2023 has all been about tech stocks and a select few, at that. While the markets have been rallying, the surge can largely be attributed to gains driven by the tech giants. And a big portion of these gains can be directly linked to the opportunities presented by this year’s most significant trend: generative AI.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

And here, it’s clear to Tigress Financial’s Ivan Feinseth that Microsoft (NASDAQ:MSFT) represents the best opportunity in the space.

“Microsoft will lead the AI revolution driving change across every facet of enterprise IT and computing processes driven by the increasing need for operating efficiency, a technology-driven competitive edge, and increasing productivity and creativity,” said the 5-star analyst. “MSFT’s increasing position as a dominant AI service provider will continue to drive revenue growth and share price gains.“

By integrating advanced AI capabilities, such as ChatGPT, into its products, Microsoft has positioned itself at the forefront of the AI revolution, and it’s a move that will accelerate the global digital transformation while highlighting the “investment opportunity” at play.

Moreover, the recent announcement of AI integration in Bing Chat Enterprise and Microsoft 365 Co-pilot establishes Microsoft as a frontrunner in end-user AI tool integration. This integration, says Feinseth, is likely to drive the growth of its Cloud performance, as it outperforms other cloud service providers in monetizing AI and effectively integrating the technology.

Additionally, benefiting from the ongoing adoption of Cloud, Office, and Teams by both large and small enterprises, the company is poised for continued success, says the analyst, with the adoption fueled by the growing integration of AI functionality across these platforms. Specifically, Feinseth singles out the cloud computing platform Azure, noting it remains the company’s fastest-growing and most profitable segment, thanks to its continuous introduction of new features and capabilities.

While there’s no doubt a huge opportunity in AI, it should not be forgotten that Microsoft is also staking its claim as a “dominant force” in gaming. This is particularly relevant now that the regulators have given the all-clear for Microsoft to complete its acquisition of gaming giant Activision Blizzard, at $70 billion, its biggest purchase to-date.

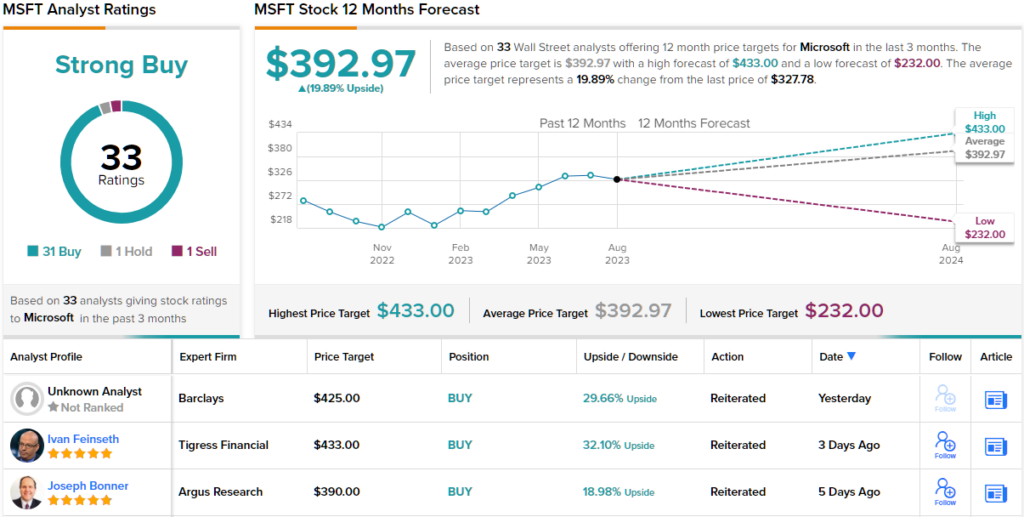

Bottom-line, all of these developments merit a price target hike. Feinseth’s objective moves from $411 to a Street-high $433, suggesting the shares will gain an additional 32% over the next 12 months. (To watch Feinseth’s track record, click here)

The rest of the Street’s take doesn’t differ all that much from Feinseth’s thesis. The stock boasts a Strong Buy consensus rating, based on 31 Buys vs. 1 Hold and Sell, each. The average target is a little more modest, however; at $392.97, it is set to deliver returns of 20% a year from now. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.