While Microsoft (NASDAQ:MSFT) has been making a concerted push to become a leader in AI, it looks like activity has been picking up in a segment that had been showing signs of slowing down only recently.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to recent checks made by Wedbush analyst Dan Ives, halfway through the March quarter Ives is seeing steady cloud enterprise spending that has “stabilized from the softness” observed in the month of December.

“While the macro is clearly a concern for CIOs looking to navigate an uncertain IT spending environment, many larger cloud platform deals have been given the green light for Redmond which is a positive so far this quarter and for 2023,” the 5-star analyst went on to say.

Given not even 50% of workloads are yet on the cloud, Ives believes shifting to the cloud remains a “key IT priority” for companies, representing an opportunity for which Azure is “extremely well positioned to gain share.”

In fact, moving forward, Ives thinks the cloud and underlying Office 365/Windows ecosystem is set to account for an increasingly bigger chunk of Microsoft’s business, which despite the current downturn will “ultimately spur growth and margins (and the multiple) into FY23/FY24.”

Microsoft’s AI endeavors will also have a role to play here with AI monetization on Azure coming next; combined with the opportunity in Search, over the next 12 to 18 months, this could add $20 per share to MSFT’s sum-of-the parts valuation.

Furthermore, despite the regulatory hurdles the company is encountering both in the U.S. and Europe in bringing gaming giant Activision Blizzard into the fold, Ives believes the deal will prevail and expects the company will bring the “prized Call of Duty franchise into its consumer wheelhouse by the late summer timeframe.”

With these catalysts at play, Ives rates MSFT shares an Outperform (i.e. Buy), along with a $290 price target. (To watch Ives’ track record, click here)

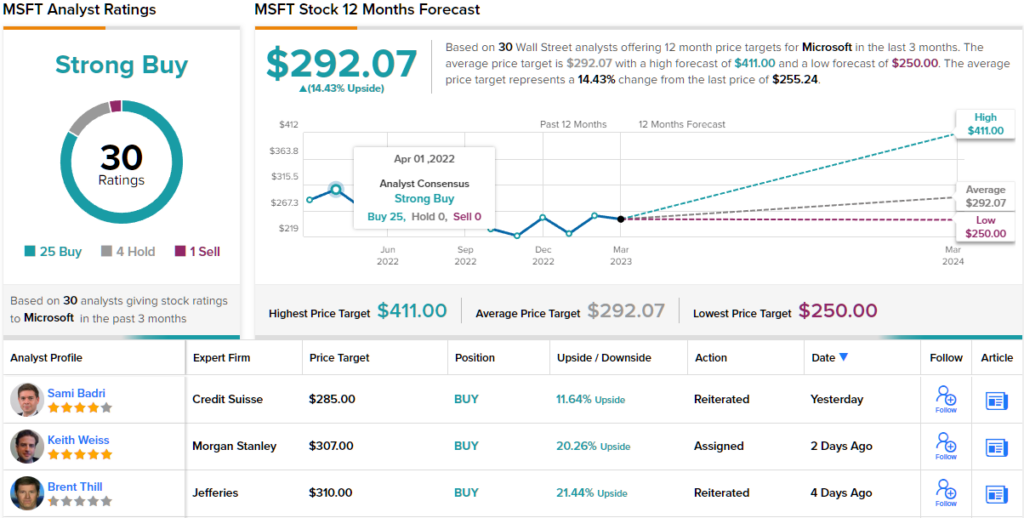

Overall, 30 analysts have waded in with MSFT reviews over the past 3 months, and these break down into 25 Buys, 4 Holds and 1 Sell, all coalescing to a Strong Buy consensus rating. The $292.07 average target is just a touch above Ives’ objective and set to yield returns of ~14% over the coming months. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.