The beverage scene has gotten much more interesting in recent years, with the “little guy” looking to go against some of the industry’s top heavyweight contenders. Undoubtedly, mega-cap beverage companies are some of the best recession-resilient stocks to sip on if you fear some sort of downturn. And while their economic moats (high barriers to entry) remain relatively wide, some smaller players on the scene, such as MNST, STZ, and COCO, have unique tricks up their sleeves to win over the consumer.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Therefore, let’s use TipRanks’ Comparison Tool to weigh in on three beverage stocks that are favored by analysts.

Monster Energy (NASDAQ:MNST)

It may be hard to believe, but Monster Energy stock has been one of the best market performers in recent decades, topping the likes of some pretty notable Magnificent Seven companies. Over the last 10 years, shares have risen 356%. And though the pace of gains has slowed somewhat, with shares rising just shy of 16% in the past year, I’d argue the stock still makes sense to own for its robust brand and still-lengthy growth runway.

With a modest $61.5 billion market cap and caffeinated innovation flowing through its veins, I see a pathway to higher highs. As such, I’m staying bullish on the stock as it looks to break out past its multi-quarter ceiling of resistance at $60 per share. Last year, Monster grew its drink revenue by 13%. It’s not explosive growth, but it’s decent for a drink company, nonetheless, especially when you factor in inflation.

The most enticing part of Monster’s growth is that it may be more sustainable than mega-cap tech firms sporting similar growth rates. The company demonstrated its pricing power, hiking prices amid inflation to keep up with higher costs.

Thus far, consumers don’t seem to be making a big deal of higher prices, as they would for some absurdly overpriced snack foods. People need their energy and want the drinks to taste good, which is a challenging feat, considering how some alternative options seem to taste downright unpleasant!

With a Zero-Sugar line (as well as other new products), the recent acquisition of Bang Energy, and plenty of international growth runway, I believe Monster has what it takes to continue delivering monster performance for investors. Just don’t expect it to keep crushing the Magnificent Seven from here.

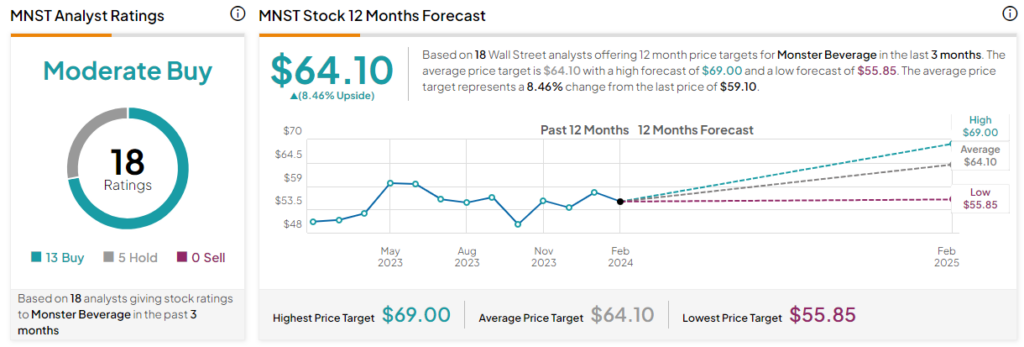

What Is the Price Target for MNST Stock?

Monster stock is a Strong Buy, according to analysts, with 13 Buys and five Holds assigned in the past three months. The average MNST stock price target of $64.10 implies 8.5% upside potential.

Constellation Brands (NYSE:STZ)

From caffeinated beverages to alcoholic ones, we have Constellation Brands, a firm that’s really gone flat in recent years. The stock is just 4% higher than its peak in early 2021. And though the firm is technically a “sin stock,” I’d argue that it’s one of the better value options to play the beverage scene right now, given its rock-solid brand portfolio and strength following its latest quarterly earnings.

Morgan Stanley (NYSE:MS) went as far as to name STZ as its top beverage stock pick. Clearly, the latest numbers gave them plenty of confidence. For now, I’m sticking with the analyst community and am staying bullish.

Five-star-rated Morgan Stanley analyst Dara Mohesenian views Constellation’s growth profile as not yet being priced in quite yet. After a solid round of earnings and the means to triumph over its beer rivals, I’d say the odds are on his side. Constellation certainly stock looks primed for performance.

At just 18.1 times next year’s expected price-to-earnings (P/E), STZ looks like a relative bargain. Its Beer Business, in particular, is expected to see net sales growth of 7-9%.

Given that the firm owns some pretty premium brands in its portfolio, I’m perplexed as to why shares trade at such a notable discount to the alcoholic beverages industry average of 20.9 times forward P/E. Perhaps Mr. Mohesenian is correct in that the market may be discounting the firm’s growth prospects from here.

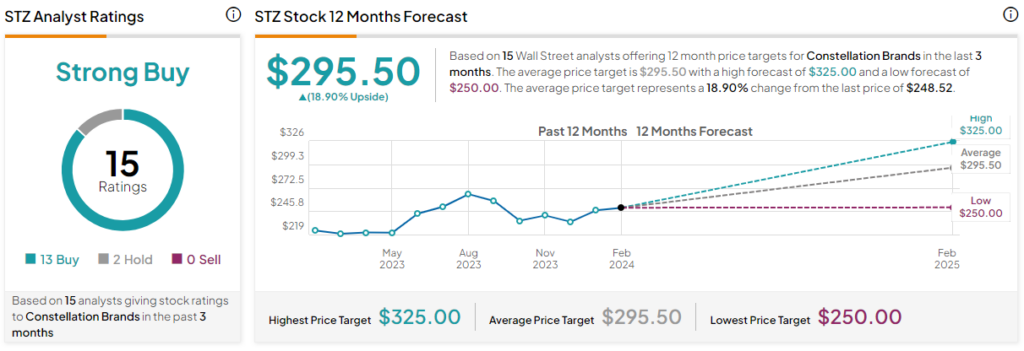

What Is the Price Target for STZ Stock?

Constellation stock is a Strong Buy, according to analysts, with 13 Buys and two Holds assigned in the past three months. The average STZ stock price target of $295.50 implies 18.9% upside potential.

Vita Coco (NASDAQ:COCO)

Shifting gears from beer to coconut water, we have Vita Coco, a mid-cap stock ($1.48 billion market cap) I think you have to own if you’re a big fan of its products and the rise of healthy, plant-based beverages that don’t skimp on the tastiness factor. As an all-natural product, coconut water stands out as one of the best positioned to ride the secular trend of increased health consciousness regarding food and drink.

However, there’s only one issue: coconut water is predominantly a commoditized product that can’t really be differentiated by any sort of secret recipe. In any case, I view Vita Coco’s well-run supply chain as an advantage that could help it rally even more. That said, I’d keep tabs on industry competitors, especially those that are serious about cracking into the market. For now, I’m staying bullish as the firm continues navigating through a tougher environment for consumers.

Coconut water is way pricier than water, and that may make Vita Coco more sensitive to fluctuations in the economy. With inflation and macro headwinds weighing on all consumers, though, I find it remarkable that Vita Coco’s numbers haven’t been too negatively impacted.

I attribute the company’s resilience to its colossal growth runway, exceptional operational stewardship, and success with expanding into flavored forms of coconut water, something that could help Vita Coco differentiate itself from the competition, perhaps giving the firm the means to stand out in the otherwise commoditized coconut water market.

At 41.4 times trailing P/E (around 28 times forward), shares are priced with growth in mind. The real question is whether COCO can continue to find success as it expands into new geographies. If it can, the current price of admission seems fair or even a tad on the cheap side.

What Is the Price Target for COCO Stock?

Vita Coco stock is a Strong Buy, according to analysts, with six Buys and two Holds assigned in the past three months. The average COCO stock price target of $29.20 implies 11.9% upside potential.

Conclusion

Apart from the rise in health consciousness (saying no to sugar), it seems like younger generations are a bit more open to trying something new, especially if you’ve got influencer marketing involved. Think Logan Paul and his Prime drinks, which have clearly hit a tune among young consumers. This alone may cause some to question if modern times pose a threat to some of the most old-fashioned moats out there.

While I don’t think Warren Buffett needs to worry about Coca-Cola (NYSE:KO) anytime soon, I do believe that investors seeking a bit of sizzle should look beyond the classic beverage kingpin for greater growth. It also doesn’t help that Coke shares have been flat lately, down 3% over the past two years.

Of the fast-growing trio, analysts expect the most upside from STZ, with about 19% in gains expected for the year ahead.