The AI arms race is about to get real. Today (Tuesday, Feb 7) should see the official unveiling of Microsoft’s (NASDAQ:MSFT) ChatGPT investment.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Do not take this event lightly, appears to be the gist behind Wedbush’s Daniel Ives’ comments ahead of the much-talked-about bot’s anticipated entrance into the Microsoft ecosystem.

“This OpenAI investment/strategic partnership which is likely in the $10 billion range is a game changer in our opinion for Nadella & Co. as the ChatGPT bot is one of the most innovative AI technologies in the world today,” the 5-star analyst said.

The investment looks like part of Microsoft’s attempt to get in on Google’s turf. Its search engine Bing currently commands around a 9% chunk of the search market but integrating the unique tool into the platform could lead to “major share shifts away” from undisputed search leader Google.

Not that Google is about to lay down and let Microsoft take over. It’s hardly a coincidence that Microsoft announced its news event right after Google said it is working on a ChatGPT rival of its own called Bard.

ChatGPT will also probably be integrated into Microsoft’s cloud services along with Azure, offering more “competitive threats” to the likes of Amazon and Google.

As such, the tech giants are about to lock horns and Ives thinks that in order to “unlock the potential of these innovative technologies across the consumer and enterprise fronts,” over the next 12 to 18 months, billions from the tech universe will be invested in the wider AI industry.

“We view this as the first shot across the bow in this Big Tech AI battle that is set to hit its next gear of investments over the coming months with Microsoft now leading the race,” the analyst summed up.

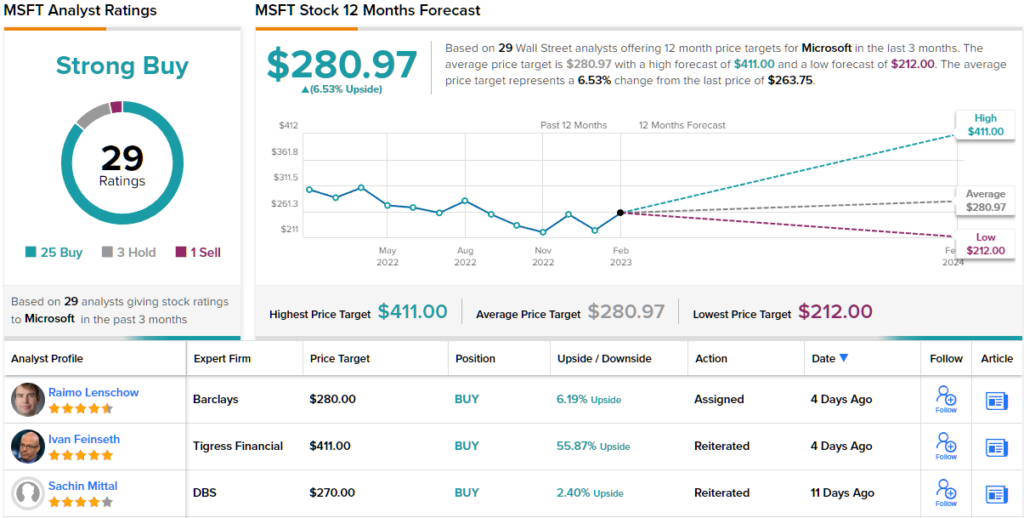

What this all means for investors? Ives gives MSFT shares a $280 price target to back his Buy rating on the stock. His target suggests room for a 10% uptick over the coming months. To watch Ives’ track record, click here)

What does the rest of the Street think about MSFT’s growth prospects? It turns out that other analysts agree with Ives. The stock received 25 Buys in the last three months compared to 3 Holds and a single Sell, making the consensus rating a Strong Buy. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.