Based on improved supply/demand and pricing dynamics, last month, Micron (NASDAQ:MU) provided an update to its F1Q (November quarter) outlook, wherein it raised the anticipated revenue forecast for the quarter (expecting ~$4.70 billion vs. the prior ~$4.40 billion), and said non-GAAP gross margins should reach almost breakeven, compared to the previous forecast of -4.0%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With the memory giant readying to announce the quarter’s results next Wednesday (December 20th), Deutsche Bank analyst Sidney Ho thinks the setup appears favorable, believing Micron’s prospects for the coming year look pretty good.

“We expect MU to sound incrementally positive on inflecting industry fundamentals and see risks to the upside heading into F2Q (Feb),” the 5-star analyst said. “Following the well-anticipated positive pre-announcement a few weeks ago, we now view the trajectory of recovery on a more solid footing.”

Ho thinks the improved outlook is almost exclusively down to “strong pricing dynamics,” especially in NAND, a trend that is set to continue through FY24. That said, Ho will be keeping an eye on whether buy-aheads from customers, for NAND in particular, will “start weighing on volume shipments beyond the seasonally stronger F1Q.”

As for the numbers, for F1Q, Ho is calling for revenue of $4.68 billion (up 17% sequentially) and EPS of -$1.00, above Street estimates of $4.49 billion/-$1.01, respectively, and topline-wise, about the same as the revised guide of “approaching” $4.70 billion.

Looking to F2Q (February quarter), Ho anticipates the company will point to a “continuation of improving fundamentals, both from a bit shipment and pricing standpoint.”

The analyst models revenue of $4.85 billion, below consensus at $4.94 billion, yet higher at the bottom-line, expecting EPS of -$0.48 vs. -$0.64.

“All in,” Ho summed up, “we remain convinced that the memory market is in the early stages of a cyclical recovery and expect to see strong EPS leverage over the next few quarters as memory prices improve.”

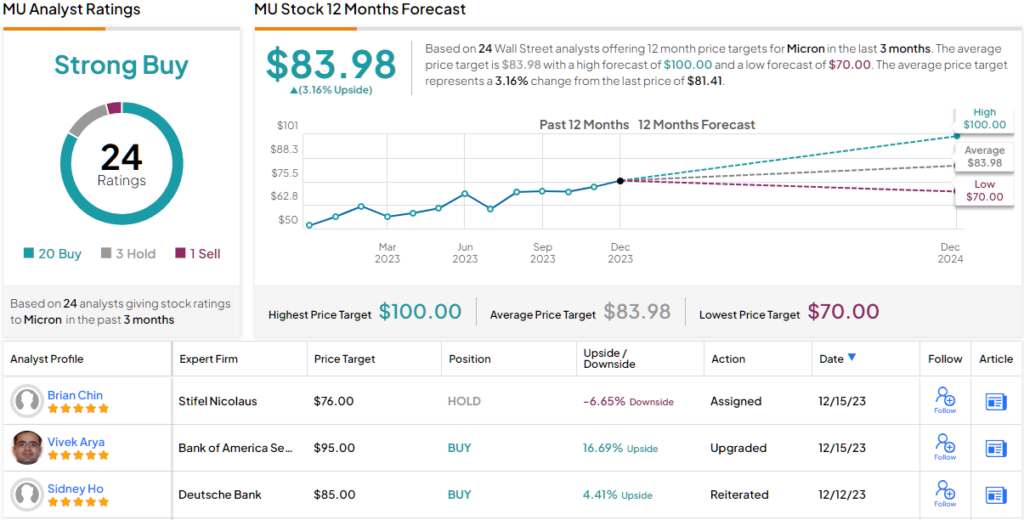

To this end, Ho reiterates his Buy rating on Micron shares with an $85 price target (To watch Ho’s track record, click here)

Shifting our attention to the broader market sentiment, with 19 Buy ratings, 3 Holds, and 1 Sell, MU stock boasts a Strong Buy consensus rating. Nevertheless, the expected gains seem to be capped, as the average target price of $83.98 indicates a modest 3% increase in share value anticipated for the year ahead. (See Micron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.