Investors have been pleasantly surprised by MercadoLibre’s (NASDAQ: MELI) recent performance as the company continues to maintain its momentum and defy the odds in an uncertain commerce landscape. Not only that, but the company’s margins are expanding at a significant pace, paving the way for some serious net income growth in the coming years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s a thrilling time for “The Amazon of Latin America,” and investors are taking notice, as shares have doubled from their 52-week lows in June. In fact, I believe that with MercadoLibre’s earnings growth potential appearing increasingly attractive, there is a strong possibility for further upside ahead. Accordingly, I am bullish on the stock.

What is Driving MercadoLibre’s Vigorous Growth?

MercadoLibre’s vigorous growth is being driven by the ongoing rapid e-commerce adoption phase in Latin America. With a population of about 670 million individuals and MercadoLibre expanding its presence in every single country in the continent, the company has been taking this untapped market by storm with relative ease. This also applies to the company’s fintech segment due to a large chunk of Latin America’s population remaining unbanked.

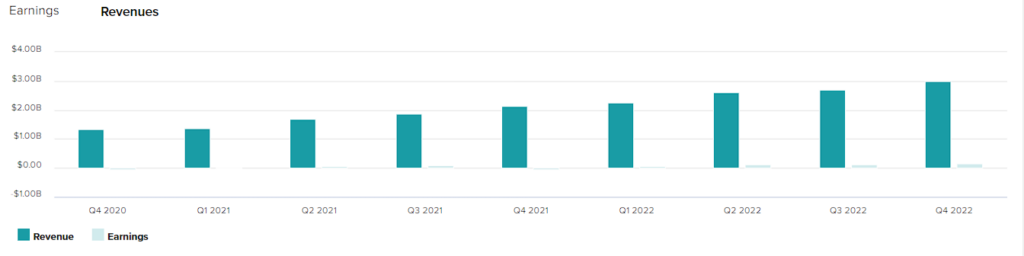

To provide some context, MercadoLibre’s revenues have grown at a compound annual growth rate of roughly 40% over the past decade. This is an exorbitant pace of growth to sustain over such a long period, highlighting the vast potential of the e-commerce and fintech industries in South America that remain largely unexplored.

Growth Shows No Signs of Slowing Down

Not only has MercadoLibre been able to maintain its remarkable rate of revenue growth over an extended period of time, but what’s even more impressive is that the company is showing no signs of slowing down. MercadoLibre’s most recent financial results indicate that the company continues to achieve exceptional growth metrics across all areas of the business.

MELI’s E-Commerce Business

In Q4, MercadoLibre’s Gross Merchandise Value rose by 35% on an FX-neutral basis to $9.6 billion. Items sold on its platform came in at 320.9 million, up 11% compared to last year-year, resulting in the company achieving a new all-time high quarterly revenue of $3.0 billion. This suggests a tremendous increase of 56% year-over-year on an FX-neutral basis.

To emphasize my previous point about the lack of a slowdown in growth, Q4’s growth percentage is notably higher than its decade-average one. This is particularly impressive because last year’s results were already bloated due to the pandemic-induced surge in e-commerce, which makes the sustained growth even more remarkable.

MELI’s Fintech Business

MercadoLibre’s fintech business is probably the company’s crown jewel when it comes to driving high-margin, hyper-growth numbers. In Q4, Total Payments Volume (TPV) skyrocketed to an impressive $36 billion, representing a whopping 80% increase from the previous year.

Surprisingly, the growth rate actually accelerated from the already impressive 73% TPV growth recorded in Q4-2021, also lacking any signs of a looming slowdown. This is particularly remarkable given that most U.S.-based fintech companies faced significant obstacles during the same period due to ongoing market turbulence. For example, PayPal (NASDAQ:PYPL) reported a meager 9% TPV growth rate on an FX-neutral basis, primarily driven by inflation, resulting in hardly any growth in real terms (ex-inflation).

Another significant point to note is that during Q4, 72% ($25.8 billion) of the Total Payment Volume occurred outside of MercadoLibre’s e-commerce platform. This indicates that the growth potential for the fintech segment is not limited to MercadoLibre’s own e-commerce expansion and can continue to grow independently even if MercadoLibre’s e-commerce growth slows down.

This point is particularly important because there is still a large portion of the population in Latin America that remains unbanked. Therefore, fintech solutions are expected to experience massive growth in the region in the coming years.

For instance, in Brazil, around 10% of the adult population does not have a bank account. And then take Argentina, Honduras, and Bolivia, where less than half of their adult population has a bank account. Consequently, there is a vast untapped market that MercadoLibre can capitalize on.

Margin Expansion to Drive Bottom-Line Growth

As with all big businesses in the e-commerce and fintech industries, the only way to achieve meaningful profitability is to be able to leverage the operating economies of scale that come from serving millions of customers in order to gradually reduce all the per-unit costs and drive margins higher.

The company’s Q4 results provide an excellent example of this, as MercadoLibre’s gross margins expanded from 40% to 48.6% year-over-year. In fact, the combination of the aforementioned revenue growth rates in e-commerce and fintech, combined with such a substantial margin expansion, resulted in the company posting record quarterly and annual profits.

For Q4 and Fiscal 2022, net income landed $165 million and $482 million. The latter was up 480% compared to Fiscal 2022. Hence, even though Fiscal 2022’s earnings per share of $9.57 implies an absurd P/E ratio of ~124 at the stock’s current levels, you can see how such a multiple can be justified assuming similar exponential earnings growth is to take place in the coming years.

Is MELI Stock a Buy, According to Analysts?

Turning to Wall Street, MercadoLibre has a Strong Buy consensus rating based on nine unanimous Buys assigned in the past three months. At $1,526.67, the average MercadoLibre stock forecast suggests 28.1% upside potential.

Conclusion

MercadoLibre is taking Latin America’s e-commerce and fintech industries by storm, recording shocking revenue and net income growth. While the stock’s valuation may look unreasonable based on last year’s and possibly next year’s expected earnings, MercadoLibre’s profitability is quite likely to snowball from here.

In my view, the company’s dominance and accelerating results likely justify the stock’s valuation multiples. Hence, I expect the euphoria surrounding MercadoLibre to be sustained, moving forward.