Microchip Technology (NYSE:MCHP) has experienced massive growth in recent years, which has shown little to no signs of slowing down. As our world becomes increasingly reliant on all sorts of semiconductors due to the digitalization and computerization of nearly everything, it seems like Microchip’s semiconductors, which are utilized by several industries, should continue to experience growing demand. In the meantime, the company offers a rapidly growing dividend. Accordingly, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s Powering Microchip Technology’s Growth?

Microchip Technology’s growth over the past few years has been nothing short of impressive. The company’s revenues over the past decade have risen at a compound annual growth rate of 18.2%. This is a remarkable growth rate to sustain over such a prolonged period, especially given that Microchip is a very mature company whose history dates back to 1989. Also, the company recently closed its Fiscal 2023, with its growth being sustained at exceptional levels. MCHP achieved record-breaking revenues of $8.44 billion, a remarkable year-over-year increase of 23.7%, indicating an accelerating trajectory for the company’s expansion.

But what exactly are the catalysts that are fueling Microchip’s growth? I have grouped them into the following sections:

1. Highly Successful Acquisitions

Microchip has an extended track record of successful acquisitions, allowing it to expand its product portfolio and market reach. The company has completed a total of 17 acquisitions throughout the years, with the acquisition of Atmel back in 2016 being a game-changer for Microchip, as it dramatically strengthened its AVR and ARM-based microcontroller capabilities. Acquiring companies is not always a great way to grow, as there are multiple risks when it comes to successfully deploying capital in the semiconductor industry. Yet, Microchip’s acquisitions have led to notable synergies within the business, as evidenced by the company’s expanding margins. Its EBITDA margin, for instance, has expanded from the high 20% range around 2016 to the high 40% range over the past 12 months.

2. MCHP’s Focus on the Internet of Things (IoT)

Another significant growth catalyst for Microchip has been the rising popularity of the Internet of Things (IoT), which the company has truly embraced. It has, in fact, positioned itself as a frontrunner in this exciting field. By meticulously curating diverse solutions explicitly crafted for IoT applications, Microchip has carved a niche for itself. And that’s all while the IoT market is poised for remarkable growth, projected to grow at an impressive compound annual growth rate of 19.4% through 2027 (with the forecast starting from 2022). This expansion presents a lucrative opportunity for Microchip’s cutting-edge semiconductors, which I expect will cause the company to reap substantial benefits from the escalating demand down the road.

3. Strong Automotive Industry Positioning

With a portfolio that includes a myriad of smart, connected, and secure components utilized in different vehicles, Microchip has solidified its position as a key player in the automotive industry through its extensive range of solutions tailored for vehicle electronics.

The automotive industry’s progressive integration of advanced electronics and connectivity (especially following the rise in popularity of electric vehicles) has resulted in the demand for automotive semiconductors surging, which has worked in Microchip’s favor. In Fiscal 2023, the company’s automotive share of total revenues grew from 18% to 19%. I expect this trend to persist and be a significant catalyst for Microchip’s growth, as its chips will likely be a major contributor to the autonomous industry revolution.

Strong Dividend Growth Prospects

Microchip has consistently raised its dividend for an impressive span of 21 years, showcasing a remarkable commitment to rewarding its shareholders. While some of these increases may have been relatively modest, especially when reviewing the period between 2014 and 2021, the company has maintained a consistent upward trajectory in its dividend payouts.

Also, dividend growth has accelerated over the past two years, raising its five-year compound annual growth rate to 11.8%. I expect Microchip’s dividend growth to remain very strong (the previous dividend increase was by 38.8%), as last year’s adjusted earnings per share of $6.02 in Fiscal 2023 comfortably covers the annualized dividend of $1.53.

Is MCHP Stock a Buy, According to Analysts?

Turning to Wall Street, Microchip Technology has a Strong Buy consensus rating based on eight Buys and three Holds assigned in the past three months. At $90.45, the average Microchip Technology stock price target implies 9% upside potential.

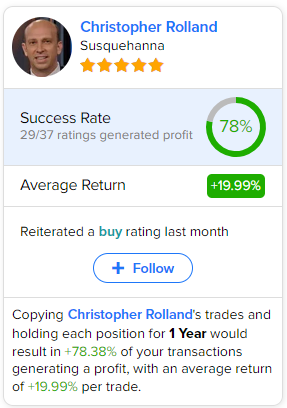

If you’re wondering which analyst you should follow if you want to buy and sell MCHP stock, the most accurate analyst covering the stock (on a one-year timeframe) is Christopher Rolland from Susquehanna, with an average return of 19.99% per rating and a 78% success rate.

The Takeaway

In my view, Microchip Technology stands out as a shining star in the dynamic world of semiconductors. Its impressive growth trajectory is a testament to the company’s strategic prowess and ability to adapt to changing market demands.

Through astute acquisitions, Microchip has not only expanded its product portfolio but also unlocked valuable synergies, leading to enhanced profitability. By embracing the Internet of Things (IoT) revolution and establishing itself as a frontrunner in this domain, Microchip has positioned itself for substantial gains in the thriving IoT market. Furthermore, its strong foothold in the automotive industry, fueled by the rising demand for advanced electronics, makes Microchip a prime player in the exciting era of autonomous vehicles.

Simultaneously, the 1.9%-yielding dividend is expected to grow rapidly in the coming years and notably contribute to the stock’s total-return potential.