Meta Platforms (NASDAQ:META) stock is heavily exposed to legal and regulatory risks. Also, the challenges related to these risks continue to increase, raising concerns. Recently, a group of Spanish media outlets filed a €550 million (about $600 million) lawsuit against Meta. They allege that Meta uses unfair ad practices.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to a Reuters report, the group asserts that Meta utilizes the extensive personal data of users on its social media platforms, including Facebook, WhatsApp, and Instagram, to provide targeted advertisements. This practice gives the tech giant an unfair advantage in creating and delivering personalized ads. The group contends that a significant portion of Meta’s advertisements rely on personal data acquired without explicit consent from users. They argue that such actions violate the EU General Data Protection Regulation.

This comes after Meta faced a setback in its legal battle with the U.S. Federal Trade Commission (FTC). Notably, the FTC proposed amending the 2019 settlement, tightening restrictions on the company, including prohibiting data monetization from users under 18 and imposing broader limits on facial recognition technology. Meta has countered by filing a lawsuit to prevent the FTC from reopening the consent agreement unilaterally.

These developments underline Meta’s heightened legal vulnerabilities and prompt a deeper analysis of its risks.

Meta’s Risk Analysis

Meta has a track record of contending with legal challenges from various regulatory bodies. These investigations pertain to multiple aspects, including advertising practices and privacy issues.

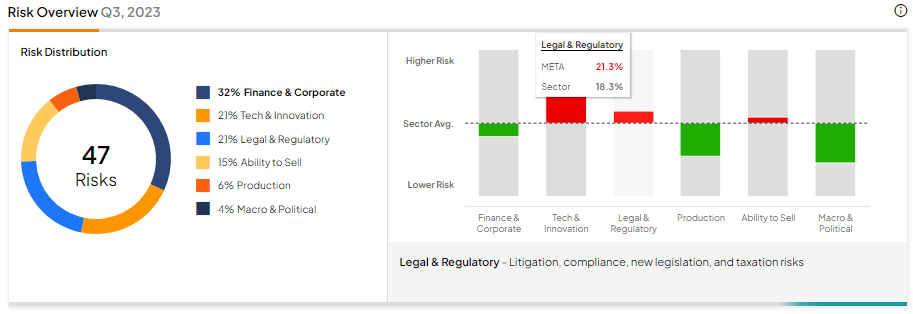

As Meta navigates through the evolving landscape of laws and regulations, TipRanks’ Risk Analysis tool shows that its legal and regulatory risk exposure is higher than the industry average.

Legal and regulatory risks account for 21.3% of its total risks, higher than the industry average of 18.3%. While its legal risks are above the sector average, Meta’s CFO, Susan Li, cautioned during the Q3 conference call that increasing legal and regulatory headwinds in the U.S. and the European Union could significantly impact its operations.

In light of these developments, let’s look at the Street’s recommendation for META.

Is Meta a Buy, Sell, or Hold?

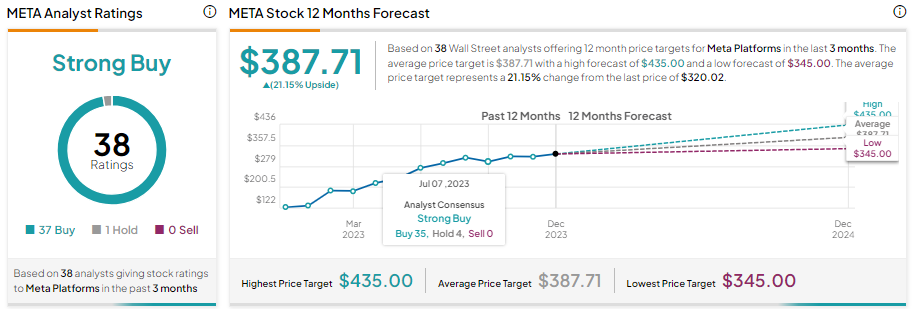

Despite rising legal and regulatory risks, Wall Street analysts are bullish about Meta stock. With 37 out of 38 analysts covering the stock recommending a Buy, Meta has a Strong Buy consensus rating. Further, analysts’ average price target of $387.71 implies 21.15% upside potential from current levels.

Bottom Line

The increase in Meta’s legal and regulatory risk exposure is a major concern as it could hurt its operations. However, analysts are upbeat about Meta’s lean cost structure, solid ad revenue, and significant investments in Artificial Intelligence (AI). This is reflected in their Strong Buy consensus rating.