The Federal Reserve is expected to start cutting interest rates in September. This could increase investors’ focus on growth stocks. Companies in the growth phase invest significantly in their businesses. Consequently, they tend to benefit from lower borrowing costs when interest rates reduce. With this backdrop in mind, we used TipRanks’ Stock Comparison Tool to place Meta Platforms (META), Netflix (NFLX), and Amazon (AMZN) against each other to find the best growth stock, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta Platforms (NASDAQ:META)

Meta Platforms shares have rallied about 46% year-to-date. The company’s upbeat second-quarter results and a better-than-anticipated outlook for the third quarter of 2024 reflected strong execution and a solid position in the digital ad market.

It is worth noting that Meta Platform’s Q2 earnings per share (EPS) surged 73% to $5.16, driven by 22% revenue growth and operating margin expansion. Remarkably, Q2 operating margin expanded to 38% from 29% in the prior-year quarter, fueled by the company’s streamlining and cost-cutting measures.

META is experiencing the benefits of its significant artificial intelligence (AI) investments. AI is improving recommendations and helping users find better content on Meta Platforms’ apps. The company estimates capital expenditure in the range of $37 billion to $40 billion in 2024 and has cautioned that it expects a significant rise in capex next year to support its AI research and product development initiatives.

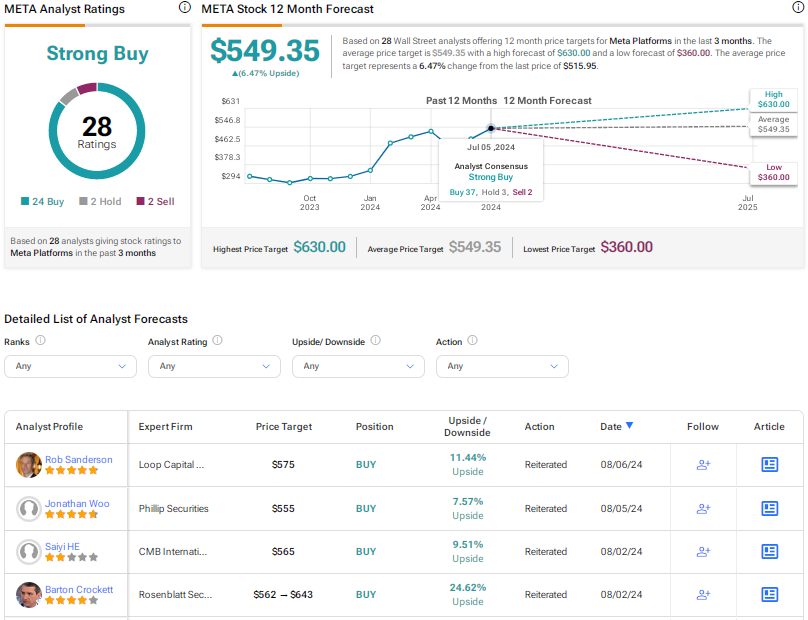

Is META a Buy, Hold, or Sell?

On August 1, Bank of America Securities analyst Justin Post reiterated a Buy rating on META stock and boosted the price target to $563 from $550. The analyst views Meta as “the top AI play” in the consumer internet space.

Post explained that his bullish stance is backed by the company’s leading infrastructure and large language model (LLM) capabilities, solid ad growth driven by core AI, and new multi-year growth prospects in generative AI.

Overall, Meta Platforms scores a Strong Buy consensus rating based on 24 Buys, two Holds, and two Sells. At $549.35, the average META stock price target indicates 6.5% upside potential.

Netflix (NASDAQ:NFLX)

Netflix reported better-than-expected results for the second quarter of 2024. The company’s revenue grew 16.8%, driven by its crackdown on password sharing and efforts to boost subscribers for the ad-supported tier. Global paid memberships increased 16.5% to about 278 million, with 8.05 million additions in the second quarter.

Strong top-line growth and robust margins drove more than a 48% rise in the EPS. Despite the upbeat Q2 results, shares fell as the company’s Q2 free cash flow declined to $1.2 billion from $1.3 billion in the prior-year quarter. Moreover, Netflix’s Q3 revenue outlook fell short of expectations.

Looking ahead, Netflix sees continued growth in its ad-supported plans, as they enable the company to offer lower prices to customers and create an additional profit stream through ad revenues. The streaming giant also continues to strengthen its content base to attract more customers.

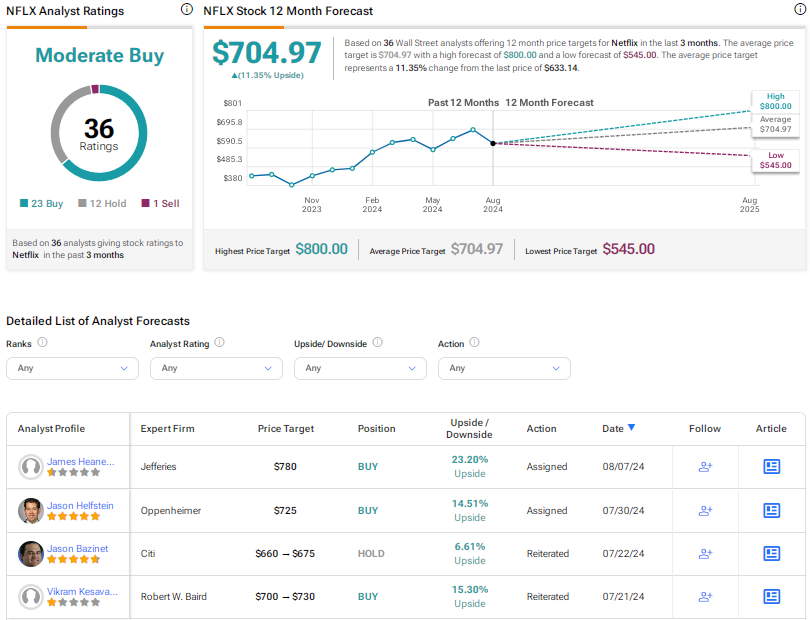

What Is the Target Price for Netflix Stock?

On August 7, Jefferies analyst James Heaney reaffirmed a Buy rating on Netflix stock with a price target of $780. The analyst believes that the recent pullback offers an attractive opportunity to buy the stock. He sees the possibility of the company raising its prices in the fourth quarter in the U.S.

Moreover, Heaney believes the combination of an attractive content slate, including Squid Game 2 and NFL Christmas Day games, and price hikes could fuel further adoption of the company’s ad-tier plan.

Wall Street’s Moderate Buy consensus rating on NFLX stock is based on 23 Buys, 12 Holds, and one Sell recommendation. The average NFLX stock price target of $704.97 indicates 11.4% upside potential. Shares have risen more than 30% so far this year.

Amazon (NASDAQ:AMZN)

Amazon shares took a hit after the company’s Q2 revenue missed analysts’ expectations due to sluggish growth in the retail business. In particular, the revenue of AMZN’s North America retail division fell short of expectations due to macro pressures and rising competition.

Amazon Web Service (AWS), the company’s cloud computing unit, delivered 19% revenue growth in Q2, while advertising revenue increased 20%. Amazon is optimistic about the prospects of its AWS business, as enterprises continue to shift to the cloud and modernize their infrastructure. AWS is also expected to gain from generative AI-led demand.

It is interesting to note that while Amazon’s Q2 net sales grew 10%, its EPS jumped 94% year-over-year to $1.26. The bottom line gained from the company’s aggressive cost-efficiency measures and enhanced inventory management.

Looking ahead, Amazon is making significant capital investments to bolster AWS infrastructure so that it can support the solid demand in generative AI and non-generative AI workloads.

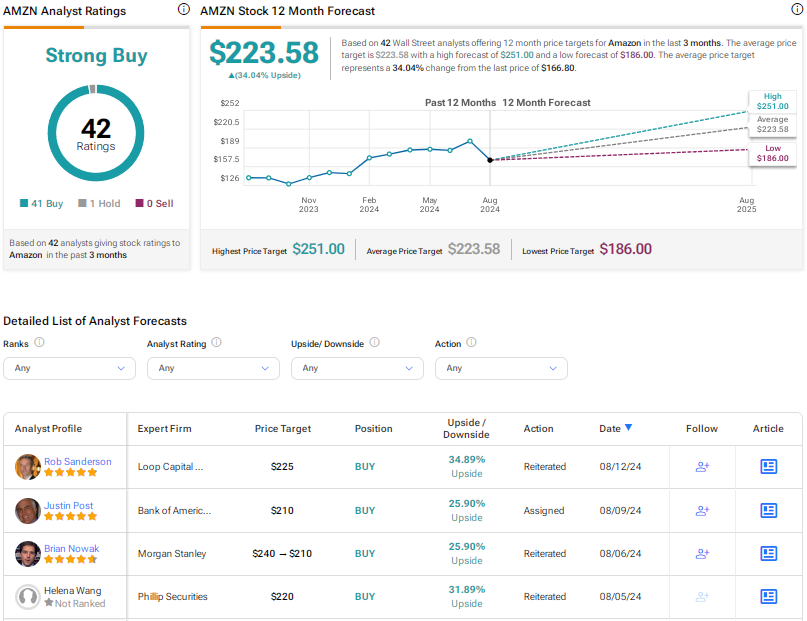

Is Amazon a Buy or Sell Right Now?

While several analysts lowered their price targets for Amazon stock to reflect the subdued growth in retail business, Maxim analyst Tom Forte increased the price target to $251 from $238 and reiterated a Buy rating on AMZN stock.

The analyst noted that while Q2 sales were lower than consensus, the company’s EBIT (earnings before interest and taxes) margin increased 420 basis points, driven by robust expense control and a favorable mix shift to the cloud.

He highlighted that AWS’ top-line growth rate accelerated for the fourth consecutive quarter. Based on AWS’ strength, Forte increased his sales and EBIT estimates for FY24 and FY25.

Amazon scores a Strong Buy consensus rating based on 41 Buys versus one Hold recommendation. The average AMZN stock price target of $223.58 implies nearly 34% upside potential. Shares have risen about 10% so far this year.

Conclusion

While Wall Street is highly bullish on Meta Platforms and Amazon stocks, it is cautiously optimistic on Netflix. Currently, analysts see higher upside potential in Amazon stock than in the stocks of the other two tech giants.

Amazon’s cost-cutting measures, its dominant position in e-commerce, the massive opportunities for AWS, and the growing advertising business are expected to drive continued growth for the company.