At the close of Friday’s session, Microsoft (MSFT) was once again at the top of the market cap pile. After briefly knocking Apple off the top spot on Thursday – the first time it has done so since 2021 – the tech giant reclaimed top dog status with its $2.89 trillion market cap currently making it the world’s most valuable company.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The achievement followed in the wake of Microsoft’s AI event in San Francisco, where Piper Sandler analyst Brent Bracelin attended several developer sessions and came away “encouraged by the momentum around the most mature AI products (GitHub Copilot and Azure AI).”

In particular, Bracelin notes that momentum is building ahead of the general availability release of GitHub Copilot Enterprise in February. The new enterprise package comes with significant improvements that Bracelin thinks easily validate its $39 per month cost (surpassing the individual pricing of GitHub Copilot at $10 per month and the business version at $19 per month). As of November 2023, the user base for GitHub Copilot has rapidly grown to over 1 million paid developers, and according to the latest data, in a show of strength, December traffic to www.github.com has accelerated on a year-over-year basis for the third month in a row.

On the other hand, Bracelin notes that commentary around M365 Copilot was “surprisingly light,” reinforcing his take that it is still in the early enterprise adoption phase and could take a while to scale.

In fact, considering the big shares price gains of the past year (57% in 2023), while MSFT now sits at the summit of the world’s most valuable companies, and remains Bracelin’s “favorite AI All-Star stock,” the analyst believes it might need “further AI proof-points and/or time to grow into the premium multiple over the next 3-6 months.” “Regardless,” Bracelin summed up, “MSFT has a first-mover advantage in AI that makes this a core growth holding.”

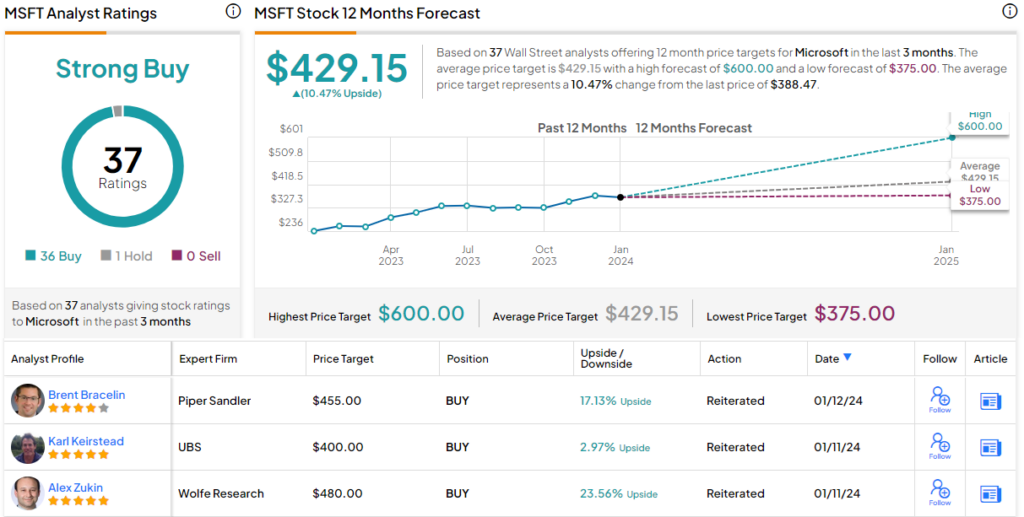

As such, Bracelin reiterated an Overweight (i.e., Buy) rating and $455 price target, implying shares will push 17% higher over the one-year timeframe. (To watch Bracelin’s track record, click here)

Almost all on the Street agree with that take. Barring one skeptic, all of Bracelin’s colleagues to have recently chimed in with MSFT reviews – 35, in total – are also bulls, making the consensus view here a Strong Buy. At $429.15, the average target suggests shares will deliver returns of 10.5% in the months ahead. (See Microsoft stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.