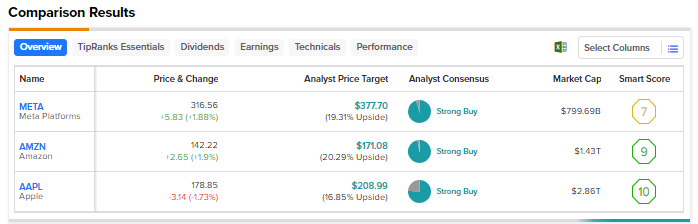

FAANG stocks [Meta Platforms (NASDAQ:META), previously called Facebook, Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Google’s parent company Alphabet (NASDAQ:GOOGL, GOOG)] have outperformed the S&P 500 (SPX) so far in 2023, with META rallying over 160%. However, macroeconomic uncertainty continues to be a drag. We used TipRanks’ Stock Comparison Tool to pit Meta, Amazon, and Apple against each other to pick Wall Street’s favorite FAANG stock at current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meta Platforms (NASDAQ:META)

Shares of social media giant Meta Platforms have been enjoying a splendid run this year, fueled by the company’s better-than-anticipated performance in the first half of the year. Last month, the company not only beat analysts’ second-quarter estimates but also issued upbeat guidance for the third quarter.

Meta’s Q2 2023 revenue grew by 11% to $32 billion, marking the first time the company generated double-digit growth since the end of 2021. The company’s top line has been under pressure in recent quarters due to the impact of macro pressures on digital ad spending, growing competition, and Apple’s iOS privacy change, which limited ad-targeting capabilities. Despite these pressures, Meta has bounced back strongly much to the delight of investors.

Moreover, the company has been taking aggressive cost control and streamlining measures to improve its profitability. In Q2 2023, the company’s EPS grew 21% to $2.98.

Is Meta a Good Stock to Buy?

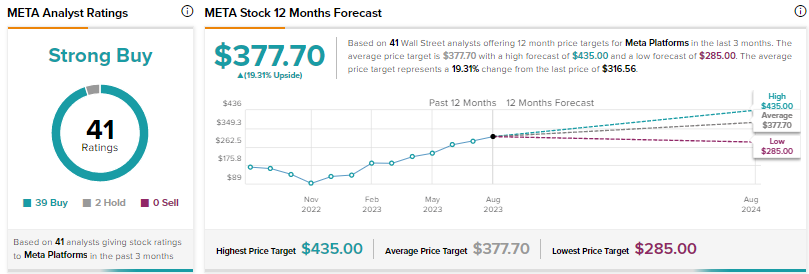

On Monday, UBS analyst Lloyd Walmsley maintained a Buy rating on Meta with a price target of $400. The analyst expects the company to introduce generative artificial intelligence (AI) consumer chatbots across its WhatsApp, Instagram and Facebook apps by the end of next month at the Meta Connect event.

Walmsley believes that a consumer chatbot launch would enable Meta to win market share in the nearly $200 billion search ads market. He projects the revenue opportunity from chatbot search ads of $7.5 billion for the Facebook app alone and potentially over $20 billion across Meta’s Family of Apps.

Walmsley concluded that Meta remains one of his favorite names in the internet sector, backed by several top-line catalysts like persistent growth in engagement, Reels monetization, click-to-message ads expansion, Shop Ads rollout, and Twitter-rival Threads.

Wall Street’s Strong Buy consensus rating on Meta stock is based on 39 Buys and two Holds. The average price target of $377.70 implies 19.3% upside. Meta shares skyrocketed 163% so far in 2023.

Amazon (NASDAQ:AMZN)

E-commerce and cloud computing giant Amazon impressed Wall Street with its market-crushing second-quarter performance. The company’s cost-cutting efforts and higher sales helped it swing to EPS of $0.65 from a loss per share of $0.20 in the prior-year quarter.

Amazon’s Q2 2023 sales grew about 11% year-over-year to $134.4 billion, driven by an 11% and 10% rise in North America and International retail sales, respectively. Further, sales from the company’s Amazon Web Services cloud business increased 12%. The company also issued a better-than-anticipated third-quarter revenue outlook.

To continue to support its growth strategies, Amazon expects capital expenditure of slightly more than $50 billion in 2023 compared to $59 billion in 2022. While the company projects its fulfillment and transportation expenditure to be down this year, it expects higher infrastructure spending to support AWS growth, including additional investments related to generative AI and large language model initiatives.

Is Amazon a Buy, Hold, or Sell?

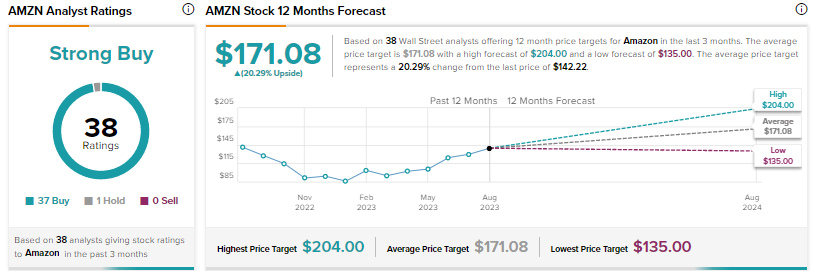

Last week, Barclays analyst Ross Sandler increased the price target for Amazon stock to $180 from $140 and reaffirmed the Buy rating on the stock.

The analyst noted that after two years of immense trouble for Amazon bulls, the company is now back with market share gains and improved margins. Sandler believes that AWS is likely re-accelerating on regular and AI workloads and retail growth is steady. He also thinks that margins may cross the 2018 peak.

With 37 Buys and one Hold, Amazon scores a Strong Buy consensus rating. At $171.08, the average price target implies 20.3% upside. Shares have jumped over 69% since the start of this year.

Apple (NASDAQ:AAPL)

Apple shares have been declining since the company announced a disappointing fiscal fourth-quarter revenue outlook. The iPhone maker managed to beat analysts’ expectations for Q3 FY23 (June quarter), thanks to the 8.8% rise in Services revenue to $21.2 billion.

However, overall revenue declined 1.4% year-over-year to $81.8 billion due to lower iPhone, Mac, and iPad revenues. Moreover, the company cautioned investors about a fourth consecutive year of revenue decline by saying that it expects the September quarter top-line performance to be similar to the June quarter.

In particular, Apple expects iPhone and Services business to accelerate on a year-over-year basis compared to the June quarter. That said, the company anticipates Mac and iPad revenues to decline by double digits due to tough comparisons.

What is Apple’s Price Target?

While several analysts remain optimistic about Apple, Rosenblatt analyst Barton Crockett downgraded the stock to Hold from Buy with a price target of $198 last week.

Crockett stated that Apple’s Q3 FY23 performance highlights the slowdown phase in which it exists currently. He feels that a slowdown in the U.S. could last until a material new product category captures the market. Given the uncertainty associated with the timing and success of a new product category, the analyst does not find the stock attractive currently due to its peak absolute and relative valuation multiples.

Wall Street’s Strong Buy consensus rating for Apple stock is based on 22 Buys and seven Holds. The average price target of $208.99 implies about 17% upside potential. Shares have risen 38% year-to-date.

Conclusion

Despite macro pressures, Wall Street is highly bullish on Meta Platforms, Amazon, and Apple and believes in their ability to drive long-term growth. Currently, they see slightly higher upside potential in Meta and Amazon than Apple.