As social media platforms and data platform companies like Matterport venture into the metaverse, website data traffic becomes an important predictor of the companies’ pivot into the metaverse.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is because for social media platforms like Meta Platforms (FB), which is banking on the metaverse becoming the next big technology platform, website traffic trends can give an insight into whether the transition to the metaverse will be successful.

But first, what is the metaverse? The metaverse is a shared, three-dimensional virtual environment where people can interact with each other socially or can engage in work. According to a Bloomberg report, this market could be worth $800 billion in 2024 versus $500 billion in 2020.

Let us compare two companies that are pivoting towards the metaverse, using the TipRanks stock comparison tool: social media company Meta Platforms, and spatial data platform company Matterport, and analyze the website traffic data for these companies.

Meta Platforms (NASDAQ: FB)

Meta Platforms has been under growing regulatory scrutiny lately, but the company’s growth drivers are intact and investors seem excited about its investment into the metaverse. It continues to be one of the top Metaverse stocks out there.

The company took a step towards the Metaverse today as it announced the opening up of Horizon Worlds, a virtual world of avatars to people who are 18 and older. This virtual reality world would be available in the U.S. and Canada.

The social media platform unveiled its metaverse strategy at its Q3 earnings call, when the company’s management added that it will continue to invest more into its virtual reality (VR) and augmented reality (AR) products.

Starting from its Q4 results, which are expected to be announced on February 2, the company will separately disclose the financials for Facebook Reality Labs, which will be a separate business segment from FB’s Family of Apps.

Moreover, the company’s management stated that for FY21, its rising investments in the AR and VR range of products, that is the metaverse, could drag down its operating profit by around $10 billion.

However, investors seem to be optimistic about FB’s metaverse investments, as the stock has soared 32.4% in the past year.

Jeffries analyst Brent Thill believes that while the metaverse investments could be “heavy,” the company could still be on the path to achieving earnings of $20 per share. That could, in turn, lead to FB trading at a price-to-earnings ratio of 25x and a market price of $500.

However, the analyst expects that revenue growth could slow down for FB in FY22, due to a difficult comparison to FY21 and the company’s need to navigate an “evolving privacy landscape.”

But Thill continues to be positive about the monetization opportunities on Facebook, Marketplace and Instagram, given that they “could breakthrough in 2022 driving advertiser demand and ad pricing higher.” What’s more, the analyst is of the view that the company’s current stock price does not reflect the “huge” monetization opportunities that exist in Instagram Reels, WhatsApp, Oculus, and Messenger.

As a result, Thill is upbeat about the stock with a Buy rating and a price target of $420 (26% upside) on the stock.

Other analysts on the Street echo Thill and are also bullish on the stock, with a Strong Buy consensus rating based on 26 Buys and 5 Holds. The average Meta Platforms stock prediction of $406.92 implies upside potential of approximately 22.1% to current levels for this stock.

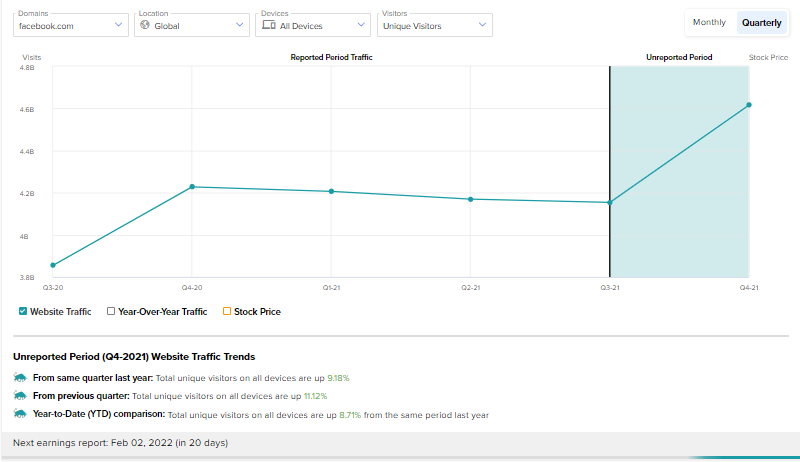

The website traffic data available on TipRanks for Meta Platforms bears out the bullish outlook on the stock. This data indicates that in Q4, unique visitors to FB across all devices have increased 9.2% year-over-year to 4.6 billion.

Matterport (NASDAQ: MTTR)

Matterport has a spatial computing platform that “turns buildings into data, making every space more valuable and accessible.” The company’s spatial computing platform and 3D capture technology have resulted in making buildings and physical spaces accessible digitally.

Matterport primarily generates revenues through subscriptions to its artificial intelligence (AI)-powered spatial data platform, licensing its data to third parties, selling its products, including its data capture devices like its Matterport Pro2 camera, and providing services to customers.

In December last year, the company partnered with Amazon’s (AMZN) Amazon Web Services (AWS) to make its platform available on AWS.

Berenberg Bank analyst Gal Munda viewed the partnership as “significant,” and potentially resulting in a rise in subscription revenues. According to the analyst, the growth in subscription revenues could be driven by this partnership as “a large and diverse freemium base” could come on board.

Moreover, the analyst thinks that more free customers could turn into paid customers than at the current average rate of around 8%. That’s because on AWS, more small-to-medium business (SMB) customers might test out Matterport’s service.

As a result, the analyst is positive, with a Buy rating and a price target of $25 (66% upside) on the stock.

The rest of the analysts on the Street are also upbeat on Matterport, with a Strong Buy consensus rating based on a unanimous 3 Buys. The average Matterport stock prediction of $31.33 implies upside potential of approximately 108% to current levels for this stock.

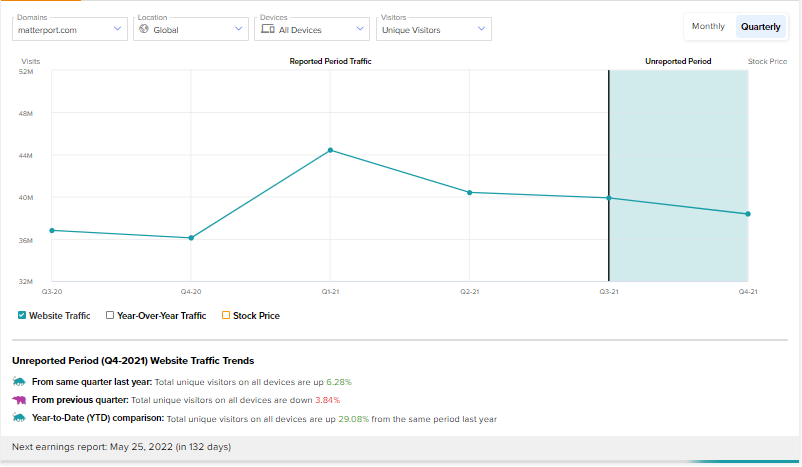

The website traffic data available on TipRanks for Matterport is also encouraging. This data indicates that in Q4, unique visitors to the website across all devices have increased 6.3% year-over-year to 38.4 million, while in the month of December, unique visitors to matterport.com increased 14.4% year-over-year to 13 million.

Bottom Line

While analysts are bullish about both stocks, based on the upside potential over the next 12 months, Matterport certainly seems to be a better Buy.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.