Microsoft (NASDAQ:MSFT) stock is a great pick for “momo” (momentum) traders and anyone seeking artificial intelligence (AI) market exposure. I am bullish on MSFT stock and would actually consider it to present good value, even after its epic rally this year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Microsoft is a true giant among software and cloud computing service providers. Plus, Microsoft is among the “Magnificent Seven” technology businesses that investors have heavily favored in 2023.

As we’ll discover, analysts also strongly favor Microsoft, and there are valid reasons for this. So, don’t worry too much about “buyers’ exhaustion,” as Microsoft stock looks unstoppable and is an excellent choice for both value investors and “momo” traders.

Is the OpenAI Imbroglio a Problem for Microsoft?

Interestingly, the financial media hasn’t focused on Microsoft during the past couple of weeks. Instead, the buzz has been about OpenAI, the developer of the popular generative AI chatbot ChatGPT.

Microsoft has invested a sizable amount of capital, around $13 billion, in OpenAI. This investment has enabled Microsoft to get a leg up over its competitors in the gen-AI (generative AI) arms race this year.

Consequently, whenever OpenAI is in the news, Microsoft’s investors should definitely pay attention. As it turns out, OpenAI has been in the news, but not necessarily for positive reasons.

Specifically, four directors on OpenAI’s board engineered an ouster of CEO Sam Altman. This was controversial, as those board members removed Altman without input from OpenAI’s investors. Furthermore, some OpenAI employees weren’t very happy about Altman’s ouster.

The broad perception is that Altman, a co-founder of OpenAI, helped to build the company into the gen-AI powerhouse that it is today. In any case, some board directors are leaving OpenAI, and Altman is reportedly returning as the company’s CEO.

Throughout the OpenAI imbroglio, Microsoft stock has held steady and even climbed higher. Clearly, the market understands that the worst is over for OpenAI in this strange chapter of the company’s history. Microsoft can continue to access OpenAI’s game-changing gen-AI technology, and the short-sellers have remained on the losing side of the trade.

Microsoft’s “Stodgy” Multiple

Microsoft is a cloud king with its Azure business, a software giant since the old days of Windows 95, and a gen-AI contender with its OpenAI stake. Yet, the skeptics and short sellers continue to stubbornly bet against Microsoft due to worries about the company’s valuation multiple.

Granted, Microsoft’s GAAP trailing 12-month price-to-earnings (P/E) ratio of 36.69x is higher than the sector median P/E ratio of 25.67x. Yet, Barron’s commentator Steven M. Sears views MSFT stock as a “red-hot stock that trades at a stodgy multiple.“

Sure, “stodgy” is an unusual descriptor for Microsoft’s valuation multiple, but it makes sense if you think about it. The analyst cited the impact that AI could have on Microsoft, and I concur that the company can benefit from the gen-AI phenomenon that started this year and should continue in 2024.

So, Microsoft’s valuation may be “stodgy” in the sense of being heavy-set, but it’s justified by the company’s expected future growth. That’s why MSFT stock can continue to climb even if the naysayers refuse to accept Microsoft’s “magnificent” qualities as a tech titan.

Is MSFT Stock a Buy, According to Analysts?

On TipRanks, MSFT comes in as a Strong Buy based on an eye-popping 33 Buys and only one Hold rating, plus no Sell ratings at all, assigned by analysts in the past three months. The average Microsoft stock price target is $412.03, implying 7.7% upside potential.

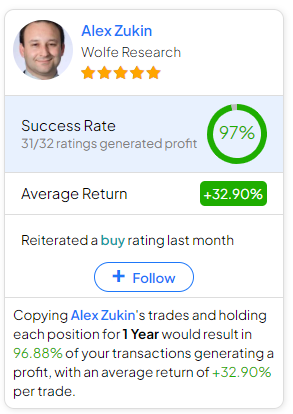

If you’re wondering which analyst you should follow if you want to buy and sell MSFT stock, the most profitable analyst covering the stock (on a one-year timeframe) is Alex Zukin of Wolfe Research, with an average return of 32.9% per rating and a 97% success rate. Click on the image below to learn more.

Conclusion: Should You Consider MSFT Stock?

Analysts generally favor Microsoft, and the company’s investors have been in the winner’s circle all year long. Meanwhile, Microsoft’s “stodgy” valuation doesn’t mean the stock has to come down, though it might take a breather and drift sideways for a while.

That shouldn’t be a problem for patient investors. Microsoft has “momo,” and betting against the company is a no-no, in my opinion. Therefore, if you’re in the market for a strong competitor in the cloud, gen-AI, and software markets, I encourage you to consider MSFT stock.