Meta Platforms (NASDAQ:META) is almost constantly a topic of controversy. Should this alter your plan to participate in Meta Platforms’ awesome revenue growth? The choice is yours to make, but I am bullish on META stock and don’t imagine that this Magnificent Seven member will slow down anytime soon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Above all else, Meta Platforms is a social-media platform provider that owns Facebook, Instagram, and WhatsApp, along with Reels and Threads. At the same time, CEO Mark Zuckerberg wants Meta Platforms to be a strong competitor in the Metaverse as well as artificial intelligence (AI).

You’ve probably heard about Meta Platforms being the target of regulatory pressure in the U.S. and Europe. This hasn’t stopped META stock from rising over the past several years, though. Yet, there’s a new development that might derail Meta Platforms’ growth story — or maybe not, so let’s get into the details now.

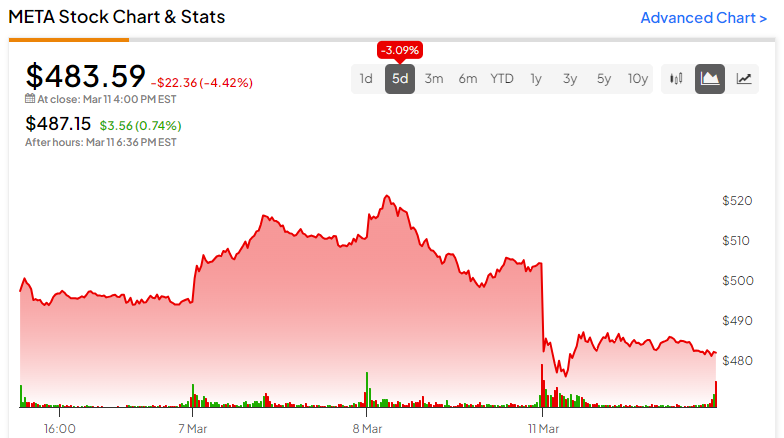

Why Meta Platforms Was in the Red Today

Overall, the U.S. stock market was a bit shaky today, but it held fairly steady. However, even though Meta Platforms is a “Magnificent Seven” company, its stock wasn’t very magnificent today.

As META stock slipped over 4%, investors might have wondered whether Zuckerberg had made a startling announcement. In actuality, however, the source of the consternation on Wall Street came not from Zuckerberg but from a famous political figure.

Specifically, former President Donald Trump had some less-than-flattering things to say about Meta Platforms. The main topic of his recent rant was rival social-media platform TikTok, which Trump considered banning when he was president.

As I see it, it’s important for investors to be aware of what’s in the news, even if they’re not taking a particular position. So, here’s what happened. According to Reuters, Trump declared that “There’s a lot of good and there’s a lot of bad with TikTok” and that “There are a lot of young kids on TikTok who will go crazy without it.” So, it seems that Trump might not be fully advocating for a TikTok ban right now.

More central to today’s topic, however, is Trump’s stance on Meta Platforms’ Facebook. Considering how a TikTok ban would benefit Facebook, Trump asserted, “I’m not looking to make Facebook double the size.” The former president added, “I think Facebook has been very dishonest.”

Then, Trump kicked it up a notch. As reported by The Wall Street Journal, Trump stated, “I consider Facebook to be an enemy of the people, along with a lot of the media.”

Meta Platforms Will be a Target but Also a Revenue Generator

Going forward, investors should just assume that Meta Platforms will be a target of controversy. Zuckerberg isn’t known for “playing nice” with regulators. It seems that he would prefer to continue doing what he’s been doing with Meta Platforms and pay any fines that regulators might impose upon the company.

Meta Platforms has deep pockets, so paying fines isn’t usually a problem. Just take a look at TipRanks’ financials page for Meta Platforms, and you’ll see what I’m talking about. The company grew its revenue from $28.64 billion in the quarter ended March 2023 to $40.11 billion in the quarter ended December 2023.

Speaking of growth, Meta Platforms’ position of cash, cash equivalents, and short-term investments increased over the quarters and reached $65.4 billion by the end of last year. Meta Platforms is so flush with cash that the company is now paying dividends.

Next, I checked Meta Platforms’ earnings page and discovered that the company has consistently grown its quarterly EPS for a year and a half. Furthermore, Meta Platforms has beaten Wall Street’s consensus EPS forecasts for a full year now. Evidently, this social media juggernaut is practically unstoppable when it comes to generating advertising revenue and posting impressive profits.

Is META Stock a Buy, According to Analysts?

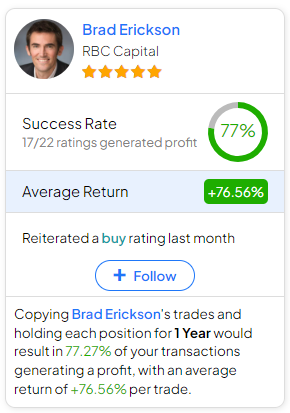

On TipRanks, META comes in as a Strong Buy based on 40 Buys, two Holds, and one Sell rating assigned by analysts in the past three months. The average Meta Platforms price target is $528.80, implying 9.35% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell META stock, the most profitable analyst covering the stock (on a one-year timeframe) is Brad Erickson of RBC Capital, with an average return of 76.56% per rating and a 77% success rate. Click on the image below to learn more.

Conclusion: Should You Consider META Stock?

A fearful attitude would be: “What if Meta Platforms stock keeps falling?” I prefer to take an opportunistic attitude. If the share price goes low enough due to controversy that won’t destroy Meta Platforms, I’ll certainly consider buying META stock.

It’s also possible to buy Meta Platforms shares now and then think about adding to one’s position if the stock continues to fall. After all, heated debates will come and go, but Meta Platforms will continue to make a whole lot of money.