McDonald’s (NYSE:MCD) iconic “I’m Lovin’ It” slogan resonates not only with customers but also with shareholders, who keep driving the stock higher. The fast-food giant continues to rapidly increase its revenues and earnings with no indication of slowing down. Its affordable offerings mix keeps pushing higher sales in existing locations, while aggressive new restaurant openings, including CosMc’s, a new beverage-led concept, promise sustained growth momentum. Accordingly, I remain bullish on MCD.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Double-Digit Growth Persists with No Signs of Slowing Down

Seeing McDonald’s keep delivering double-digit revenue growth with no signs of slowing down is absolutely remarkable. You would assume that many of the company’s locations should have already maximized their sales potential, as they have been in business for years.

However, by deploying smart sales tactics, such as incentivizing loyalty program participation and rolling out the annual Monopoly promotion, McDonald’s has been able to drive growing spending per store. The push of digital ordering for faster service and, crucially, maintaining competitive prices in an inflationary environment has also contributed to continuous growth in same-store sales.

In Canada, for example, McDonald’s maintained its iconic McMuffin and hot coffee bundle throughout Q4, offering a compelling bundle during the crucial morning hours. This led to notable gains in breakfast market share. McDonald’s also incentivized in-app orders and promoted the advantages of the “Ready on Arrival” offering, resulting in a 60-second reduction in wait times for curbside pickups nationwide.

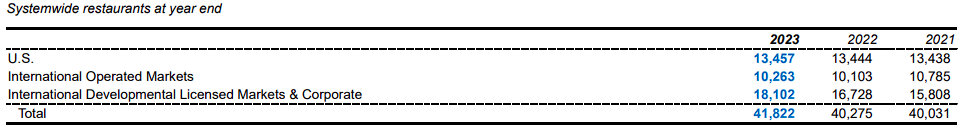

The result of these initiatives, and again, importantly, McDonald’s menu mix remaining quite affordable against other eating-out options, drove same-store sales growth of 9% in Fiscal 2023. Combined with McDonald’s achieving 1,547 net restaurant openings during the year, pushing its total location count to 41,822, total revenues for the year rose by 10% to $25.5 billion.

Expanding Operating Margins Drove Record Profits

The brilliance of McDonald’s business model lies in its ability to grow profits at a greater pace than its sales due to its royalty-based structure. With a whopping 95% of its locations operating under franchise agreements, the company makes its money mainly from royalties and the rent its franchises pay for on its properties.

As same-store sales climb, McDonald’s effortlessly collects higher royalties without bearing additional expenses. Because of this, the company inherently enjoys expanding profit margins over time, helping its bottom-line growth outpace its revenue growth. Indeed, in FY2023, McDonald’s operating profit margin reached a record 45.9%, up from 44.6% last year, resulting in the company’s net income surging by 37% to $8.47 billion. Buybacks further boosted EPS, which grew by 39% to a record $11.56.

Growth Catalysts Remain Robust, Justifying McDonald’s Valuation

McDonald’s growth catalysts remain robust, in my view, which should translate to robust revenue growth and, as explained, even more significant earnings growth. Specifically, the company expects to continue expanding its global footprint and to reach 50,000 restaurants by 2027. This implies an acceleration to the current pace of openings.

Further, McDonald’s has identified an opportunity in a $100 billion category across its top six markets: beverage-led experiences, where its core business typically underindexes. In a little less than a year, when this opportunity was identified, McDonald’s opened a pilot CosMc’s restaurant, attracting significant buzz.

This single location is now based in Bolingbrook, IL, and management plans to run a 10-store test. Any contribution to revenues will be minimal in the beginning, of course. However, McDonald’s now has the opportunity to slowly build a new brand in the beverage space, which could eventually grow into a big franchise with thousands of locations. This initiative alone could make for a significant long-term sales growth tailwind on top of McDonald’s core brand.

Therefore, despite McDonald’s prolonged share price rally, I believe that its bullish momentum could be very well maintained. In the meantime, the stock’s forward P/E of 22.7 appears well-justified, considering the company’s underlying earnings growth and future growth catalysts.

Is MCD Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, McDonald’s features a Moderate Buy consensus rating. This is based on 18 Buys and eight Hold ratings assigned in the past three months. At $323.24, the average MCD stock forecast suggests 14.3% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell MCD stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Palmer from Evercore ISI, with an average return of 16.14% per rating and a 98% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, McDonald’s continues to demonstrate impressive, double-digit revenue increases while posting record operating margins and earnings. With initiatives like digital ordering, menu bundling, and maintaining affordable prices, the company has been able to keep driving growing traffic in its stores and even capture market share in some categories.

Management’s plan to reach 50,000 locations by 2027, as well as the potential of CosMc’s growing into a big franchise opportunity for McDonald’s, should keep boosting its financials. Thus, I can see the stock’s ongoing bullish momentum lasting, especially given that its valuation remains at rather reasonable levels.