Social media giant Meta Platforms (NASDAQ:META) is scheduled to announce its third-quarter results after the stock market closes on Wednesday, October 25. META stock has rallied over 156% year-to-date, as the company impressed investors with an impressive rebound in its performance in the first half of 2023. Several analysts expect a solid growth in Meta’s earnings, backed by recovery in digital ad spending and the company’s cost control measures.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q3 Expectations for Meta Indicate Strong Growth

After suffering from weak digital ad spending due to macro pressures and the adverse impact of Apple’s (NASDAQ:AAPL) iOS privacy policy changes, Meta’s top-line rebounded well in the first half of 2023. In particular, Q2 2023 revenue grew 11% to about $32 billion. Further, the company’s focus on cost-cutting and streamlining drove a 21% rise in earnings per share (EPS) to $2.98.

Back in July, Meta guided for third-quarter revenue in the range of $32 billion to $34.5 billion, which reflects year-over-year growth of at least 15%.

Analysts expect the company’s revenue to increase by over 21% to nearly $33.6 billion. Additionally, they project a massive jump in Q3 EPS to $3.64 from $1.64 in the prior-year quarter, fueled by strong revenue growth and margin expansion.

Analysts’ Comments Ahead of Meta’s Q3 Earnings

On October 20, Bank of America analyst Justin Post reiterated a Buy rating on META stock with a price target of $375. Commenting on the upcoming results, the analyst said that he expects the company to continue to benefit from solid revenue trends, with checks by his firm indicating recovery in the digital ad market, increasing Reels monetization, and favorable AI-driven ad growth.

In particular, Post expects Q3 revenue of $33.5 billion and EPS of $3.79. He also expects the company to deliver a slight beat for the Daily Active Users (DAUs) metric.

The analyst expects a higher-than-anticipated Q4 2023 revenue growth outlook to be a key driver for Meta shares. He projects robust Q4 guidance compared to the sector, driven by favorable revenue trends, including AI-driven benefits for engagement.

Like Post, Citigroup analyst Ronald Josey also reaffirmed a Buy rating on Meta Platforms last week, with a price target of $385, saying that the stock continues to be his Top Pick. The analyst expects better-than-consensus results, supported by the company’s revitalized product roadmap and a strengthening digital ad market heading into the holiday season.

Josey also highlighted greater visibility into next year’s ad budgets based on his firm’s checks. He believes that Instagram engagement growth is accelerating due to Reels usage and investments in its AI content discovery engine.

On Sunday, Evercore analyst Mark Mahaney said that he sees the possibility of a modest upside to Q3 revenue estimates. His channel checks on the overall ad backdrop indicated stable to slightly accelerating spending trends, with advertisers having a consistently bullish sentiment on Meta’s momentum.

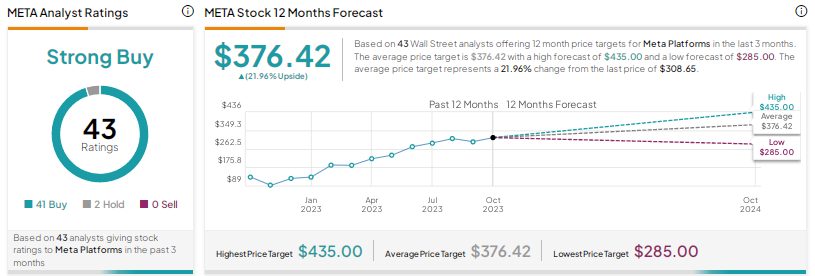

Is Meta a Buy, Sell, or Hold?

With 41 Buys and two Holds, Meta stock scores a Strong Buy consensus rating. Despite a stellar year-to-date rally, Wall Street expects Meta stock to rise further. The average price target of $376.42 implies about 22% upside potential.

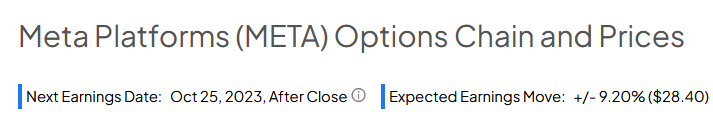

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 9.20% move on Meta’s earnings. META shares have averaged a negligible (0.11)% move in the last eight quarters. The stock rose 4.4% in reaction to Q2 2023 results.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Conclusion

Analysts are optimistic about Meta’s upcoming Q3 2023 results due to improving digital ad trends, growth in Reels, and the company’s cost-cutting efforts. Wall Street expects an upbeat outlook to drive further upside in META stock.