Stocks of casino operators with exposure to Macau, an administrative region in China and a major gambling destination, have recently rallied in hopes of a strong recovery following the easing of COVID-19 restrictions. Moreover, Macau granted new licenses to six casino operators in late 2022 for a period of ten years. Additionally, certain analysts expect demand in Las Vegas to be strong, while others remain cautious due to a tough macro backdrop. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place Melco (NASDAQ:MLCO), MGM Resorts (NYSE:MGM), and Las Vegas Sands (NYSE:LVS) against each other to select the most attractive casino stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Melco Resorts & Entertainment (NASDAQ:MLCO)

Melco operates integrated resort facilities (an integrated resort includes a hotel, a casino, and other facilities) in Asia and Europe. The travel restrictions imposed across mainland China and Macau significantly impacted the company’s operations last year. Melco’s Q3 2022 revenue plunged 46% to nearly $242 million and adjusted loss per American depositary share (ADS) widened to $0.52 from $0.43 in the prior-year quarter.

The easing of restrictions in Macau is expected to immensely benefit Melco as the company generates most of its revenue from its gaming business in the region.

Is Melco a Good Buy?

Following Macau’s decision to end all inbound quarantine restrictions and the easing of COVID-related rules in China, JP Morgan analyst Joseph Greff named Melco, Las Vegas Sands, and Wynn Resorts (WYNN) as his top picks. In line with the general view, the analyst also anticipates a greater recovery in the gross gaming revenue of operators with more exposure to mass markets compared to those with significant VIP exposure.

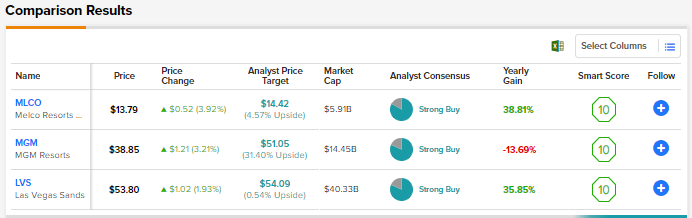

Melco scores a Strong Buy consensus rating backed by five Buys and one Hold. Given the stellar 44% rally over the past year, the average MLCO stock price target of $14.42 indicates a modest upside potential of 4.6%.

MGM Resorts (NYSE:MGM)

MGM Resorts operates 32 hotel and gaming destinations worldwide. Its portfolio also includes its 50-50 venture BetMGM, a leading sports betting and iGaming operator. MGM’s Q3 2022 revenue increased 26% to $3.4 billion, as the COVID-led disruption in its MGM China business was more than offset by solid volumes and travel activity at the company’s Las Vegas Strip resorts. However, MGM slipped to an adjusted loss per share of $1.39 from adjusted EPS of $0.03 in the prior-year quarter as higher costs weighed on the bottom line.

MGM is expected to benefit from the potential recovery in MGM China business this year. Moreover, the company continues to gain from strong growth in BetMGM. In Q3 2022, BetMGM’s revenue grew 90% to $400 million. BetMGM is on track to achieve its target of delivering over $1.3 billion in revenue in 2022. The company expects BetMGM to be profitable in 2023.

What is the Target Price for MGM Stock?

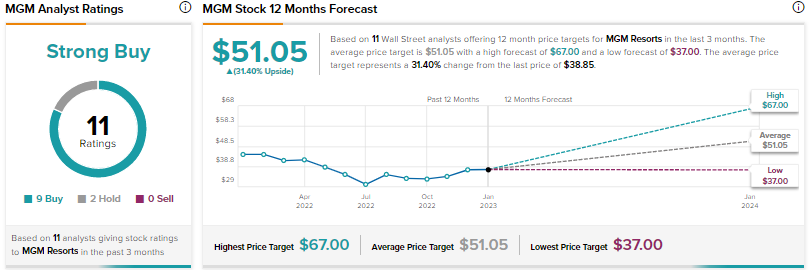

Last week, Stifel analyst Steven M. Wieczynski upgraded MGM Resorts stock from a Hold to Buy and raised the price target to $46 from $42. The analyst prefers operators with exposure to the Las Vegas Strip and Macau compared to pure-play regional gaming operators.

Wieczynski expects the momentum in the Las Vegas Strip to continue due to a strong event calendar and the return of group travel and convention business. Wieczynski also expects cruise operators to gain from solid pent-up demand. He also anticipates MGM to benefit from the potential for new licenses in locations like New York and momentum in iGaming.

The Street’s Strong Buy consensus rating for MGM Resorts is based on nine Buys and two Holds. The average MGM stock price target of $51.05 suggests 31.4% upside potential. Shares have declined nearly 14% over the past year.

Las Vegas Sands (NYSE:LVS)

Las Vegas Sands operates five integrated resorts in Macau and one in Singapore. In February 2022, the company completed the sale of its properties and operations to VICI Properties (VICI) and Pioneer OpCo for $6.25 billion to focus on its core Asian business.

COVID-related mandates impacted Las Vegas Sands’ performance in 2022. The company’s Q3 2022 revenue grew over 17% to $1.01 billion, as recovery in the company’s Singapore operations helped in offsetting dismal revenue from Macau. However, Q3 adjusted net loss of $0.27 per share was higher than anticipated due to a rise in interest expenses. Looking ahead, Las Vegas Sands is expected to be a major beneficiary of Macau reopening due to its significant exposure to the region.

Is Las Vegas Sands a Buy, Sell, or Hold?

Earlier this month, Wells Fargo analyst Daniel Politzer increased the price target for Las Vegas Sands stock to $53 from $45 and maintained a Buy rating to reflect the potential impact of Macau’s reopening. However, the company’s conviction about the pace of the recovery is low. The analyst feels that the reopening in Q1 2023 would be messy, with potential stabilization expected in the second quarter and improvement in the third and fourth quarters. Politzer projects Macau operations to be relatively normal in 2024.

Overall, the Strong Buy consensus rating for Las Vegas Sands stock is based on nine Buys and two Holds. At $54.09, the average LVS price target indicates that the stock is fully priced at current levels. Shares have rallied over 38% in the past 52 weeks.

Conclusion

The Macau operations of Melco, MGM, and Las Vegas Sands are expected to rebound due to the easing of significant restrictions in the region. Nonetheless, investors should keep in mind the COVID-related uncertainty in Macau and the associated risks for these companies. Wall Street is bullish about all these three casino operators. However, analysts see higher upside potential in MGM Resorts stock from current levels than Melco and Las Vegas Sands.