Microsoft (NASDAQ:MSFT) kicked off the artificial intelligence (AI) wars with its upped stake in OpenAI, the now well-known firm behind the language model and AI phenomenon ChatGPT. With Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google scrambling to get its chatbot out the door, many investors are wondering which of the two tech titans will end up winning the AI battle. I am bullish on both MSFT and GOOGL, as I believe both firms can win from the rise of AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Undoubtedly, Alphabet was widely seen as one of the leaders in the AI race. The search giant had the keys to one of the biggest data sets out there. Now, the tides are shifting. ChatGPT caught the attention of over 100 million, and Microsoft is announcing plans to incorporate the technology alongside many of its much-loved offerings.

Therefore, let’s see how the two big-tech firms stack up as the AI battle heats up.

ChatGPT’s “iPhone” Moment Kicks Off AI Battle

After a huge week of AI news for Google and Microsoft, the AI wars have kicked off just ahead of Superbowl weekend. The current state of ChatGPT (version 3.5) is anything but perfect, but there’s no denying its usefulness in a wide range of subjects.

From writing high-school essays to creating meal and workout plans for those looking to go on a diet, it certainly seems like generative AI stands to threaten a growing list of professions. Indeed, ChatGPT does a great job of explaining so many complex topics in plain English and in record time.

Undoubtedly, it seems like chatbots are the next step from traditional search engines. In many ways, the user-friendly ChatGPT is going through its “iPhone” moment. Whether the product ends up as lucrative as the iPhone, though, is another question.

Looking ahead, Microsoft is poised to go all-in on AI, which could grow to become the firm’s new growth engine as Azure begins to stall. The software behemoth has the cash to spend and the user base to showcase the latest and greatest innovations coming out of the OpenAI pipeline. Most importantly, Microsoft has CEO Satya Nadella — a man that played a key role in making the company one of the most innovative and growthy forces in the tech sector.

What is the Price Target for MSFT Stock?

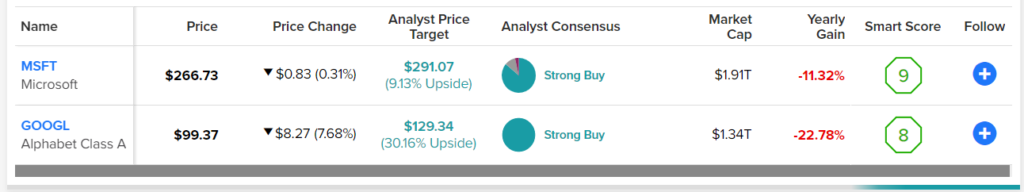

Wall Street has a “Strong Buy” consensus rating on Microsoft stock, with 17 Buys, two Holds, and one Sell. The average MSFT stock price target of $285.90 implies 7.2% upside potential.

AI Could Give Microsoft’s Bing a New Edge

It’s hard not to be excited (or perhaps a tad overwhelmed) by Microsoft’s plans to revamp Bing search and its Edge browser with powerful AI technology. Indeed, Bing and Edge have taken the backseat to Alphabet’s Google and Chrome for many years. The trillion-dollar question is whether AI will cause users to switch over from Google’s ecosystem.

Given the popularity of ChatGPT, I do think many hardcore Google fans will give Bing a try for the very first time. If Bing with AI is a good product (I think it will be), Alphabet may have a problem on its hands as the moat protecting its search business begins to show a few cracks.

After Google’s embarrassing AI fumble on Wednesday, it appears that investors see Microsoft as the disruptor and Alphabet as the disrupted. In case you missed it, Google’s chatbot Bard gave the wrong answer to a question in a demo. The news contributed to Alphabet stock tanking 7.7% on the day.

Indeed, generative AI is a work in progress. That said, I think it’s pretty cringy (maybe a bit funny if you’re not an Alphabet shareholder) to have a behemoth like Google unknowingly “showing off” one of its chatbot’s faults. I think the fumble shows how much the company is rushing to respond to Microsoft and ChatGPT.

AI is not something that should be rushed. In that regard, I think Microsoft is really smart for quietly investing in OpenAI, rather than risking reputational damage by pulling the curtain on Microsoft-branded AI this early in the game. Perhaps Microsoft learned a valuable lesson about the dangers of releasing an imperfect product following its disastrous launch of AI chatbot Tay back in 2016.

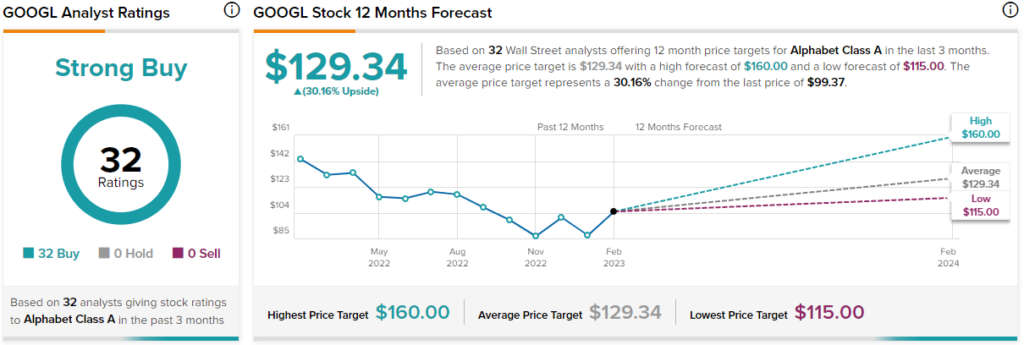

What is the Price Target for GOOGL Stock?

Analysts continue to love Alphabet, with a “Strong Buy” rating based on 32 unanimous Buy ratings. The average GOOGL stock price target of $129.34 implies 30.2% upside.

Takeaway: Microsoft’s Leading the AI Battle, but the War Isn’t Over

At this juncture, it seems like Microsoft has the clear upper hand in the AI war with Google. Still, I view the nearly 8% plunge in Alphabet stock as exaggerated.

Sure, there’s a lot at stake here (perhaps the future of search) as the two AI titans duke it out. Still, I view Alphabet’s demo hiccup not as a sign that Bard is vastly inferior to ChatGPT but as a simple mistake on the part of those who put together the demo!

If anything, Alphabet’s flop may be more of an opportunity than a cause for concern. At writing, GOOGL stock trades at 20.8 times trailing earnings, well below MSFT stock, which goes for 29.7 times trailing earnings.

Microsoft may be better at communicating its game plan with AI. However, Alphabet has the data and the more popular search engine, at least for now. In that regard, I view Alphabet as down but definitely not out in the early innings of its AI battle with Microsoft.

Bank of America (NYSE:BAC) analyst Justin Post agrees. Post notes that Google has “years of investment” on its side and views the firm as “well-prepared” for the AI battle. Bank of America has a $119 price target, implying 19% gains from current levels.