To say Meta (NASDAQ:META) is having a good 2023 would be a bit of an understatement. Year-to-date, the company’s shares have surged by 152%, primarily fueled by a stellar Q2 report. This report showcased strong metrics across the board, culminating in double-digit year-over-year revenue growth, a milestone not seen since the end of 2021.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With the social media giant about to report Q3 earnings this afternoon, is another expectation-beating display in the offing? That’s a possibility, says Evercore’s Mark Mahaney, an analyst ranked in the top 1% of Street experts.

“Our channel checks on the overall ad environment suggest stable to modestly accelerating spending trends,” said the 5-star analyst, “with consistently bullish sentiment from advertisers on Meta’s momentum, as all key factors weighing on Meta’s growth last year are turning into tailwinds – Ad targeting & measurement improvement, Reels monetization, Advantage+ traction.”

Mahaney’s Q3 revenue estimate is in line with the Street’s forecast of $33.6 billion, amounting to a 21% year-over-year uptick and 5% sequential improvement for which he sees the possibility of “modest upside.” The analyst’s Operating Income estimate of $12 billion (indicating a 35.6% margin), however, is above the Street’s $11.5 billion forecast (implying 34.2% margin).

The potential for Operating Margin expansion into 2024 is real, and could not only further bolster the bull case but would also mean that Meta’s “Year of Efficiency is turning into its Years of Efficiency.”

That in turn, would be a “positive catalyst” for the stock. And despite the huge share gains notched this year, Mahaney points out that Meta’s current valuation (15X P/E) remains the “cheapest among the high-quality Tech stocks out there.”

As for the Q4 guide, Mahaney considers the Street’s revenue estimate of $38.83 billion (up 21% YoY, 16% sequentially) as “bracketable, with modestly greater upside variance based on historical seasonality.” Moreover, there’s further potential upside from political ads ramping up earlier than usual. However, Mahaney does concede that Meta is among the “higher expectation stocks” under his coverage.

Down to business, then, what does this ultimately mean for investors? Mahaney reiterated an Outperform (i.e., Buy) rating alongside a $435 price target, suggesting shares will climb 38.5% higher over the one-year timeframe. (To watch Mahaney’s track record, click here)

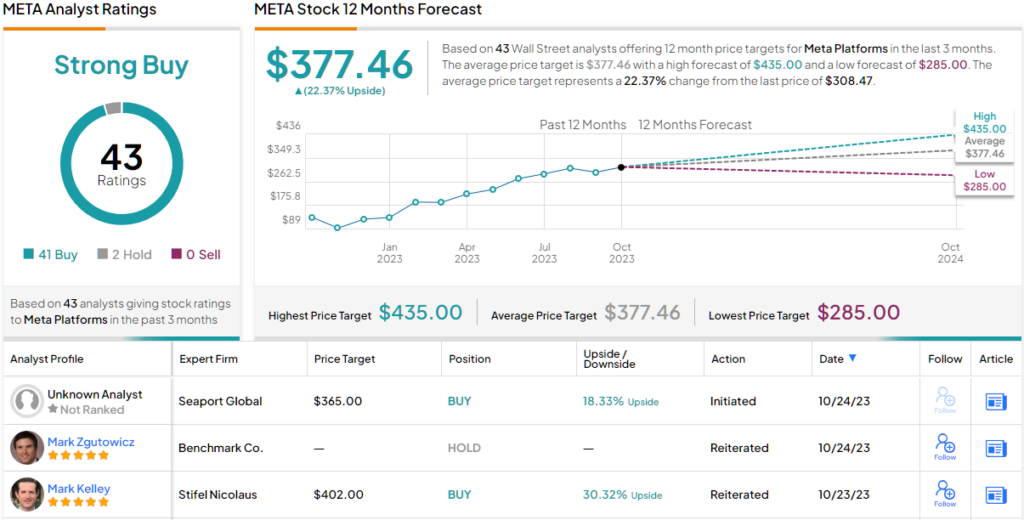

It’s clear that Wall Street generally agrees with the Evercore take on Meta. The stock has 43 recent reviews, which include 41 Buys and 2 Holds, giving the stock its Strong Buy consensus rating. The share price is $308.46, and the average target of $377.46 indicates room for ~22% growth in the year ahead. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.