Despite macroeconomic headwinds, Microsoft (NASDAQ:MSFT) displayed robust Cloud segment strength in its most recent quarterly results, which should be a strong earnings catalyst for the company, moving forward.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This leads me to believe that the company’s earnings growth will significantly rebound in the near-to-medium term, forming a compelling investment opportunity, as it will show that the stock is likely undervalued at its current levels. Accordingly, I am bullish on Microsoft stock.

Fiscal Q2 Results Were Actually Strong

Investors and analysts had low expectations from Microsoft going into its Fiscal Q2-2023 results, as the ongoing slowdown in economic growth has suppressed enterprise spending and thus suppressed the performance in some of the tech giant’s divisions. That was indeed the case. Revenues from Devices, for instance, plummeted by 39% or 34% in constant currency (CC) as sales peaked during the work-from-home economy that persisted during the pandemic.

The same can be said for Microsoft’s Xbox Content and Services revenue, which fell 12% (8% in CC) compared to the prior-year period. With gaming spending also peaking last year, it makes sense that we see a correction now that outdoor entertainment has recovered. For context, Xbox Content and Services revenue had increased by 10% in the comparable period of Fiscal 2022. So, all we see really is just the segment’s growth trajectory returning to its single-digit (ex-currency) growth mean.

Some cyclicality in gaming and devices revenues is to be expected during tougher economic conditions, so in that regard, the decline in revenues from these two segments is relatively natural and shouldn’t alert investors.

However, when it comes to Microsoft’s core growth segments, which determine the company’s long-term evolution trajectory and world-domination prospects, Microsoft once again delivered fantastic results. Specifically, revenue in the company’s Intelligent Cloud segment came in at $21.5 billion, up 18% (24% in CC). This was driven by a 20% increase (26% in CC) in Cloud Services revenue, which was, in turn, powered by Azure’s revenue growth of 31% (38% in CC).

These growth numbers, especially when it comes to Azure, are just out of this world. Don’t forget we are currently in an economic downturn loaded with uncertainty and corporate cost-cutting, while the macro landscape could potentially lead us into a prolonged recession.

Yet, nothing seems to be able to halt Azure’s growth, which, if it weren’t for the stronger dollar, last quarter would have seen an increase in revenues of nearly 40%.

It’s amusing to imagine what its growth would have been assuming normalized business conditions. Growth would have likely exceeded 40%-45%. Yet, Microsoft sees multiple add-on opportunities that are likely to maintain Azure’s momentum, such as the upcoming integration with ChatGPT.

Profitability is Set to Rebound Firmly

Microsoft’s profitability should rebound strongly once the current headwinds in its more cyclical segments soften, backed by the Cloud segment’s exceptional growth, which is a high-margin business.

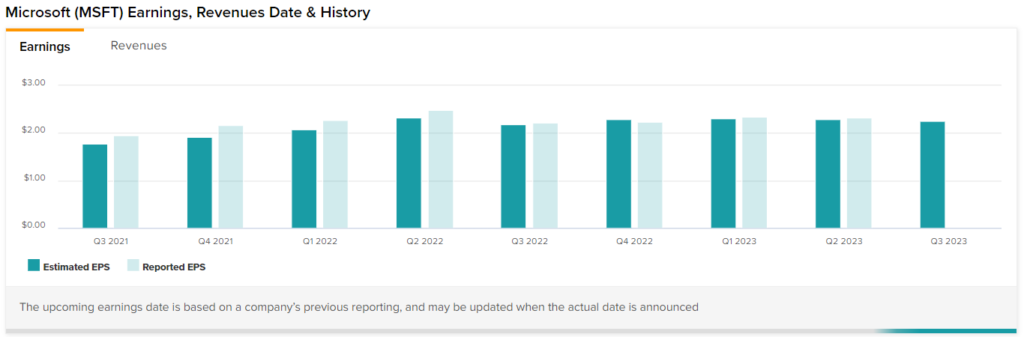

For context, Microsoft’s earnings per share during the first half of Fiscal 2023 have amounted to $4.56, suggesting a year-over-year decline of about 12.8%. It makes sense, after all, as a decline in revenues in the company’s segments that are already low-margin (Devices, Xbox) can crash their profitability.

But again, these segments are cyclical. Once results normalize in these areas, Cloud will essentially take over the bottom line’s growth prospects. In fiscal Q2, Microsoft Cloud’s gross profit margin even expanded by about 2% year-over-year to 72%. When you have a business with such high margins growing at 20%+, profitability is set to expand considerably even if revenues in other segments fail to rebound.

Wall Street analysts seem to agree with this since, despite the 12.8% fall in earnings per share during the first half of the year, the company is expected to generate earnings-per-share of about $9.32 for the Fiscal 2023, which implies a year-over-year increase of 1.2%. In other words, the market expects strong net income growth during the second half of the year, which should be driven by none other than Microsoft’s high-margin Cloud division.

Is MSFT Stock a Buy, According to Analysts?

Turning to Wall Street, Microsoft has a Strong Buy consensus rating based on 25 Buys, four Holds, and one Sell rating assigned in the past three months. At $274.69, the average Microsft stock forecast suggests 8% upside potential.

Conclusion: Attractive Valuation Given Growth Potential

As noted, Microsoft’s profitability is set to rebound at a swift pace in the second half of the year. Further, with Microsoft’s Intelligent Cloud showing no signs of slowing down, as well as the segment experiencing a margin expansion, net income growth has strong catalysts, moving forward. Now add Microsoft’s hefty buybacks, which continuously lower the company’s share count, and you can see why Wall Street analysts forecast earnings-per-share growth of about 16%/annum in Fiscal 2024 and Fiscal 2025.

Such growth implies that Microsoft shares are currently trading at about 22x next year’s earnings and 20x the following year’s earnings. Given the company’s global dominance, overall qualities, and strong growth catalysts in the Cloud, I find Microsoft’s forward-looking valuation multiples quite attractive today – especially if you are willing to hold the stock for the long run.