Medical Properties Trust (NYSE:MPW), a REIT involved with medical properties, recently reported its Q3-2023 earnings results, which I’ll discuss in detail. In a nutshell, higher interest rates impacted cash available for distributions and will likely continue to do so for a while longer. Nevertheless, the Federal Reserve is broadly expected to start cutting rates in a few months. As a highly indebted company, Medical Properties Trust will be one of the key beneficiaries.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I am bullish on the stock due to its attractive valuation on a firm-wide basis and the defensive nature of its hospital portfolio. Nevertheless, investors need to be mindful of its high leverage and the need for management to preserve liquidity.

Medical Properties Trust’s Operational Overview

Medical Properties Trust, or MPT, is one of the largest owners of hospital real estate. The company is active in 31 U.S. states and several international markets. As of Q3 2023, 62.1% of its assets were in the United States, with the United Kingdom the second largest market at 21.6% of all assets.

In Q3 2023, MPT recorded adjusted funds from operations (AFFO, a cash-flow metric commonly reported by REITs) of $0.30/share, down 16.7% year-over-year. The decrease was the result of both lower revenues as well as higher interest costs. Given that total debt amounted to $10.2 billion at the end of Q3 2023, liquidity and cash flow generation are a prime concern for the company. Indeed, management announced plans to raise $2 billion in liquidity over the next 12 months.

Medical Properties Trust’s Capitalization Rate

It is always important to consider the capitalization rate (the rate of return on a real estate investment property based on its expected cash flows) of a REIT you invest in and not just the yield based on AFFO. Usually, to increase returns, REITs borrow from banks and other lenders. This often results in a high AFFO yield.

However, if the REIT needs to sell a property on the market, the buyer will consider the capitalization rate, as it encompasses all cash flows of the property to equity and debt holders combined.

To arrive at Medical Properties Trust’s capitalization rate, we can combine the current AFFO run-rate amount and interest expense, multiply it by four since it is a quarterly number, and divide the result by the company’s enterprise value.

In Q3 2023, AFFO amounted to $182 million, while the company’s interest expense was $107 million. As a result, MPT currently produces about $1.15 billion on an annual basis, available to pay interest on debt and dividends to shareholders. Against an enterprise value of about $12.9 billion, the market-implied capitalization rate is about 8.9%.

The capitalization rate allows investors to compare REITs with different levels of financial leverage (the portion of the enterprise value funded by debt, which, at Medical Properties Trust, is about 80%, a very high amount) since it looks at cash flows at the enterprise level rather than to shareholders specifically. The high amount of financial leverage exposes MPT to excessive interest rate risk.

The cap rate is also useful when comparing the absolute return potential of Medical Properties Trust as an investment and makes it easy to compare it to other alternatives, such as government bonds. For instance, the 10-year U.S. government bonds yield around 4.4% currently.

Recent disposals can also be benchmarked on a cap-rate basis. For example, in October, MPT sold its remaining Australian assets at a cap rate of 5.7% – an attractive cost of capital relative to where the company is currently trading.

Last but not least, the 8.9% cap rate can be seen as the expected return before the use of leverage, inflation indexation, or rental growth.

High Short Interest

The company has attracted a lot of short interest in the past year, with about 22% of shares currently held short, meaning an outsized amount of investors are currently betting on MPW stock going down further. That said, total short interest is down more than 50% from its Q1 2023 peak.

Prospects for Fed Rate Cuts

With the Federal Reserve embarking on one of the fastest rate hiking cycles in history, markets and economists now expect the Fed to reverse course and begin cutting rates in 2024. Markets currently give a 27.4% chance that the Fed will cut the federal funds rate to 5.00-5.25% at its March 20, 2024 meeting. Current futures pricing indicates three additional 0.25% rate cuts after that, resulting in a Federal Funds Rate of 4.25-4.50% at the end of 2024.

MPT currently pays a weighted average rate of 4.04% for its $10.2 billion in debt. However, as the company continues to refinance its debt, old low-rate bonds are replaced with new ones at a higher rate of interest, cutting into the company’s AFFO. For reference, the company currently pays 5.36% to 6.93% on its floating rate revolver. As such, the company will need to wait for deeper 2025 Fed rate cuts for it to see a sustained reduction in interest headwinds.

Is MPW Stock a Buy, According to Analysts?

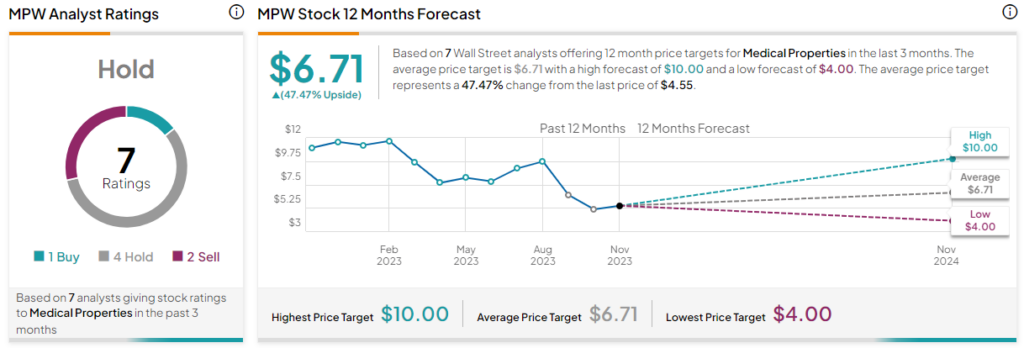

Turning to Wall Street, Medical Properties Trust earns a Hold consensus rating based on one Buy, four Holds, and two Sell ratings. Additionally, Medical Properties stock’s average price target is $6.71, implying 47.5% upside potential.

The Takeaway

Medical Properties stock has fallen sharply over the past year, with higher interest rates and a heavy debt burden being the main culprits behind the large losses. As the prospects of lower rates are now months away, the forces that drove the stock down will slowly revert in its favor, setting the stage for a possible recovery in the share price.

Given the defensive nature of its hospital portfolio, the company will likely perform well if a recession materializes, outperforming both the broader commercial real estate market as well as the main stock market indices. Even if rates do not drop as much as expected, the 8.9% cap rate provides an adequate return. Last but not least, prospective investors should always be mindful of the excessive leverage of the company.