Shares of Meta Platforms (NASDAQ:FB) are under immense selling pressure. FB stock has lost about one-third of its value since reporting its Q4 financials earlier this month. A slowdown in user growth, increased competitive activity, and weak guidance due to the Apple’s (NASDAQ: AAPL) privacy changes led to this decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Meta Platforms faces headwinds in the near term, could this pullback be an investment opportunity?

Analysts Weigh In

Highlighting the recent pullback in FB stock, Ivan Feinseth of Tigress Financial stated that the “near-term headwinds” for Meta “create a significant long-term buying opportunity.”

Feinseth has a Buy recommendation on Meta Platforms and expects the ongoing momentum in reels, commerce, and virtual reality to drive its performance. The analyst sees significant upside in Meta stock and expects it to benefit from the monetization of its applications, “including Instagram, Messenger, WhatsApp, and Oculus.”

Feinseth expects Meta to enhance shareholders’ value through “innovation and strategic acquisitions along with ongoing share repurchases.” His price target of $466 represents upside potential of 114.1%.

Like Feinseth, Monness analyst Brian White views the recent crash in Meta Platforms stock as a buying opportunity. White expects Meta to capitalize on the ongoing digital transformation. Further, he expects the company to benefit from long-term digital ad trends and its ability to innovate in the metaverse.

However, White warns that advertising headwinds and regulatory scrutiny could impact Meta’s near-term performance.

Wall Street’s Take

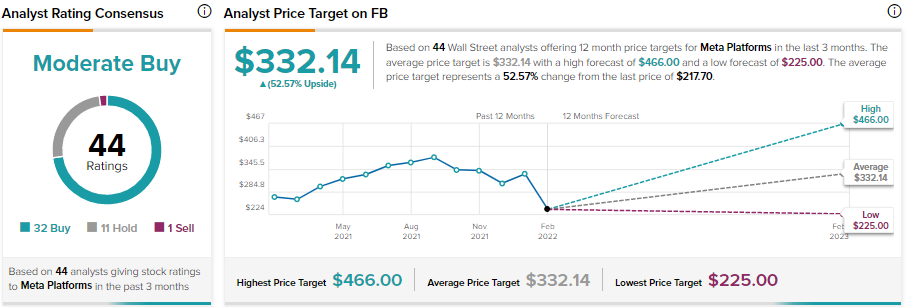

It’s worth noting that increased competitive headwinds and Apple’s privacy changes could take a toll on Meta’s financial performance in 2022, which is why Wall Street remains cautiously optimistic about FB’s prospects. On TipRanks, FB has a Moderate Buy consensus rating based on 32 Buy, 11 Hold, 1 Sell recommendations.

Further, Meta Platform’s stock price forecast on TipRanks shows significant upside potential due to the correction. The average Meta Platforms price target of $332.14 implies 52.6% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.