Meta Platforms (NASDAQ: META) is a love-it-or-hate-it kind of company that’s in a controversial transition phase now. I am neutral on Meta Platforms stock, as there are things to like about the company and its CEO, Mark Zuckerberg, as well as potential problems that could persist into the coming year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meta Platforms owns the social media platforms Facebook and Instagram, but Zuckerberg seems intent on morphing the company into a metaverse-focused business. During a time of elevated inflation, some commentators may question whether consumers are willing and able to spend $1,000 or more on a virtual reality headset.

If you’re going to hold Meta Platforms stock with confidence, you’d better be on board with Zuckerberg’s metaverse-obsessed vision for the company. Plus, be prepared to withstand some pushback as not everyone’s a fan of Meta Platforms – and regulatory issues could limit the company’s ability to generate revenue in 2023.

META Stock Looks Cheap, and the Company Has Loyal Users

Growth investors won’t like the trajectory of META stock in 2022, as it has lost more than 64% of its value this year. However, the result of this share-price drawdown is that Meta Platforms stock finally looks like a bargain.

A year ago, it was unthinkable that Meta Platforms could have a trailing 12-month P/E ratio of just 11.4x. Yet, here we are, and the unthinkable has happened. On top of that, Meta Platforms’ price-to-book (P/B) ratio is fairly reasonable at 2.6x (I typically like to see a P/B ratio under 3x).

That’s positive news for value seekers, and growth investors should be glad to know that Meta Platforms is gaining traction among certain age demographics of consumers. First of all, Meta Platforms scored the number-one position on Morning Consult‘s list of the fastest-growing brands of 2022 among U.S. adult consumers.

This may be a surprising result, as not everyone trusts Facebook’s use of personal data, and some folks are skeptical about the metaverse. Yet, Meta Platforms was the 11th-fastest growing brand in 2022 among millennials, second-fastest among Generation X users, and also second-fastest among baby boomers.

It’s also been reported that Instagram remains popular among Generation Z users. Thus, Meta Platforms appears to have retained a following among multiple age demographics of consumers; this bodes well as the company’s investors look for a long-awaited turnaround next year.

Meta May Encounter Pushback in 2023 from Workers and Regulators

The data from Morning Consult reveals that Meta Platforms has a large number of loyal users, but not everyone is a fan of Zuckerberg and his company. META stock could slide in 2023 if the company’s reputation deteriorates – and if regulators cause legal problems for Meta Platforms.

As Morning Consult reported, Meta Platforms laid off around 13% of its staff, which translates to roughly 11,000 employees. This might help to explain why some of the company’s current and/or former employees are expressing negative views of Meta Platforms on the anonymous online forum Blind.

Apparently, comments on the forum suggested that Zuckerberg “is leading this company in the wrong direction” and “Leadership is having no clue, they mistake motion for a progress.” Other comments opined, “Poor leadership is on track to sink this ship,” and, “I thought it was a data-driven company but actually it is one man’s gut feeling and emotions-driven. Nobody can overwrite his decision.”

Clearly, some folks are skeptical of Zuckerberg’s ability to lead Meta Platforms. Meanwhile, the Federal Trade Commission (FTC) is suing Meta Platforms to block its acquisition of virtual reality (VR) technology company Within Unlimited Inc. due to antitrust concerns. Also, European Union regulators are suing Meta Platforms over the company’s requirement that users allow personalized advertisements based on their online activity.

These regulatory actions could have a profound, negative impact on Meta Platforms’ ability to dominate the VR space and generate revenue through sales of targeted ads.

Is META Stock a Buy, According to Analysts?

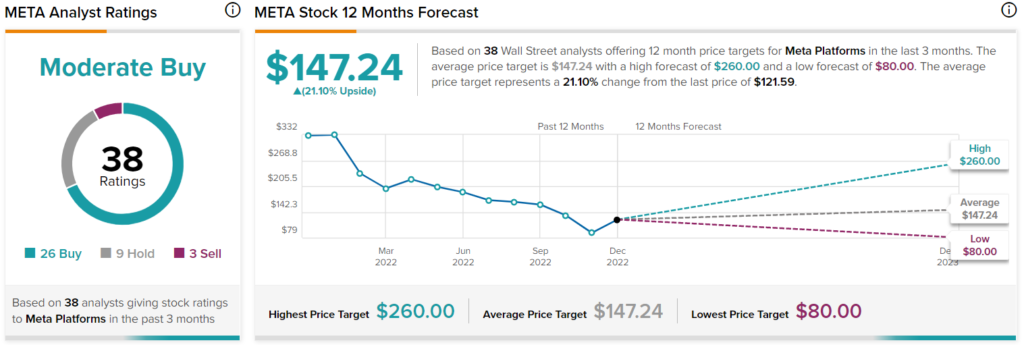

Turning to Wall Street, META is a Moderate Buy based on 26 Buys, nine Holds, and three Sell ratings. The average Meta Platforms price target is $147.24, implying 21.1% upside potential.

Conclusion: Should You Consider Meta Platforms Stock?

The experts on Wall Street seem to envision moderate upside potential for META stock from its current price. Furthermore, the shares look cheap, and Meta Platforms’ brand growth is surprisingly strong.

On the other hand, it’s wise to remain neutral on META stock for the time being. Meta Platforms’ workers have insights into the company that most people don’t have, and some employees aren’t particularly pleased with Zuckerberg.

It’s also alarming that Meta Platforms is facing regulatory action in two different continents, and both of them could crimp the company’s revenue next year. Therefore, despite what looks like an irresistible value proposition, cautious investors should probably hold off if they’re thinking about buying META stock today.