This Halloween, inflation, rising interest rates, geopolitical issues, and other economic disruptions are spooking investors. At times like these, it can be a great idea to take cues from analysts’ opinions and make informed investment decisions. In the last 24 hours, Mercadolibre (NASDAQ:MELI) and HubSpot (NYSE:HUBS) have made their way to the top of the list of Wall Street analysts’ favorite stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Mercadolibre (MELI)

Latin-American e-commerce and payments platform Mercadolibre is riding on the back of robust product and credit portfolios.

The company’s USP lies in its services that have been designed to take advantage of synergies among them. MercadoLibre Marketplace, a fully automated, user-friendly online commerce service, enables businesses as well as individuals to buy and sell online in both fixed-price and auction-based formats. MercadoPago works as a complementary service, providing an integrated online payments solution that allows for smooth checkout and easy money transfers through the website or MercadoPago App. There’s also MercadoCredito, designed for qualified merchants to take loans.

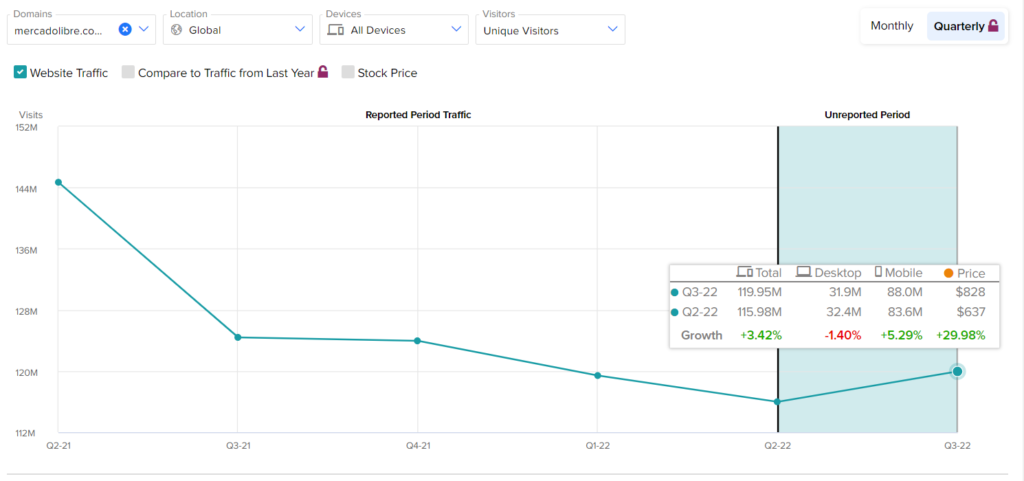

Further, MercadoLibre Classifieds Service, which was developed to improve the company’s non-marketplace unit, is an online classified listing service for the transaction of vessels, aircraft, motor vehicles, and real estate services in all addressable countries. This service has emerged as a significant source of traffic to the website. In the third quarter of 2022, the company clocked in a 3.42% quarter-over-quarter growth in unique visitors to its website, according to the TipRanks website traffic tool.

The company’s competitive pricing structure and ongoing investments to improve its payments and logistics are boding well. Although this is putting pressure on margins now, especially when costs have increased, this creates a solid runway for growth over the years in the American, Latin American, and Canadian consumer markets.

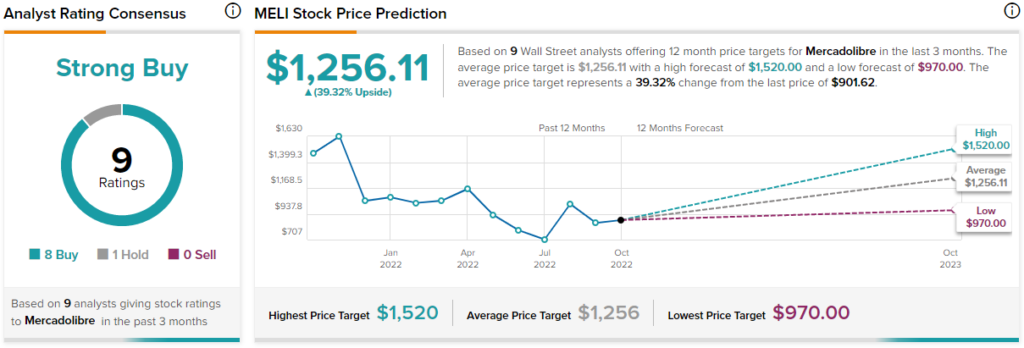

Is MELI Stock a Buy or Sell?

Mercadolibre stock is a Strong Buy on Wall Street, based on Buy ratings from eight analysts and a Sell rating from one. The average price target for MELI stock is $1256.11, indicating upside potential of 39.3%.

HubSpot (NYSE:HUBS)

HubSpot is a well-known innovative online inbound marketing platform provider for CRM experts, SEO optimizers, content managers, and social media marketers. The company provides an end-to-end solution, making it an attractive SaaS (software-as-a-service) offering, catching up quickly to market leaders with similar products like Salesforce (NASDAQ:CRM).

HubSpot generally targets mid-sized businesses with fewer than 2,000 employees. This market is relatively underpenetrated, presenting a significant opportunity for HubSpot to expand its base. A recent IDC White Paper report calculated a remarkable revenue opportunity for HubSpot’s ecosystem. The firm expects HubSpot TAM (total addressable market) to grow from $7.4 billion in 2021 to $17.9 billion in 2025.

Is HUBS a Good Stock to Buy?

On October 31, Wells Fargo analyst Michael Turrin cut the price target on HubSpot to $475 from $500 to reflect the difficult economic backdrop and currency exchange headwinds. However, the analyst reiterated his Buy rating on the shares. HUBS stock price has more than halved so far this year, leading Turrin to believe that the negativity around the company is exaggerated.

Turning to Wall Street, analysts are bullish on HubSpot stock, with a Strong Buy rating based on 19 Buys and two Holds. The average price target of $411.20 indicates that HUBS stock can rise 39.7% over the next 12 months.

Final Thoughts

Mercadolibre and HubSpot have carved a solid path ahead of them, which should keep them safe from this year’s storms, making them recent picks on Wall Street.