When you think of Moderna (NASDAQ:MRNA) and its efforts to develop a next-generation COVID-19 vaccine, what do you think of? Chances are, you probably have the same concern that it’s simply a rehash, a sophomore album put out by a musical act to fulfill contract requirements. However, a more robust vaccine may be exactly what society needs at this hour. Therefore, I am bullish on MRNA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Endemic Threat Brings Significant Value to MRNA Stock

At first glance, MRNA stock might not seem particularly compelling, especially with the acute fear of the virus well in the rearview mirror. As I mentioned last month, the Associated Press reported in February 2022 that anxieties associated with the virus began fading. You can also refer to the technical chart of Moderna stock at that time.

Indeed, MRNA stock suffered its first warning that not all was well in September 2021. However, the stock left no doubt in December to early January 2022. An effort by the bulls was made to restore confidence later that year. Unfortunately, this market initiative failed, leading to greater erosion.

Even now, the circumstances surrounding MRNA stock don’t seem that compelling. On a year-to-date basis, shares gained under 6%. That’s not a particularly exciting statistic. Nevertheless, the endemic nature of COVID-19 may give Moderna much-needed relevance.

According to MedlinePlus, endemic means a “disease that is always present in a population within a geographic area, typically year-round.” In other words, impacted communities must learn to live with COVID rather than eradicate it completely.

Because of the vast resources available that biotechs – including Moderna – have forwarded, living with COVID-19 doesn’t seem so terrible. However, one must consider the framework multidimensionally. The virus is still a threat. And COVID isn’t just a matter of the sniffles but can be a temporarily debilitating disease.

That raises broader economic concerns. For example, one study shows that missing work leads to productivity losses that amount to $225.8 billion for U.S. employers, or $1,685 per employee.

On the other end of the scale, there’s a risk called presenteeism. This circumstance describes workers who are legitimately sick but show up for work anyway due to various “incentives.” These could range from not wanting to fall behind to financial concerns such as lack of sick time.

Whatever the cause, presenteeism can also be disruptive in the form of healthy workers becoming sick.

The Threat of Serious Complications May Rise

To address COVID’s endemic threat, Moderna is developing a next-generation vaccine. More strains of the virus are appearing, which means that first-gen vaccines are not as effective. By protecting more people, Moderna can be an accretive benefit for the wider economy. Not only that, but the relevance of a new vaccine has likely risen due to the accelerated threat of serious COVID-19 complications.

While the medical machinery has largely addressed or has frameworks in place to combat “manageable” COVID, the threat of serious infection that can lead to devastating results such as organ failure lingers. That’s because the virus is especially dangerous to people who already have chronic conditions.

Per the Mayo Clinic, those who have serious conditions such as heart disease are at risk of contracting severe COVID-19. Among the risk factors is obesity. Here’s the problem: America’s waistline is expanding.

Data from various health agencies report that a worrying number of adults and children are obese. According to one analysis conducted in late 2022 to early 2023, 19 states have incurred obesity rates of over 35%. This figure increased by three states from just the year prior.

What’s more, this isn’t just a problem that materialized overnight. Back in 2004, a medical journal sounded the alarm with its article title, “Fat land: how Americans became the fattest people in the world.”

It’s not just the endemic threat of COVID-19. Rather, it’s that Americans are at greater risk of serious infection, and that’s a powerful narrative for MRNA stock.

Moderna’s Valuation

MRNA isn’t what you would call a discounted stock at the moment. Right now, shares trade at 8.9x trailing-year revenue. However, the biotech sector runs an average sales multiple of 6.92x. What’s worse, analysts anticipate that Fiscal 2024 sales may only reach $4.15 billion. That’s down 39.5% from last year’s tally of $6.85 billion.

Stated differently, you can expect the multiple to rise unfavorably on a forward basis.

Nevertheless, the market appears to have priced in much of the pessimism. In the trailing month, MRNA stock lost about 16% of its equity value. Once the volatility is fully baked in, Moderna looks compelling. Fundamentally, COVID-19’s endemic threat poses a societal and economic threat. Someone has to address it. Moderna’s next-gen vaccine may help.

Is Moderna Stock a Buy, According to Analysts?

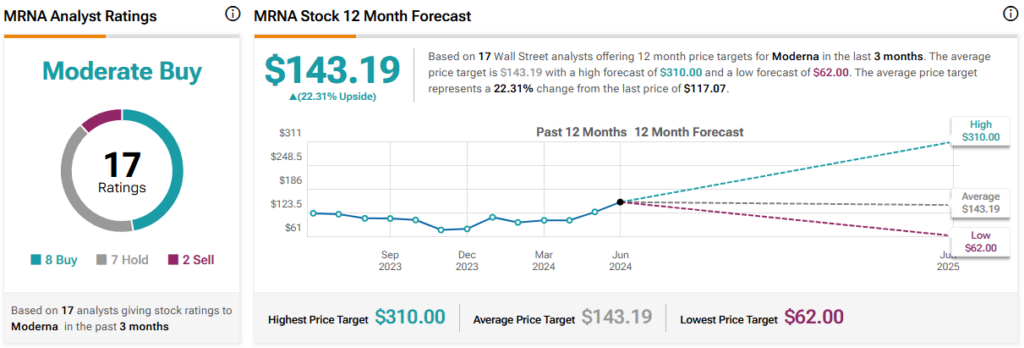

Turning to Wall Street, MRNA stock has a Moderate Buy consensus rating based on eight Buys, seven Holds, and two Sell ratings. The average MRNA stock price target is $143.19, implying 22.3% upside potential.

The Takeaway: The Next-Gen Vaccine Is a Big Deal for Moderna

With public fears of COVID-19 in the rearview mirror, Moderna’s efforts in developing a next-gen vaccine might seem superfluous. However, it’s actually surprisingly relevant. Due to the endemic threat of the virus, more people may suffer infections, which could impact economic productivity. What’s worse, the fading health of the American public raises the threat of serious COVID-19 symptoms. That means investors shouldn’t ignore the potential opportunity for Moderna.