During the early days of the COVID-19 pandemic, Moderna (NASDAQ:MRNA) and Pfizer (NYSE:PFE) were praised as not only top mRNA innovators but some of the most innovative firms on the market. Indeed, as lockdowns swept the nation, few things mattered more than finding a safe and effective vaccine.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Leveraging next-generation mRNA technology, both firms were able to deliver in record time. Indeed, Moderna and Pfizer are, in ways, corporate heroes. In recent months, though, investors have turned against both firms. It seems like such a long time ago when shares of both MRNA and PFE were heating up on the back of their robust COVID-19 businesses. Nowadays, the COVID-19 “windfall” seems to be winding down, and investors have moved on to more exciting plays.

Therefore, let’s weigh in on Moderna and Pfizer to see how they stack up going into the post-COVID environment.

Moderna (NASDAQ:MRNA)

Moderna stock is now off more than 70% from its all-time high hit back in September 2021. Since then, it’s been a tough ride for the mRNA innovator that’s been trading at a single-digit trailing price-to-earnings (P/E) earnings multiple for quite some time now. On a forward basis, earnings are actually expected to go negative. Nonetheless, I am bullish, as the stock looks oversold.

Moderna went from a virtually-unknown biotech firm to a household name when it unveiled its first COVID-19 vaccine to the world. Moderna’s COVID-19 vaccines have been a massive cash windfall for the firm. Still, as the pandemic winds down, the company will need to look to new cash generators if it’s to put an end to its stock slip.

Though the best days for Spikevax — Moderna’s COVID-19 vaccine — are over, I do think it’s a mistake to conclude that Moderna doesn’t have the means to grow in the post-COVID age.

SVB Securities recently slapped Moderna with a downgrade, citing “the end” of its “pandemic revenue boom.”

Indeed, Moderna stock looks like a value trap, given its unsustainably-low P/E multiple as COVID-related earnings shrink with time. There’s no arguing against SVB’s bearish points. Moderna still appears like a one-hit wonder. That is, until the firm can release something ground-breaking from its mRNA pipeline.

Moderna has a lot of potential in its pipeline, but it’s tough to pinpoint if and when anything will be the firm’s next big hit. For now, investors are losing patience with the firm after its quarterly earnings miss (falling 68% year-over-year). Vaccine demand fell while costs rose sharply.

The company seems to be a victim of its own past success, and it remains tough to value, but I do think the firm is at risk of plunging below fair value as the sell-off intensifies, leaving me bullish.

What is the Price Target for MRNA Stock?

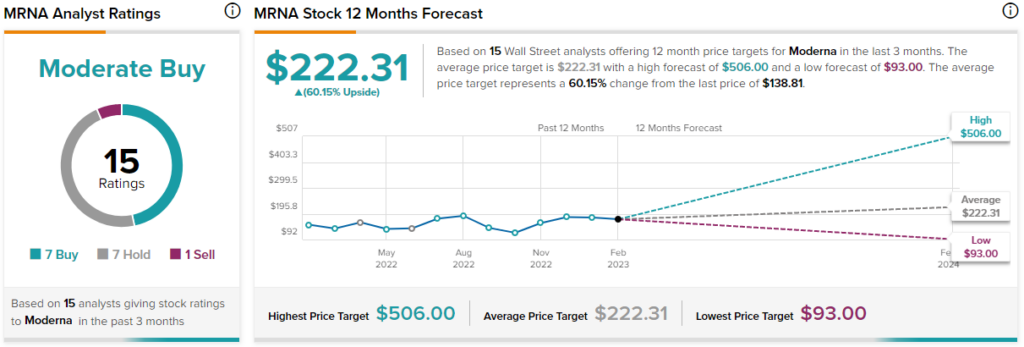

Wall Street has a “Moderate Buy” on Moderna, with seven Buys, seven Holds, and one Sell. The average MRNA stock price target of $222.31 implies a 60.15% gain from here.

Pfizer (NYSE:PFE)

Unlike Moderna, Pfizer has a plan to move on from its COVID-19 windfall. The company has used its COVID-19 cash “windfall” well, picking up some solid cash-generative assets (like the migraine drug Nurtec) in 2022. Further, Pfizer has much potential in its pipeline, including an RSV vaccine and other non-mRNA treatments for various ailments.

Pfizer is doing its best to stay in growth mode, and with a lot of promise in the pipeline, I think the risk/reward is simply too good to pass up at these levels, even after the company’s underwhelming 2023 guidance ($13.5 billion Comirnaty (the COVID-19 vaccine) sales and $8 billion Paxlovid (COVID-19 oral treatment) sales expected). Wells Fargo (NYSE:WFC) recently slapped Pfizer with a downgrade over its dwindling COVID-19 business.

Indeed, it won’t be easy to move on from the COVID-19 windfall, but Pfizer seems well-equipped to do so. The stock trades at just 11.5 times forward earnings. With plenty of growth levers to pull and potential blockbusters going through trials, I view PFE stock as a blue-chip stock that could hold its own in a recession year. I am bullish.

What is the Price Target for PFE Stock?

Wall Street has a “Moderate Buy” on Pfizer. There are five Buys and nine Holds on the name. The average PFE stock price target of $50.14 implies 23.6% gains.

The Takeaway

Although it seems like the COVID-19 pandemic is over (we don’t hear about new COVID-19 variants in the news nearly as much these days), it hasn’t officially concluded.

As Dr. Anthony Fauci once put it, we may all be “done with COVID-19,” but COVID-19 is “not done with us.” With that, I still think the COVID-19 businesses of Moderna and Pfizer are being heavily discounted. Sure, they may be winding down, but probably not to zero in the near future.

Beyond COVID-19, mRNA technologies (think personalized cancer vaccines) can potentially deliver more game-changing treatments. While mRNA’s next big breakthrough may still be years away, I think the technology is promising enough to give the fallen mRNA stocks a second look.