Mobileye Global (NASDAQ:MBLY) offers best-in-class technology for self-driving cars, so investors should definitely keep an eye on this fascinating company. However, there’s panic in the air today, as Mobileye’s financial outlook is putting the market in a bad mood. I am neutral on MBLY stock because, while Mobileye has a promising future, the share price is likely to drop for a little while longer.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Based in Israel, Mobileye Global develops advanced driver assistance systems (ADAS) for autonomous (self-driving) vehicles. As you may recall, Intel (NASDAQ:INTC) spun off Mobileye as a separate, publicly-traded business in 2022.

Mobileye actually has a consistent track record of quarterly EPS beats and generally very positive confidence from hedge funds. There’s not a whole lot of confidence in Mobileye today, though, so let’s delve into the details and see why investors are dumping their MBLY shares.

An Awful Day for MBLY Stock

Mobileye stock is trending today, but not for positive reasons, as it’s down 25% midday and fell below the crucial $30 level. It’s a startling U-turn, as the stock looked ready to finally break through the $45 resistance level just a few days ago.

The stock market was fairly calm overall, so clearly, there was something company-specific going on. Indeed, it was Mobileye’s press release, which included the company’s preliminary Fiscal Year 2023 financial results and initial outlook for Fiscal Year 2024, that prompted the sell-off.

Most likely, it wasn’t Mobileye’s FY2023 results that caused the stock to take a nosedive. As the company pointed out, Mobileye’s “preliminary results reflect revenue consistent with the guidance provided on October 26, 2023.” Besides, Mobileye’s estimated FY2023 unadjusted operating loss of $33 million to $39 million and the company’s adjusted operating income of $687 million to $693 million were “moderately better than expected.”

So far, it certainly sounds like the 25% drawdown in MBLY stock is an overreaction and perhaps even completely irrational. Yet, the headline story today isn’t about Mobileye’s preliminary FY2023 results. Rather, the market is focused on Mobileye’s guidance for FY2024.

First, let’s back up to the COVID-19 crisis of 2020. This led to supply-chain bottlenecks and shortages of automotive components, so some of Mobileye’s customers probably panic bought whatever parts were available. Mobileye’s press release describes this phenomenon as “decisions by Tier 1 customers to build inventory in the Basic ADAS category due to supply chain constraints in 2021 and 2022 and a desire to avoid part shortages.”

Fast-forward to 2024, and supply-chain disruptions have eased somewhat. Yet, Mobileye’s customers still have many of the automotive parts they previously purchased. In Mobileye’s words, “As supply chain concerns have eased, we expect that our customers will use the vast majority of this excess inventory in the first quarter of the year.”

Mobileye’s Warning for Investors

You can probably see where this is going. Mobileye expects that the company’s first-quarter 2024 revenue “will be significantly below first quarter 2023 revenues.” That’s certainly not what investors wanted to hear today.

Granted, Mobileye doesn’t anticipate that this issue will last forever. Notably, the company expects to “see revenue normalized during the remainder of 2024” (after the first quarter).

Thus, dip-buyers might consider looking toward 2024’s half and buying MBLY stock now. Before anyone jumps into a hasty trade, though, it’s prudent to check the numbers and see what Mobileye actually expects for Q1 FY2024.

It’s not a positive prediction, to say the least. For the first quarter of FY2024, Mobileye expects its revenue “to be down approximately 50%, as compared to the $458 million revenue generated in the first quarter of 2023.” That’s a bitter pill to swallow, I’ll admit.

Citigroup (NYSE:C) analyst Itay Michaeli still seems to envision a good long-term future for Mobileye, though. Michaeli published a Buy rating and a $72 price target on MBLY stock, assuring, “The update is clearly disappointing but doesn’t appear long-term thesis changing.”

Is MBLY Stock a Buy, According to Analysts?

On TipRanks, MBLY comes in as a Strong Buy based on 12 Buys, one Hold, and one Sell rating assigned by analysts in the past three months. The average Mobileye stock price target is $48.09, implying 60.7% upside potential.

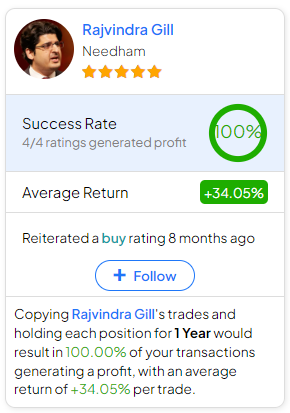

If you’re wondering which analyst you should follow if you want to buy and sell MBLY stock, the most accurate analyst covering the stock (on a one-year timeframe) is Rajvindra Gill of Needham, with an average return of 34.05% per rating and a 100% success rate. Click on the image below to learn more.

Conclusion: Should You Consider MBLY Stock?

If Michaeli is right, the bullish “long-term thesis” on Mobileye should still be intact. On the other hand, Mobileye’s revenue guidance for Q1 FY2024 is disappointing. This type of disappointment can cause the market to turn against a company for days, weeks, or even longer. Investors can overshoot in one direction or another before taking a breather to consider the long-term outlook for a company.

Consequently, I expect continued near-term volatility in MBLY stock and am not considering a position right now. At the same time, I’m keeping my eye on Mobileye and might think about a dip buy when the market calms down, as I still believe in the future of the global self-driving technology industry.