretical capacity, and while there has been widespread speculation that Trump might encourage (force?) customers on them we don’t believe that is really plausible, or even necessary.” In short, Intel’s key challenge isn’t funding – it’s proving it can manufacture high-quality parts at scale, on time, and at a competitive cost.

That issue, however, does not seem to make that much difference to the stock right now. Rasgon has long believed that Intel faces fundamental challenges, yet he has been “terrified” to short it, especially with shares surging on recent announcements. In fact, Trump even posted a picture of himself watching the stock rise – a move so surprising Rasgon initially thought it was fake. As much as the analyst hesitates to admit it, “Trump wants the stock to go up” could actually be a temporary bullish factor – not one Rasgon is endorsing, although he “wouldn’t talk you out of it for now.”

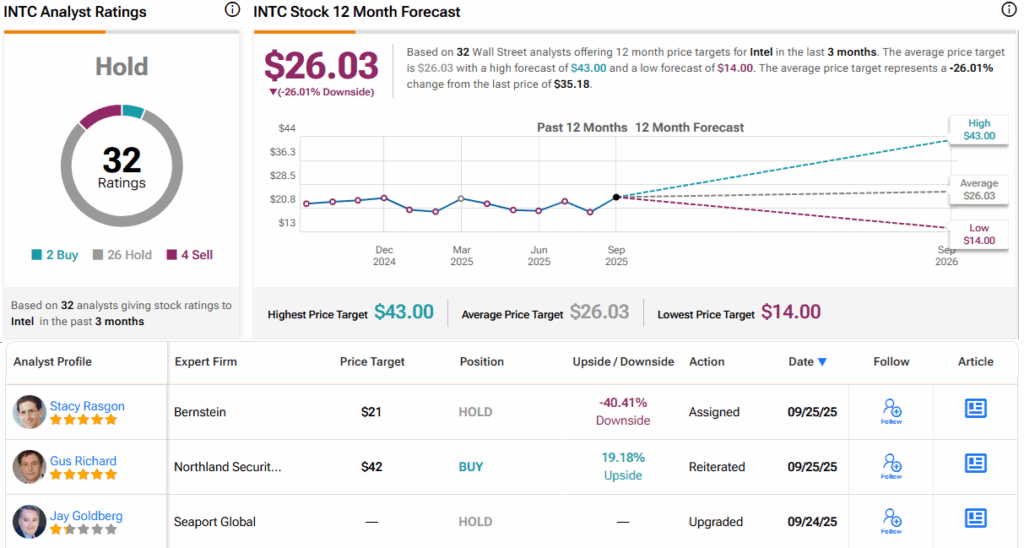

Bottom line, Rasgon rates the stock as Market Perform (i.e., Neutral), backed by a $21 price target. That might as well be a Sell, however, given the target sits 40% below the current share price. (To watch Rasgon’s track record, click here)

The Street’s average target is a more forgiving $26.03, which nevertheless suggests the stock is still overvalued by 26%. All told, the shares claim a Hold consensus rating, based on a mix of 26 Holds, 4 Sells, and 2 Buys. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.