Social media giant Meta Platforms (NASDAQ:META) recently reported market-crushing third-quarter earnings that reflected the company’s strong execution and recovery in the digital ad market. While management’s cautionary comments about potential ad softness due to the ongoing Middle East turmoil overshadowed the solid beat, Wall Street analysts remain bullish on the stock and see further upside despite a stellar 166% year-to-date rally in META stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta Firing on All Cylinders

Meta suffered for a couple of quarters due to weak digital ad spending amid macro pressures, Apple’s (NASDAQ:AAPL) iOS privacy policy changes that impacted the ability to effectively target ads, and rising competition from TikTok. However, the company bounced back strongly this year with the help of strategic initiatives that helped improve user engagement. Also, gradual recovery in the digital ad market aided top-line improvement.

In Q3 2023, Meta’s revenue grew 23% year-over-year to $34.1 billion, with the online commerce vertical contributing the most to the top-line growth. Further, the company’s earnings per share (EPS) jumped 168% to $4.39, handily surpassing analysts’ consensus estimate of $3.64. The company’s streamlining efforts and aggressive cost cuts in what CEO Mark Zuckerberg calls “the year of efficiency” drove the massive increase in the bottom line.

Additionally, Meta continues to experience increased user engagement. Family Daily Active People (DAP), which indicates the number of users who used any one of the company’s apps (Facebook, Instagram, Messenger, and WhatsApp), increased 7% to 3.14 billion on average for September 2023. The company is leveraging generative artificial intelligence (AI) to drive further user engagement and boost its customer base.

Is Meta a Buy, Sell, or Hold?

Following the Q3 print, Citigroup analyst Ronald Josey increased the price target for Meta Platforms stock to $425 from $385 and reaffirmed a Buy rating on October 26. While the company’s Q4 revenue guidance midpoint was about 2% below consensus due to geopolitical uncertainty, Josey believes that the guidance is “likely to prove conservative” as the holiday shopping season ramps.

Josey is also encouraged by the continued AI-induced improvement in engagement and Meta’s product roadmap. Additionally, on October 30, Josey reacted to the news of Meta launching advertising-free subscription tiers for users in Europe. He thinks that this move removes a key regulatory overhang on the stock.

On November 1, another Meta bull, Loop Capital analyst Rob Sanderson, reiterated a Buy rating on the stock with a price target of $375. He raised his FY23 EPS estimate to $14.58 from $13.71 and FY24 estimate to $17.88 from $17.34.

Sanderson highlighted the continued product momentum in Reels, Advantage+, and messaging, noting the significant interest in recent launches of gen-AI products across most of Meta’s family of apps.

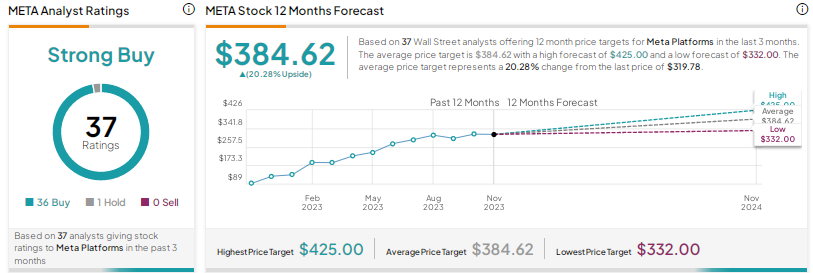

Overall, Meta scores Wall Street’s Strong Buy consensus rating based on 36 Buys versus just one Hold rating. The average price target of $384.62 implies 20.3% upside potential.

Conclusion

Meta Platform has delivered robust performance this year and has impressed investors with its initiatives to revive its top-line growth and improve profitability. Despite near-term macro pressures, Analysts remain highly bullish about the road ahead, as the company is working on further enhancing its apps with generative AI.