The market landscape has started to become quite treacherous lately for home builders. While home builders enjoyed fantastic growth tailwinds last year, the worsening macroeconomic environment has already reversed that trend. As stock prices of home builders have been on the decline, some of them have likely sold off quite excessively. One of them is M.D.C. Holdings (NYSE:MDC), which now appears to be too cheap to ignore. Especially considering the company’s strong dividend. I am bullish on the stock.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

What is Impacting MDC’s Stock Price?

MDC shares have suffered significantly over the past year, with the primary reason being the sudden change in investors’ expectations due to the ongoing macroeconomic setup.

Remember that while the COVID-19 pandemic had a significant impact on the U.S. economy between 2020 and 2021, surprisingly enough, demand for homes surged.

This was supported at the time by the working-from-home economy driving demand for new homes and home renovations. Another significant factor, however, was that home buyers were able to take advantage of low mortgage rates at the time, which persisted as the Fed tried to keep the economy afloat. Accordingly, home builders like MDC experienced a wonderful trading environment during the two previous years.

However, the narrative has reversed lately. With inflation levels remaining sky-high, which is likely to negatively impact consumers’ purchasing power, demand for new homes is set to ease. Further, rising energy prices as a result of the ongoing conflict in Ukraine are set to take a further chunk of consumers’ disposable income, further pressuring the value of homes.

On top of that, following years of historically low mortgage rates, buyers are now being greeted with higher financing costs for home purchases, as the average rate on the 30-year fixed-rate mortgage has risen nearly 200 basis points year-over-year.

Driven by unease over the raised uncertainty caused by these and various other factors, investors have grown increasingly tense over the earning prospects of M.D.C. Holdings. This is not speculation, as M.D.C.’s latest quarterly results have already started to display the effects of the ongoing reverse from what was previously positive momentum.

MDC’s Q2 Results Indicate That Demand for Homes is Plunging

MDC’s Q2 2022 results revealed a fierce reverse in the trend of demand for new homes. On the surface, the company reported 6% year-over-year revenue growth in its home sales.

However, there are two things to note here. Firstly, the company actually reported a 7% decline in unit closings, with revenue growth only being driven by a 14% rise in average selling prices. Secondly, these numbers account for orders that had already been placed previously. When it comes to the company’s forward-looking backlog, there is a clear plunge in demand for new homes.

This is evidenced by the 29% year-over-year drop in unit orders during the quarter, and the fact that cancellations as a percentage of beginning backlog surged 400 basis points to 9.7% from 5.7% compared to last year. Thus, not only are the number of new home buyers shrinking, but existing home buyers that previously placed an order are now canceling.

The company now expects to achieve home deliveries between 2,200 to 2,500 in Q3 at an average selling price of $580,000 and $590,000. Based on these estimates, the company should achieve Fiscal Year 2022 earnings per share of just over $9.00 based on my calculations. Note that earnings per share of $9.00 would indicate a year-over-year increase of 10.7%.

However, with demand for homes declining and economies of scale reversing (i.e., shrinking margins), investors should not expect similar performance in the next couple of years.

MDC Stock is Cheap

As the decline in future home deliveries indicates, MDC’s earnings per share are set to normalize in Fiscal Year 2023 and beyond, possibly falling below 2021’s $8.13. While it’s speculative to do so, if we project an EPS of $4.50 for Fiscal Year 2023, then that would be lower than the $5.33 in 2020. Yet, at its current share price of $32, this would imply a P/E ratio of 7.1, which I believe is cheap on a normalized basis, even for a home builder with cyclical revenues.

Additionally, MDC has seen its equity value increase over the past few years amid robust profitability. Indeed, its book value per share currently stands at $40.39, implying significant upside potential from the current price.

The Dividend Should Help Lift MDC Stock

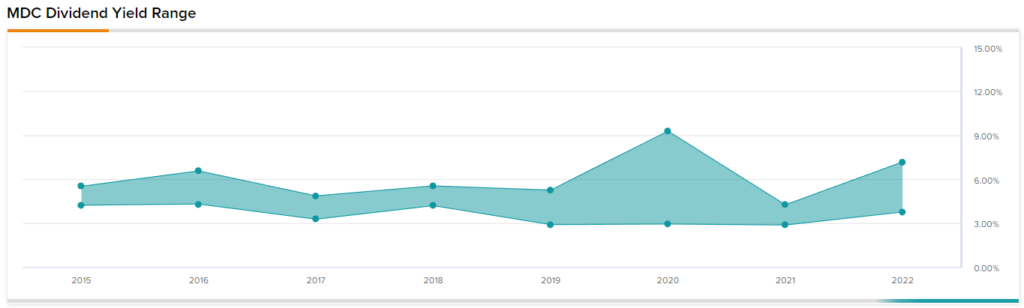

MDC has a long track record of strong dividend payments. At a quarterly rate of $0.50, the dividend should remain covered even if the company’s earnings take a strong hit in the short term. Further, following the stock’s massive decline, the dividend yield currently stands at over 6%.

Thus, there is a strong incentive for shareholders to hold the stock, as it offers an increased margin of safety when it comes to the total return potential. One could argue that the market is essentially pricing the stock for a dividend cut, but dividends should remain covered even if earnings were to drop below $4.00 per share.

Is MDC Stock a Buy?

Turning to Wall Street, MDC stock has a Hold consensus rating based on two Buys, one Hold, and one Sell assigned in the past three months. At $36.88, the average M.D.C. Holdings stock forecast implies 15.3% upside potential.

Takeaway – Concerns Remain, but Don’t Give Up on MDC Stock

MDC is about to experience a shaky residential market environment where earnings will most definitely normalize by next year. The market has already tried to price this in, as evidenced by the steep stock price decline. However, the market may have oversold the stock, with MDC appearing quite cheap on normalized future earnings and book value basis. With a hefty dividend yield attached, I wouldn’t give up on the stock now.