Well that was certainly a surprise!

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Heading into earnings Wednesday evening, analysts polled by The Fly had predicted that Meta Platforms (NASDSAQ:META) — the artist formerly known as Facebook — would earn $2.22 per share on sales of $31.5 billion. As it turned out, Meta missed the earnings estimate, at least, by a metric mile, reporting profits of only $1.76 per share — a $1 billion-wide earnings miss.

On the plus side, sales came in at a strong $32.2 billion, and Meta hit a “milestone,” reporting that for the first time ever it has reached 2 billion daily active users.

Investors broke out in applause. Despite the earnings miss, in after hours trading, Meta stock soared 20%, erasing more than six months of losses from the stock, and returning Meta shares to prices last seen in June 2022.

And no wonder. According to Mark Zuckerberg, 2023 is going to be the “Year of Efficiency” at Facebook — sorry, “Meta.”

Despite reporting a 4% year over year decline in revenue in Q4 (total revenues dropped only 1% for the year), a 22% increase in costs (23% for the year), and a staggering 52% decline in per-share profits (38% for the year), Meta undeniably beat earnings estimates with a stick. What’s more, management predicted it will beat revenue expectations in Q1 2023, delivering sales in a range from $26 billion to $28.5 billion. And over the course of this year, management promised to rein in capital spending by as much as 19% (below previous expectations), and to cut total costs by as much as 11%.

All of this means that, after missing earnings in Q4 2022, Meta is most likely going to outperform earnings expectations all through 2023.

Commenting on the results, Baird analyst Colin Sebastian declared unqualifiedly that “Meta [is] getting its mojo back,” “increasing expense discipline,” and “making improvements with both users and advertisers.” After praising Meta’s performance in Q4 2022 and predicting great things for 2023, Sebastian proceeded to reiterate an “outperform” rating on Meta stock.

Yet, Meta Platforms stock isn’t out of the woods just yet. Because promises of efficiency notwithstanding, the simple fact is that as of Q4 2022, at least, Meta is still on a downtrend. Sales for the quarter, remember, were worse than for 2022 as a whole — down 4%. Earnings for Q4 (down 52%) were also worse than full-year earnings (down 38%). And while Meta’s guidance for Q1 holds out the potential for a return to sales growth if management maxes out its prediction of $28.5 billion, if sales fall towards the lower end of the guidance range ($26 billion), well, that would be a decline of 7%.

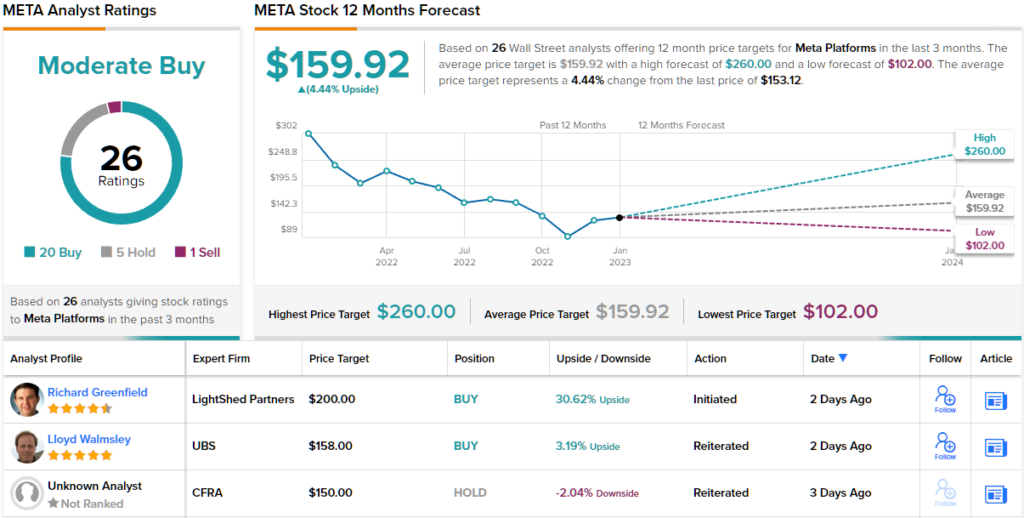

Looking at the consensus breakdown, the majority of analysts are bullish on Meta’s prospects; 20 Buys, 5 Holds, and 1 Sell add up to a Moderate Buy consensus rating. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.