Microsoft (NASDAQ:MSFT) has been in focus due to its aggressive efforts to grab opportunities in the generative artificial intelligence (AI) space. The company was also in the news this week due to updates related to its proposed acquisition of Activision Blizzard (NASDAQ:ATVI) and the announcement of new cybersecurity products. Microsoft shares have risen 43% so far in 2023. Most analysts covering the stock remain optimistic about the company’s growth potential and continue to rate it a Buy despite the solid year-to-date rally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Solid Growth Opportunities

Microsoft’s investments in generative AI are expected to boost its revenue over the long term. Earlier this year, the company confirmed that it is making a multi-billion dollar investment in OpenAI, the start-up behind the popular ChatGPT AI chatbot tool.

Moreover, the company is expanding into other high-growth areas like cybersecurity. On Tuesday, the company introduced two products, Microsoft Entra Internet Access and Microsoft Entra Private Access, under the Secure Service Edge (SSE) category. These products are expected to boost Microsoft’s security revenue. It is worth noting that in its fiscal second-quarter earnings call held in January 2023, Microsoft CEO Satya Nadella stated that the company’s security revenue over the past 12 months surpassed $20 billion.

Earlier this week, Morgan Stanley analyst Keith Weiss highlighted that with the launch of the two new SSE products, Microsoft is now entering what could possibly be its largest and final major cybersecurity market. Weiss noted that Microsoft would be competing with cloud network security providers, mainly Zscaler (NASDAQ:ZS), Cloudflare (NYSE:NET), and Palo Alto Networks (NASDAQ:PANW). These cybersecurity stocks fell in reaction to the launch of Microsoft’s SSE products.

However, the analyst contended that while Microsoft has advantages like an extensive network and enough cash to invest, capturing a substantial market share in this particular segment of the security market could be more challenging, as it is “less synergistic with the existing Microsoft estate.” Weiss has a Buy rating on MSFT with a price target of $415.

Meanwhile, on Thursday, Oppenheimer analyst Timothy Horan increased the price target on Microsoft to $410 from $330 and reiterated a Buy rating. The analyst believes that Microsoft will improve on its “already dominant” position in the enterprise IT market, given that it is the only player with an integrated AI platform and a key wholesale marketplace via Teams and Azure.

Horan added that the company can “uniquely integrate” compute, networking, and security services, which are converging. He noted that Microsoft has 1 billion Windows users and 1.5 billion devices, with no one else in the business segment coming close to these impressive numbers.

He thinks that while Amazon’s (NASDAQ:AMZN) Amazon Web Services (AWS) and Alphabet’s (NASDAQ: GOOGL, GOOG) Google would remain strong in the wholesale space, they do not have the customer base nor the front-end operating system and integrated applications like Microsoft.

Horan also believes that Microsoft is “structurally advantaged” to ride the AI computing boom due to its collaboration with OpenAI.

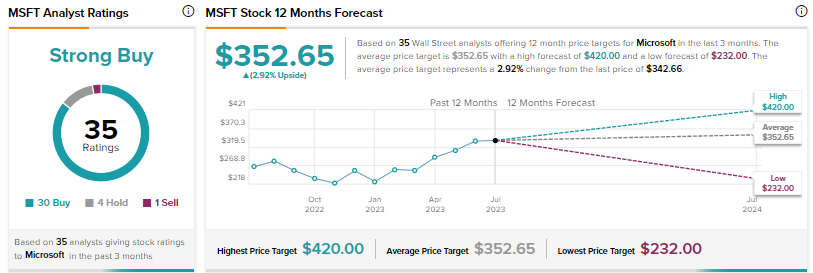

Is Microsoft a Buy, Sell, or Hold?

With 30 Buys, four Holds, and one Sell, Microsoft earns a Strong Buy consensus rating. The average price target of $352.65 implies about 3% upside potential.

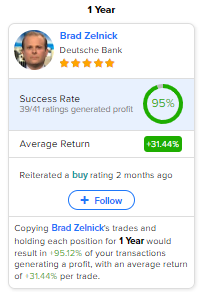

Investors looking for MSFT’s most accurate and profitable analyst could follow Deutsche Bank analyst Brad Zelnick. Copying the analyst’s trades on this stock and holding each position for one year could result in 95% of your transactions generating a profit, with an average return of 31.4% per trade.