There are as many paths to market success as there are market investors, but one that stands out is following the blue-chip stocks. These market stalwarts, well-known companies with long records of profitable success and stability, let investors tap into the advantages of the ‘known knowns,’ the reliability that gives us confidence in strong future performance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

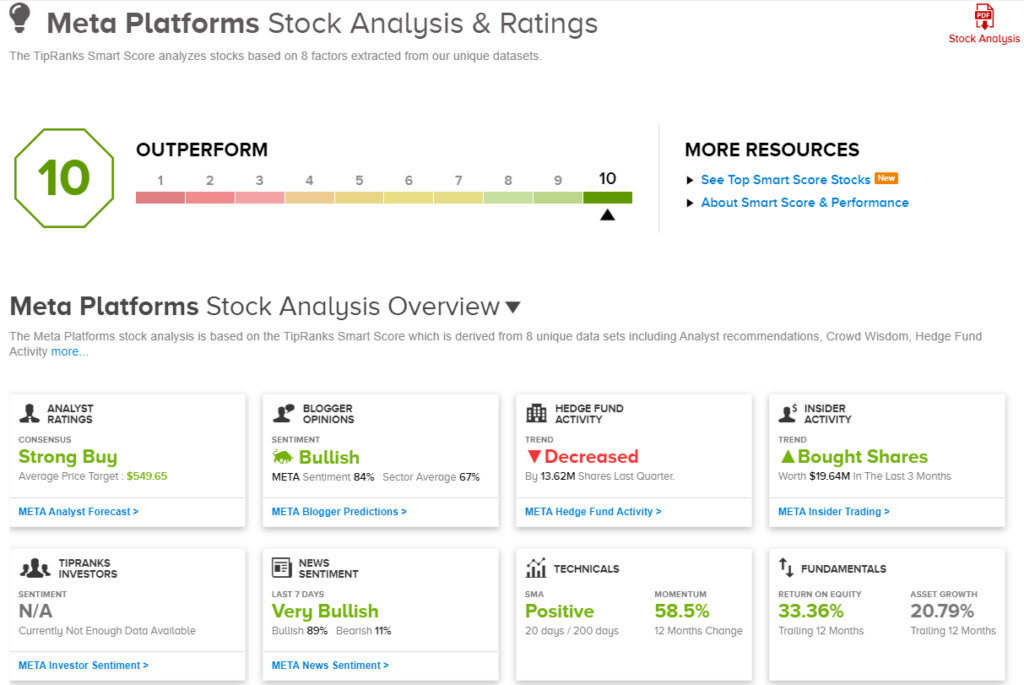

But even knowing what we know, it’s still good to find confirmation from the data. The Smart Score tool, an AI-based, natural language algorithm, gathers, collates, and analyzes the reams of raw information put up by millions of daily stock transactions – and distills it down to a single-digit score that’s easy to understand and use.

The Smart Score is given on a simple scale of 1 to 10, with a ‘Perfect 10’ being a stock that measures up according to a set of factors known to predict future outperformance. These are the stocks that are worth some extra attention – and when those stocks are also blue-chip leaders like Meta Platforms or Walmart, companies that have brought long-term gains and profits, it’s a clear and bullish signal for investors to follow.

So let’s do that. Using the TipRanks platform, we’ve pulled up the latest data on those two blue-chip ‘Perfect 10s,’ Meta and Walmart. Here they are, along with comments from the Street’s analysts

Meta Platforms (META)

Up first is Meta Platforms, originally founded as Facebook – the company that set off the social media storm in the early 2000s. In its current incarnation, Mark Zuckerberg’s creation has become a holding company, operating in the social media realm through its subsidiaries: Facebook, Messenger, Instagram, and WhatsApp. Meta operates globally, reaching out across linguistic and geographic barriers. The company has a total user base, across all of its platforms, well in excess of 3 billion people.

Meta’s core business is social media, monetized through digital advertising. This business model depends on reach, and the company’s unmatched success in that metric – its platforms connect with some 40% of the world’s total population – provides a solid base for profitable operations. In 1Q24, the last reported, Meta saw a top line of $36.46 billion, a figure that was up 27% year-over-year and beat the forecast by $240 million. At its bottom line, Meta generated earnings of $4.71 per share, 39 cents per share better than had been anticipated.

It’s important to note that Meta finished Q1 with those successes even as it paid out capital expenditures of $6.72 billion. The company reported a free cash flow in the quarter of $12.53 billion, and had $58.12 billion in cash and other liquid assets on hand.

Like all successful companies, Meta has been adapting itself to changing conditions. The company’s Meta AI research lab is working on several AI applications simultaneously, including apps for creative and connection AIs – and most importantly, a generative AI user interface. The company is working to develop a seamless transition from the real-life and AI universes, with scalable AI systems operable at any level the user chooses.

Turning to the analysts, we find that Deepak Mathivanan, from Wolfe Research, is staking out a strongly upbeat position in his initiation of coverage. He notes the company’s increasing capital expenditure, particularly on AI, and explains that it has potential to pay back for investors, writing, “We believe that META’s expected uptick in OpEx and CapEx is warranted to solidify a leading position in the Gen AI arms race vs. other Mega cap names and that the company should see benefits to top-line growth from Gen AI product flow-through as well as the ability to exercise cost discipline in order to continue expanding margins over the next two years.”

Looking ahead, Mathivanan adds, “We agree with the Bulls that META can continue to grow top-line (although not accelerate through the year) and gain share, supported by Gen AI initiatives, Reels monetization, and rising contribution of click-to-messaging. We see upward estimates revision to be more likely of a driver than multiple expansion for the stock to work near-to-mid-term.”

These comments, taken together, back up the analyst’s Outperform (Buy) rating on META shares, while his $620 price target points toward a one-year upside potential of 34.5%. (To watch Mathivanan’s track record, click here.)

Overall, this Magnificent 7 mega-cap stock has earned a Strong Buy consensus rating from the Street’s analysts, based on 44 reviews that include 39 Buys, 3 Holds, and 2 Sells. The shares are trading for $461.27 and their $539.59 average target price implies an upside of 17% on the one-year horizon. (See Meta’s stock forecast.)

Walmart, Inc. (WMT)

Next on our list here is Walmart, known as the world’s largest brick-and-mortar retailer – and the second largest of all types, after Amazon. Walmart company has long billed itself as an American success story, growing from its roots as a Mom-and-Pop store in Arkansas to become a global giant with a $568 billion market cap and $648 billion in total revenues for its fiscal year 2024, which ended this past January 31. Walmart employs over 2 million people worldwide and is the clear leader in the discount retail segment in the US.

In addition to its eponymous stores – focusing on the discount department store and grocery niches, Walmart also owns and operates the Sam’s Club chain of warehouse membership stores. The company operates more than 10,500 locations in 19 countries, including 4,609 Walmart superstores and 599 Sam’s Club stores in the US and another 5,399 Walmart locations internationally.

In addition to its brick-and-mortar presence, the company has a strong global eCommerce component, that showed 21% year-over-year growth in the last quarter reported, fiscal 1Q25. Walmart has pursued an interesting variation on eCommerce, leveraging its brick-and-mortar network: customers can pay and order online, and pick up their merchandise at the nearest Walmart store.

During that quarter, Walmart registered $161.5 billion in consolidated revenues, for year-over-year growth of 6% and beating the estimates by $3.36 billion. The company’s earnings, reported as a non-GAAP EPS of $0.60, were 8 cents per share better than the forecast. We should note here that shares in WMT are up 35% for the year-to-date, strongly outpacing the ~14% gain on the S&P 500.

Analyst Peter Keith, of Piper Sandler, agrees with the upbeat sentiment towards Walmart. He points out the stock’s strong year so far, as well as the company’s potential to continue bringing in solid returns: “While WMT shares have had a terrific run YTD, we believe the company is in the early stages of an unprecedented profit growth acceleration for a large and mature retailer. By leveraging its massive omni-channel model, WMT is driving significant valuation creation in the form of new and high-margin revenue streams (e.g., Supplier Advertising, E-com Marketplace, etc.) that should not only accelerate EBIT growth in the years to come, but will also create a steadier and more sustainable growth model, in our view.”

This position leads the 5-star analyst to rate WMT shares as Overweight (Buy) and to set an $81 price target that suggests an upside of almost 15% for the coming year. (To watch Keith’s track record, click here.)

There are 30 recent analyst reviews of Walmart’s stock, and the 27 to 3 breakdown, favoring Buy over Hold, gives the shares a Strong Buy consensus rating. WMT shares are selling for $70.6, and the $74.11 average target price implies they will gain 5% over the next 12 months. (See Walmart’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.