After a series of quarterly sales declines, Meta Platforms (NASDAQ:META) finally returned to its growth path. The technology company that owns top social media platforms like Facebook, Instagram, and WhatsApp witnessed growing momentum in its products and platforms, implying better days are ahead for the company. Following the Q1 results, Meta stock gained about 12% in the after-hours trade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta’s Q1 in Brief

Meta delivered revenues of $28.65 billion in the first quarter of 2023, up about 3% year-over-year. Moreover, its top line surpassed analysts’ forecast of $27.67 billion. Meanwhile, its earnings of $2.20 per share came well ahead of the Street’s expectations of $2.02.

During the Q1 conference call, Meta’s CEO, Mark Zuckerberg, highlighted that the company is seeing solid engagement growth across its apps. Moreover, the company made notable progress in monetization efficiency. The ongoing improvement positions Meta to deliver solid business results.

Zuckerberg said that Reels are the key catalyst behind growing app engagement. Also, Meta is gaining share in short-form videos, which is positive, especially amid the heightened competitive environment.

It’s important to note that Meta’s Family of Apps continues to grow. Moreover, for the first time in its history, Meta surpassed 3 billion people using at least one of its Family of Apps daily in March.

Facebook’s engagement remains strong, with DAU (Daily Active Users) and MAU (Monthly Active Users) growing sequentially across all regions.

Outlook Remains Strong

Thanks to the momentum in its business, Meta expects its Q2 revenue to be in the range of $29.5-$32 billion, reflecting both year-over-year and sequential growth. Furthermore, it compares favorably to the analysts’ forecast of $29.48 billion.

What’s the Prediction for Meta Stock?

Meta is poised to deliver solid growth in the coming quarters. Meanwhile, its cost-saving initiatives are likely to cushion its bottom line.

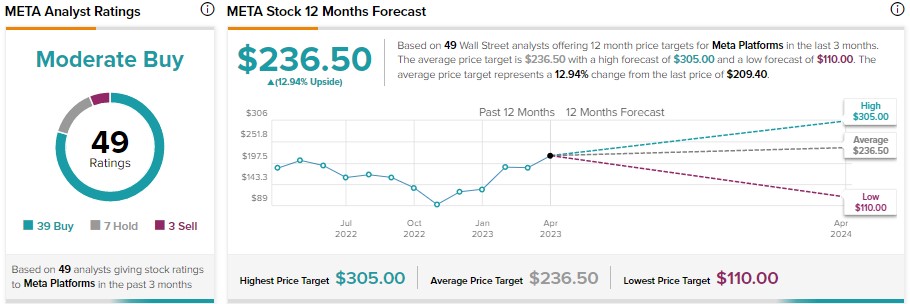

Following the solid quarterly performance, seven analysts, including Goldman Sachs analyst Eric Sheridan, raised their price target on META stock. Sheridan expects an initial positive reaction to the company’s Q1 results as it impressed on multiple fronts, including advertising revenue and monetization efficiency.

Meta stock has 39 Buys, seven Hold, and three Sell recommendations for a Moderate Buy consensus rating. Meta stock has gained over 74% year-to-date. Meanwhile, analysts’ average price target of $236.50 implies a further upside potential of 12.94%.