Meta Platforms (NASDAQ: META) dominated the financial market headlines last week as Founder and CEO Mark Zuckerberg announced the company will be laying off roughly 13% of its staff, or more than 11,000 employees. While the news itself is not exactly positive, it contributed to the stock rallying substantially from its November lows. In my view, this decision shows that the management team at Meta has not gone completely delusional, recognizing that burning cash at past rates is completely unsustainable. That said, the metaverse is still going to be a cash vacuum whose future earnings potential remains completely unpredictable.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Thus, while this first cost-cutting initiative is a step in the right direction, it’s hard to tell whether Meta can return to profitable growth in the coming years. Accordingly, even as a Meta shareholder, I remain somewhat wary and neutral on the stock.

Are Layoffs Going to Cut Costs Meaningfully?

While the market has reacted quite positively to Meta’s layoffs, it’s actually worth checking if these layoffs will meaningfully reduce costs and help the company’s profit margins recover. It’s honestly hard to exactly estimate how much money Meta will save, but we can get a rough idea.

If we assume that Meta spends anywhere between $110,000 and $140,000 per employee per year, including benefits, the company could be saving anywhere between $1.21 billion and $1.54 billion annually. This may appear like a substantial number, but it’s really not.

Year-to-date, Meta’s cost of revenue has amounted to $16.9 billion, while its total expenses approached $62 billion – and these numbers refer to three quarters, not even an actual financial year. Thus, even if we suppose the company will be saving close to $1.5 billion following the recently announced layoffs, that’s still a drop in the bucket.

From another point of view, Reality Labs, the company’s metaverse-focused segment, generated sales of just $1.4 billion between Q1 and Q3 while reporting a loss from operations of $9.4 billion. This implies an annualized rate of over $12.5 billion in operating losses. So, you see, $1.5 billion in savings is next to nothing.

So, why did the market send shares rallying higher following the news? In my view, the market likely believes this is the first move towards a series of cost-cutting actions, which could include reducing stock-based compensation, loosening discretionary spending, and slowing down metaverse-related capital expenditures.

Meta’s Core Business Remains Solid Despite Metaverse Flop

Meta has failed to convince both investors and consumers of the merits of the metaverse. Could the market be wrong? Could the metaverse be developed into the prominent platform/universe, proving to everyone that it’s not just a wild money pit? Maybe, but probably not. The financials of it make absolutely no sense.

At a burn rate of $40 billion per year, the company will literally have to generate hundreds of billions in revenues by some arbitrary point in the coming years to make a decent return on its investment. It may be early to draw a conclusion, but it’s not wild to say the metaverse more or less died before it was even born.

That said, I am encouraged by the fact that the company’s core business remains as solid as ever. In its Q3 results, Monthly Active Users (MAUs) came in at 2.96 billion in the company’s Family of Apps segment, a 2% year-over-year increase, which is utterly impressive. Too many have been prophesizing the demise of Facebook and Instagram for years. Yet, not only have these apps retained their user bases but even continue to add users despite almost half of the globe already logging in at least once a month.

Additionally, while ad prices declined 18% amid reduced global ad spending due to the ongoing macroeconomic situation, ad impressions delivered across the company’s Family of Apps actually increased by 17%. The decline in ad prices is not that worrisome, as ad prices will eventually go back up once economic growth re-accelerates. However, the increase in ad impressions is something to celebrate, as it undoubtedly proves that engagement within Meta’s platforms remains very strong.

Given TikTok’s success during the past couple of years, the growth in MAUs and ad impression should solidify the resilience of its core platforms and confirm that Meta has a functioning, highly-profitable core business that should be sustained, even if the metaverse fails to materialize.

Is META Stock a Buy, According to Analysts?

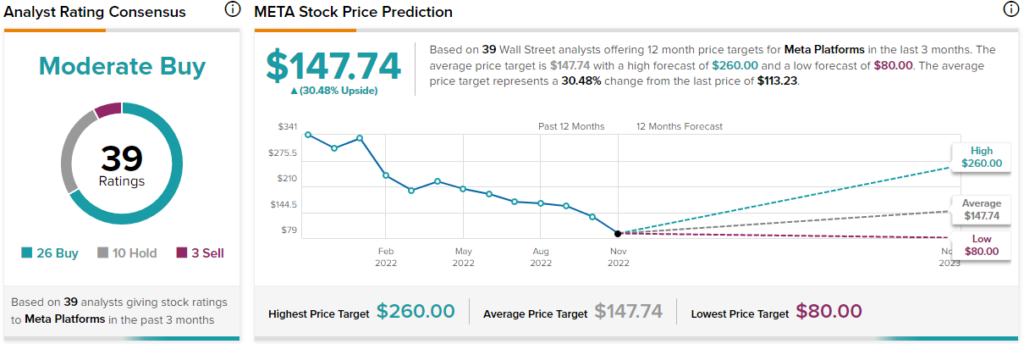

Turning to Wall Street, Meta has a Moderate Buy consensus rating based on 26 Buys, ten Holds, and three Sells assigned in the past three months. At $146.46, the average Meta price target implies 30.5% upside potential.

Takeaway: Meta Has More to Prove

With the most recent decision to lay off staff likely to lead to further cost-cutting efforts and Meta’s core business remaining strong, the stock’s investment case has somewhat improved lately.

Nevertheless, Mr. Zuckerburg and his team have more to prove before the market starts taking this company seriously again. Specifically, Meta needs to demonstrate it can actually achieve much more meaningful cost savings moving forward and convince the market it can continue developing the metaverse via profitable growth and not by senselessly throwing billions of dollars away. Until then, I will likely remain neutral on the stock.