Social media giant Meta Platforms (NASDAQ:META) is scheduled to announce its second-quarter results after the market closes on Wednesday, July 26. Expectations are high following the company’s solid performance in the first quarter. Moreover, the stellar launch of the rival Twitter app Threads has also impressed investors. Meta shares have skyrocketed over 142% year-to-date. Most analysts remain bullish on the stock and expect revenue growth to accelerate in the second quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts’ Expectations from Meta’s Q2 Results

Meta returned to top-line growth in the first quarter after three quarters of decline in revenue due to the slowdown in digital ad spending owing to macro pressures, growing competition, and a change in Apple’s (NASDAQ:AAPL) iOS privacy policy.

Meta’s revenue grew 2.6% year-over-year to $28.6 billion in Q1. However, the first-quarter earnings per share (EPS) fell 19% to $2.20, with restructuring charges related to its streamlining efforts adversely impacting the bottom line by $0.44. Meta has slashed its workforce through multiple rounds of layoffs, calling 2023 the “year of efficiency.”

Coming to Q2 expectations, analysts anticipate EPS to grow over 18% year-over-year to $2.91. Revenue is projected to increase by almost 8% to $31.1 billion. The company had guided for Q2 revenue in the range of $29.5-$32.0 billion.

On Monday, Monness analyst Brian White reiterated a Buy rating on Meta with a price target of $275. White expects Meta’s revenue growth to accelerate in Q2 and the company to at least meet his revenue forecast of $31.26 billion and EPS estimate of $2.89. The analyst expects the company to benefit from improving advertising trends.

Additionally, White noted that while the company is focused on efficiency, it is making significant investments in AI-related initiatives and innovation.

Another Meta bull, Stifel analyst Mark Kelley, raised his price target to $336 from $280 last week and maintained a Buy rating on the stock. Ahead of Q2 earnings, Kelley modestly raised his digital advertising growth forecasts for 2023 and 2024, though he expects only “slightly better results” from ad-based companies compared to the top-line outperformance seen in the first quarter.

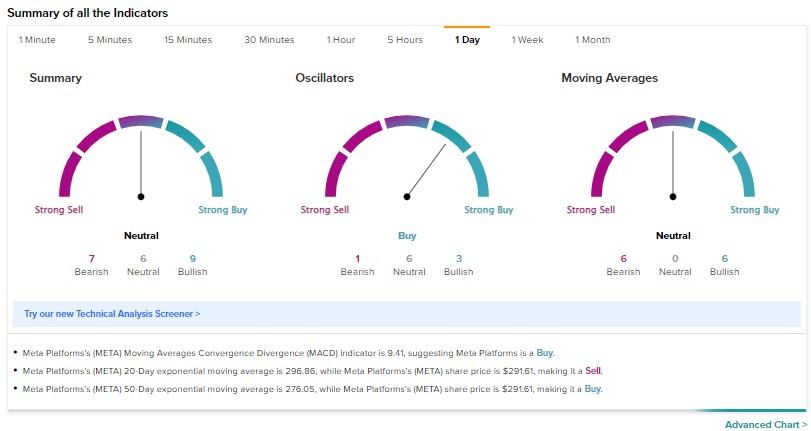

Technical Indicators Ahead of META’s Q2 Earnings

Heading into Q2 results, technical indicators reveal a Neutral stance on Meta Platforms. According to TipRanks’s easy-to-understand technical tool, META’s 50-Day EMA (exponential moving average) is 276.05, while its price is $291.61, making it a Buy. In contrast, META’s shorter duration EMA (20-day) signals that it is a Sell.

What is the Target Price for Meta?

Wall Street’s Strong Buy consensus rating on Meta is based on 36 Buys and three Holds. The average price target of $326.45 implies 10.9% upside from current levels.

Insights from Options Trading Activity

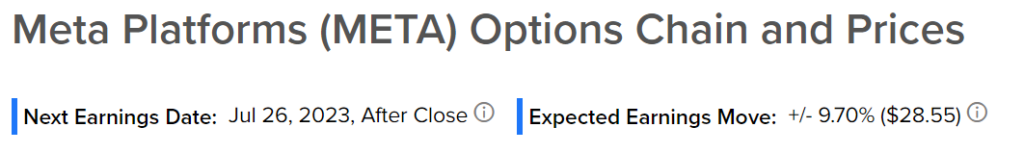

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a 9.70% move on Meta Platforms earnings. META shares have averaged a (1.16)% move in the last eight quarters. In particular, the stock rose 14% in reaction to Q1 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.