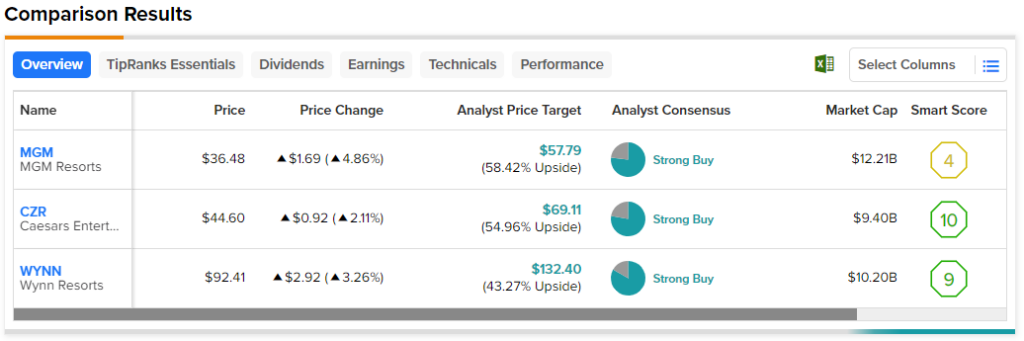

Vegas gambling/casino stocks, such as MGM, CZR, and WYNN, have been dealt a pretty tough hand in recent months, with shares of many now deep into a bear market (down more than 20% from their highs). Despite the pressures facing the industry, though, the analyst community remains upbeat, with Strong Buy ratings across the board. Indeed, the Wall Street community seems to think that your odds of getting a decent return are pretty good for the year ahead.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Therefore, let’s check with TipRanks’ comparison tool to stack up the big three Vegas gaming plays and see which holds the most potential for your portfolio.

MGM Resorts (NYSE:MGM)

MGM and Caesars are dominant behemoths in Las Vegas that will continue to duke it out for Vegas Strip supremacy for many years to come. Over the decades, the two firms have done a great job of consolidating casinos along the Vegas Strip. As it stands today, I’m a bigger fan of MGM Resorts, given that it operates some of the most impressive casinos on the Strip, including Bellagio, MGM Grand, and many intriguing, budget-savvy theme-based casinos to the south end of the Strip (think Excalibur and Luxor).

With a robust rewards program and, in my opinion, the best lineup of resorts and casinos out there, I stand with the many analysts who are bullish on the name, despite recent volatility and disruption from cyberattacks.

At writing, MGM stock is looking like a losing bet for investors who chased it during the mid-2021 reopening boom. Shares have plunged by nearly 30% from 2021 all-time highs near $51 per share. The perfect combination of a casino cyberattack and broader September stock market weakness has weighed heavily on MGM shares.

Following the unfortunate September 11 cyberattack, many loyal MGM (and Caesars) gamers are probably wondering if the firm was gambling with their data by not having the infrastructure in place to prevent it in the first place. The cyberattack reportedly disrupted day-to-day operations, as it was reported that some customers witnessed “about half” of slot machines being down around the time of the incident, while many BetMGM kiosks were also offline.

It’s never a good feeling when loyalty is rewarded with the compromise of one’s data. Still, I think MGM will move on from the debacle. Things are reportedly back to normal, and one has to think the cyber hit is already priced in after September’s slide. At writing, the stock goes for 24 times forward price-to-earnings (P/E), a deserved premium to the sector median forward P/E ratio of 14 times.

Even as gamblers stand to bet less amid tougher economic conditions, Truist analyst Barry Jonas noted that various events are still bringing in the reservations that could help keep the Vegas business going strong.

What is the Price Target of MGM Stock?

MGM stock’s a Strong Buy, according to analysts, with 10 Buys and three Holds given in the past three months. The average MGM stock price target of $57.79 entails 58.4% upside potential.

Caesars Entertainment (NASDAQ:CZR)

Caesars Entertainment is the bitter rival of MGM, with its own loyalty program and its own section on the Strip. The stock is also a heck of a lot cheaper, with shares going for just 11.3 times forward price-to-earnings, well below that of MGM stock’s 24 times. As always, a cheaper industry player may be cheap for a reason.

In the case of Caesars, the company had an operating loss in 2022, thanks in part to digital investments, while MGM stayed comfortably profitable. Further, MGM just seems to have the more impressive casinos that can beckon a greater number of patrons. Although MGM seems to be the better operator, I wouldn’t bet against the underdog in Caesars while the price of admission is relatively depressed. As such, I am bullish on CZR.

The company’s Digital segment is experiencing remarkable strength as it looks to benefit from the rise of sports betting and digital bets. Caesars reportedly plowed $1.1 billion into its digital sportsbook and online casino, which is expected to jolt growth and steer the firm to greater profitability.

Indeed, Caesars has a lot to prove as it doubles down on its Digital business. If it does things right, it could close a bit of the gap with MGM.

What is the Price Target of CZR Stock?

Caesars is a Strong Buy on Wall Street as well, with seven Buys and two Hold ratings. The average CZR stock price target is $69.11, entailing 55% upside potential.

Wynn Resorts (NASDAQ:WYNN)

Wynn Resorts may not be a Vegas behemoth, but it’s an interesting wild card that provides a good mix of gaming exposure in Macau and Vegas. After enduring turbulence through the past several years, thanks in part to weakness in China, the stock looks intriguing for fans of the resort. Though it’s been a turbulent ride, I have to be bullish at these depths.

Stifel Research analyst Steven Wieczynski thinks it’s worthwhile for long-term investors to stay the course as the stock sails through macro headwinds, primarily coming from the Chinese region.

He also noted in an interview with Barrons that there “really has never been much correlation between macro trends in China and what happens in Macau.” That’s an astute observation alongside some sage advice for investors willing to think longer term.

In the meantime, the stock trades at 21.1 times forward price-to-earnings, putting it in the middle ground between MGM and CZR.

What is the Price Target of WYNN Stock?

Wynn is a Strong Buy, according to analysts, with five Buys and one Hold rating assigned in the past three months. The average WYNN stock price target of $132.40 implies 43.3% upside potential.

The Bottom Line

Is it finally time to place a bet on the Vegas (and Macau) gaming stocks? Many analysts certainly seem to think so, and I think they’re right, even amid rising macro pressures. Of the trio, analysts expect the most upside from MGM stock, with over 58% in expected returns from here. Additionally, CZR and WYNN shares are also expected to gain quite a bit from here.