Precious metals holders and dividend collectors are opposites, right? Not always, as First Majestic Silver (NYSE: AG) (TSE: FR) allows financial traders to participate in the silver market indirectly while also receiving quarterly cash payments. That combination is hard to resist, so I am bullish on First Majestic Silver stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First Majestic Silver is a Canadian company that actually mines both gold and silver, primarily in Mexico and the U.S. However, as the company’s name implies, First Majestic Silver is mainly focused on silver exploration and production.

Let’s be honest – some commodities miners are trying to get people to purchase their shares, but they don’t have any productive mines yet. Thankfully, First Majestic Silver has multiple producing assets, so the shareholders can be investors instead of just speculators. Besides, not every silver producer is a dividend payer, so AG stock offers benefits for income-focused investors.

Why Invest in Silver and in AG Stock?

Historically, First Majestic stock has followed the direction of the silver price fairly closely. There is a magnified effect, though, so be aware that you’d be somewhat leveraged as an AG shareholder compared to the silver price. That’s not a bad thing, as silver can move frustratingly slowly sometimes, and a little bit of leverage is certainly a good thing when silver is slowly going up.

There are plenty of reasons to be optimistic about silver. People call it an industrial metal because it’s used in a variety of industries, including jewelry, electronics, medicine, dentistry, water purification, and more.

Of course, we can’t ignore silver’s use in electric vehicle batteries as well as in solar panels.

Consider Collecting and Reinvesting Dividends with AG Stock

One of the downsides of holding physical silver is that you’d need the silver price to go up in order to book a profit. Also, trading physical silver typically involves paying a dealer more than the silver spot price. First Majestic Silver shares, on the other hand, don’t involve precious metal dealer fees (and fee-free stock trading is available through many different brokers nowadays). Furthermore, AG stock can offer profit potential even if the silver price doesn’t move. That’s because First Majestic Silver, unlike some other silver miners, proudly provides dividend payments.

The company is on record as having paid out quarterly dividends for over a year now. First Majestic’s current policy is to target quarterly per-share dividend payouts that are “equal approximately [to] 1% of the Company’s net quarterly revenues divided by the Company’s then outstanding common shares.”

You probably won’t become fabulously wealthy overnight from those dividend distributions, as the dividend yield is only 0.26%, but consider the long-term effect of compounding if you were to reinvest those dividends and the potential for dividend growth if silver rises. Between the dividends and the leverage, AG stockholders could significantly outperform silver holders if the silver price heads north.

First Majestic Silver Has Multiple Producing Assets

Before you jump into the trade with any silver miner, make sure that the company isn’t just speculating on possible silver producers. There’s no need to worry about First Majestic, as the company has not just one but three currently productive silver properties.

All three of them are located in Mexico. There’s San Dimas, with estimated 2022 silver production of 6.6 million to 7 million ounces. Then there’s Santa Elena, which is estimated to yield 1.6 million to 1.7 million silver ounces in 2022. Finally, there’s La Encantada, which is expected to produce 3 million to 3.2 million ounces of silver this year.

By the way, First Majestic Silver also owns the Jerritt Canyon property, which is located in the U.S. state of Nevada. This is a gold mine with estimated 2022 gold production of 96,000 to 103,000 ounces. Thus, while First Majestic is silver-focused, it’s not a bad idea for the company to diversify into gold with a currently productive mine.

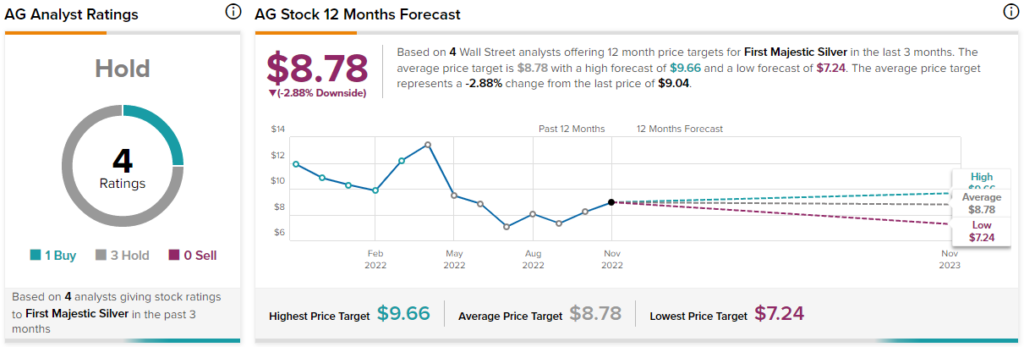

Is First Majestic Silver Stock a Buy, According to Analysts?

Turning to Wall Street, AG stock is a Hold based on one Buy and three Hold ratings. The average First Majestic Silver price target is $9.58, implying 2.9% downside potential.

Conclusion: Should You Consider First Majestic Silver Stock?

You can buy AG stock because of its income-generating potential, or because you’re bullish on silver. Maybe you also don’t want to pay dealer fees, or you’re looking to get some leverage compared to silver’s price moves. Finally, you might want to own AG stock because First Majestic owns silver assets that are already productive. For any or all of these reasons, it makes sense to consider a long-term position in First Majestic Silver.