A weak macro environment, COVID-led production challenges in China, currency headwinds, and reduction of operations in Russia is why Microsoft (NASDAQ:MSFT) stock has lost a notable portion of its value so far this year. However, Tigress Financial analyst Ivan Feinseth expects MSFT to overcome these headwinds. Feinseth is bullish about MSFT’s prospects, and his price target of $411 implies 55.4% upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s Why Feinseth Is Bullish on MSFT Stock

Feinseth sees strength across MSFT’s multiple platforms to support its growth. The analyst stated, “MSFT continues to experience extremely strong Azure and Cloud adoption, gains in its Microsoft 365 application suite, and growth in Teams, Dynamics, and Power Platform.”

It’s worth mentioning that despite macro headwinds, Microsoft’s cloud business continued to grow rapidly and expanded its market share. Microsoft’s cloud revenue increased 28% year-over-year in Q4, and for the first time, quarterly cloud revenues exceeded $25 billion.

As enterprises continue to focus on the digital-first strategy, MSFT’s cloud business is poised to benefit from this shift. Thanks to the strong demand for its cloud offerings, MSFT won a record number of large deals ($100 million-plus and $1 billion-plus deals) in Q4.

Feinseth also highlighted MSFT’s ability to deliver solid shareholder returns through dividends and share repurchases. During Q4, MSFT returned $12.4 billion to its shareholders (up 19% year-over-year) in the form of share buybacks and dividends. Further, in FY22, MSFT returned total cash of about $46 billion.

Is Microsoft Buy or Sell?

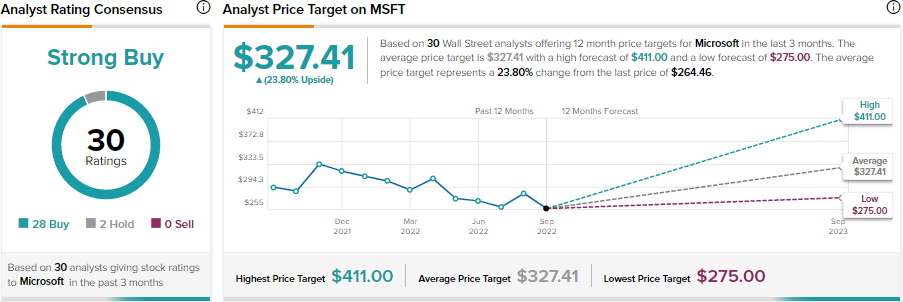

Per Wall Street analysts, MSFT stock is a Buy. On TipRanks, it has received 28 Buys and two Holds for a Strong Buy consensus rating. Meanwhile, MSFT’s average price forecast of $327.41 implies upside potential of 23.8%.

Along with analysts, hedge funds are also optimistic about MSFT’s prospects. They have bought 12.7M MSFT stock in the last three months. Overall, MSFT stock scores a nine out of 10 on TipRanks, indicating it has strong potential to outperform the market.

Bottom Line

The ongoing macro headwinds and a slowdown in the PC and gaming market could continue to impact MSFT’s near-term financials. However, the global digital transformation and strong demand for its cloud platform and Microsoft 365 application suite provide a solid foundation for long-term growth.

Read full Disclosure