Investors in Chinese stocks haven’t had much to cheer about in recent times. The iShares MSCI China ETF (NASDAQ:MCHI) is down 10.3% year-to-date, and the ETF has generated an ugly negative annualized return of -17.4% over the past three years as of October 31st.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

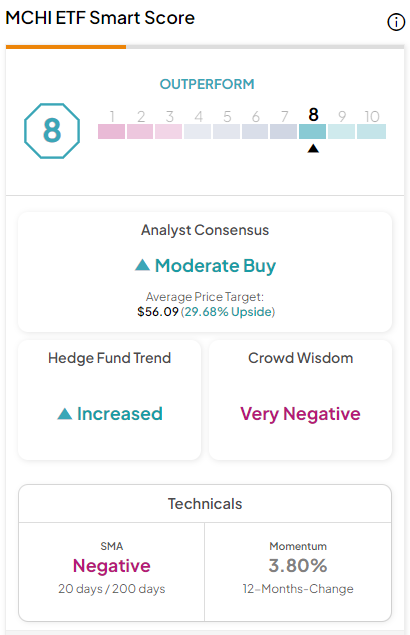

However, better times could be ahead. I’m bullish on MCHI, as there is plenty of room for a catchup rally, and Chinese stocks are conspicuously cheap compared to their U.S. peers. What’s more, analysts see plenty of upside potential based on their average price target for MCHI, and TipRanks’ Smart Score system gives MCHI an Outperform-equivalent rating.

What is the MCHI ETF’s Strategy?

According to iShares, MCHI “seeks to track the investment results of an index composed of Chinese equities that are available to international investors.” It gives investors exposure to both “large and mid-sized companies in China” and provides “targeted access to the Chinese stock market.”

With $6.7 billion in assets under management (AUM), it is currently the largest U.S. ETF focused on China.

An Inviting Entry Point

MCHI’s performance has left something to be desired in recent years. As of October 31st, the fund has lost 17.4% on an annualized basis over the past three years and has lost 3.3% on an annualized basis over the last five.

Over the past 10 years, it has eked out a positive annualized return of just 0.5%, but this is clearly an underwhelming return that badly underperforms the S&P 500 (SPX).

All that said, this leaves plenty of room for a turnaround and creates an attractive entry point for new investors looking for areas of the market that aren’t overheated.

Chinese stocks are cheap. The average price-to-earnings ratio for MCHI’s holdings is just 12.2, representing a significant discount to the S&P 500, which has an average price-to-earnings multiple of 20.4.

Broad Exposure to China

MCHI gives investors wide-reaching exposure to the Chinese market. The ETF owns 644 stocks, and its top 10 holdings make up 41.3% of the fund.

Below, you’ll find an overview of MCHI’s top 10 holdings from TipRanks’ holdings tool.

Many U.S. investors will be familiar with many of MCHI’s top holdings like Tencent (OTC:TCEHY), Alibaba (NYSE:BABA), and PDD Holdings (NASDAQ:PDD) (often referred to as Pinduoduo).

However, a key difference between MCHI and other top China ETFs like the iShares China Large-Cap ETF (NASDAQ:FXI) and the KraneShares CSI China Internet ETF (NASDAQ:KWEB) (which are attractive investment opportunities in their own right) is that with 646 holdings, MCHI’s portfolio goes well beyond these household names and invests in companies from all facets of China’s economy, not just the biggest and best-known names from China’s tech sector.

As alluded to above, these top holdings are inexpensively valued. Tencent and PDD trade for 15.8 and 18.9 times 2024 consensus earnings estimates, respectively.

Shares of Alibaba are even cheaper, trading at 8.7 times 2024 earnings estimates. Alibaba could benefit from many of the same AI tailwinds that have pushed U.S. tech stocks higher, but it clearly hasn’t experienced the same type of boost in its share price.

JD.com (NASDAQ:JD), another top holding, also trades at just 8.6 times 2024 earnings estimates.

In addition to these modest valuations, another thing investors will immediately notice is that these top holdings have some fantastic Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Not only do an impressive eight of MCHI’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or higher, but three of its top four holdings, Tencent, Alibaba, and PDD, feature ‘Perfect 10’ Smart Scores. Add in Netease (NASDAQ:NTES), BYD (OTC:BYDDF), and Ping An Insurance (OTC:PIAIF), and more than half of MCHI’s top holdings feature the highest possible Smart Score, painting a compelling picture of the strength of its portfolio.

Beyond the top 10 holdings, additional holdings like Li Auto (NASDAQ:LI), Yum China (NYSE:YUMC), and PetroChina (OTC:PCCYF) feature Perfect 10 Smart Scores as well.

MCHI itself features an Outperform-equivalent ETF Smart Score of 8.

Does MCHI Pay a Dividend?

Another benefit of MCHI is that it is a dividend payer. While MCHI’s dividend yield of 2.6% isn’t huge, it is significantly higher than the average yield of the S&P 500. Furthermore, MCHI has been a consistent dividend payer, having made 13 straight years of dividend payments to its holders dating back to its inception in 2011.

It’s important to recognize that MCHI, like numerous international stocks and ETFs, pays a dividend on a semiannual basis (twice a year) rather than on the quarterly basis that many U.S. investors are accustomed to. The amount of the dividend can vary, and MCHI occasionally pays out a special dividend to investors, including one this year.

What is MCHI’s Expense Ratio?

It has to be said that MCHI’s expense ratio of 0.58% is on the higher end. This 0.58% expense ratio means that an investor in the fund will pay $58 in fees on a $10,000 investment in the fund over the course of one year.

Assuming that the expense ratio remains constant at 0.58% and that the fund returns 5% a year going forward, this same investor would pay $726 in fees over the course of 10 years.

While this is somewhat steep, remember that gaining access to the Chinese market and investing in locally-listed shares can be difficult and expensive for investors based outside of China. Plus, MCHI is actually cheaper than its aforementioned peers, like the KWEB and FXI, which charge 0.69% and 0.74%, respectively.

Is MCHI Stock a Buy, According to Analysts?

Turning to Wall Street, MCHI earns a Moderate Buy consensus rating based on 134 Buys, 506 Holds, and five Sell ratings assigned in the past three months. The average MCHI stock price target of $56.09 implies 29.7% upside potential.

The Takeaway

The MCHI ETF has been an underwhelming performer in recent years, but that potentially creates an attractive entry point for new buyers. Chinese stocks look very cheap compared to their U.S. peers, based on MCHI’s average price-to-earnings ratio of 12.2, making MCHI an interesting investment opportunity going forward.

MCHI is the biggest China ETF and offers a lower expense ratio than its peers. Plus, it is differentiated in that it gives investors more all-encompassing exposure to the breadth and depth of the Chinese market beyond the usual suspects that most U.S. investors are familiar with.

Additionally, Wall Street analysts see substantial potential upside in MCHI, and TipRanks’ Smart Score system also rates the ETF and many of its top holdings highly.

Lastly, investing in China can also help U.S. investors diversify their portfolios, spread out their risk, and gain exposure to growth opportunities outside of their home market.