The news on Wall Street is that Microsoft (NASDAQ:MSFT) is eyeing a $10 billion investment in OpenAI, the company behind ChatGPT, the AI tool that has been making a bit of a splash lately.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft appears to be among other firms ready to invest in the start-up, with the funding round valuing the company at $29 billion. Under the terms of the deal, until Microsoft recoups its investment, it will receive a 75% share of OpenAI’s profits. Following which, the tech giant will hold a 49% stake in the company.

Backing ChatGPT could help Microsoft strengthen its position in the web search market, one in which Google is currently the clear leader.

AI investments aside, Wedbush’s Daniel Ives thinks it is another segment in which Microsoft is going head-to-head with Google (and other fellow tech giant, Amazon) that will get more of its attention over the coming years.

“Our thesis remains that the cloud and underlying Office 365/Windows ecosystem is going to comprise a bigger and bigger piece of Redmond going forward and will ultimately spur growth and margins (and the multiple) into FY23/FY24 despite this downturn,” the 5-star analyst said. “We believe the shift to cloud is still less than 50% penetrated and represents a massive opportunity for Nadella & Co. going forward despite the dark storm clouds forming for FY23 in the uncertain macro backdrop.”

In fact, despite what Ives describes as “doomsday fears” around the current state of the tech sector amidst evidence of a “clear slowdown in cloud,” recent checks have the analyst in a confident mood. Azure growth appears more “stable” than what the doomsayers would have you believe and Ives thinks that when Microsoft reports December quarter earnings later this month (Jan 24), the company “should be able to exceed its 37% Azure growth target (constant currency).”

There might be ongoing concerns around an economic downturn’s impact on the company, but Ives thinks Azure growth will be able to “navigate this economic storm,” and he believes MSFT remains a “core name to own in 2023 despite worries.”

All told, then, Ives reiterated an Outperform (i.e., Buy) rating backed by a $290 price target. Should the figure be met, investors will be sitting on returns of 21% a year from now. (To watch Ives’ track record, click here)

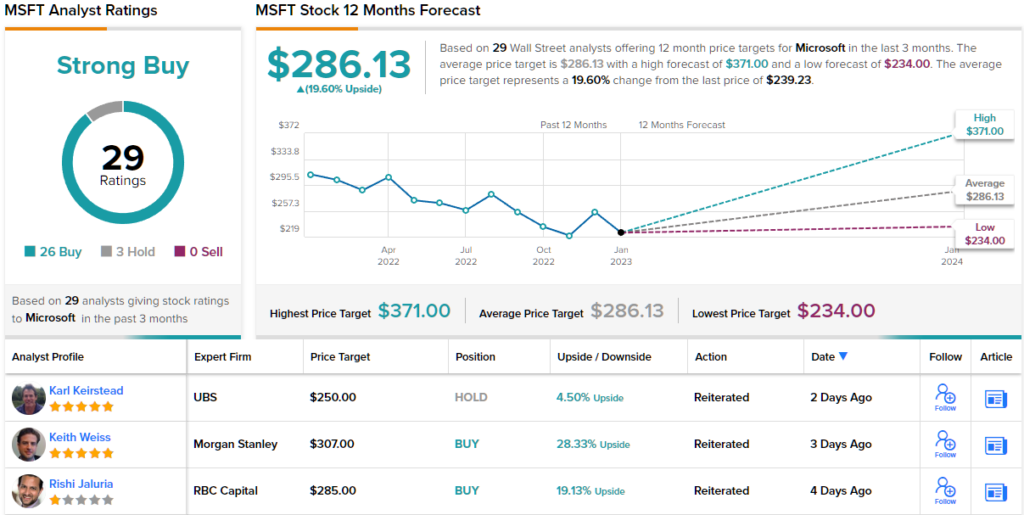

Most analysts are thinking along the same lines; barring 3 fence sitters, all 26 other recent reviews are positive, making the consensus view here a Strong Buy. The average target is just a touch below Ives’ objective; at $286.13, the figure implies 12-month growth of ~20%. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.