In this piece, I evaluated two fast-food stocks, McDonald’s (NYSE:MCD) and Restaurant Brands International (NYSE:QSR), using TipRanks’ comparison tool to determine which is better. McDonald’s is a multinational fast-food chain, while Restaurant Brands International owns four of the world’s most iconic fast-food chains: Burger King, Firehouse Subs, Popeyes, and Tim Hortons.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

McDonald’s shares are up 3% year-to-date and 15.5% over the last year, while Restaurant Brands is up 4.7% year-to-date and 22.1% over the last year.

While the companies have similar year-to-date performances, Restaurant Brands has outperformed MCD in the past 12 months. Despite that, McDonald’s is trading at a higher valuation than Restaurant Brands.

In this article, we’ll look at their price-to-earnings (P/E) ratios to compare their valuations and gauge them against the valuation of their industry. The restaurant industry is trading at a P/E of 45.4 versus its three-year average of 51.5, although newer names like Wingstop (NASDAQ:WING) are skewing these numbers higher.

Thus, for a closer comparison of McDonald’s and Restaurant Brands, we’ll consider a couple of other legacy fast-food competitors. Yum! Brands (NYSE:YUM) is trading at a P/E of 25.2, while Wendy’s (NASDAQ:WEN) is at a P/E of 23.1.

McDonald’s (NYSE:MCD)

At a P/E of 24.8, McDonald’s is trading toward the high end of its fast-food peers but below its five-year mean P/E of 28.9. Given its relative valuation, strong fundamentals, upward stock trajectory (in the long term), and current macroeconomic conditions, a long-term bullish perspective seems fitting.

First, McDonald’s has very solid earnings and revenue numbers despite the growing concerns about its fading market share. The company smashed earnings-per-share estimates in the last four quarters, posting solid year-over-year increases in three of the last four quarters.

On the other hand, insiders have sold $6.7 million worth of McDonald’s shares over the last three months, including via a meaningful number of Informative Sell transactions a month ago. While that is admittedly a bearish signal, the stock was trading closer to its record high at that time, suggesting that the insiders might not have seen any more near-term upside from that level.

Importantly, McDonald’s shares have fallen since then, suggesting some potential for upside from current levels. However, the focus here is on long-term stock gains. The shares are up more than 80% over the last five years and over 250% in the past 10 years, demonstrating long-term upward momentum. For context, the S&P 500 (SPX) has gained about 59% in the past five years.

Additionally, McDonald’s tends to be more recession-resistant than other restaurant chains, given that consumers seek cheaper food options amid economic downturns. In fact, the stock continued to rise during the Great Recession, rising from the lower-$40 range in January 2007 to around $58 two years later.

Finally, McDonald’s pays a respectable dividend yield of 2.3% and has raised its dividend annually for the past 21 years, making it look like a solid buy-and-hold dividend play.

What is the Price Target for MCD Stock?

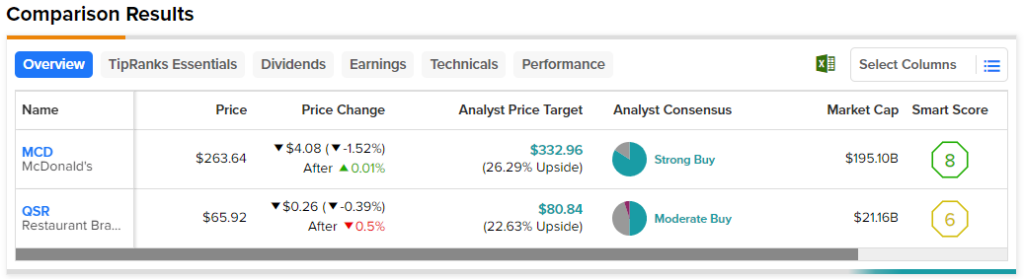

McDonald’s has a Strong Buy consensus rating based on 21 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $332.96, the average McDonald’s stock price target implies upside potential of 26.3%.

Restaurant Brands International (NYSE:QSR)

At a P/E of 20.5, Restaurant Brands International is trading at a discount to its fast-food peers and its five-year mean P/E of 25.7. However, despite its low valuation and solid fundamentals, the company’s stock-price action isn’t as strong as McDonald’s is, suggesting a neutral view could be appropriate, at least for now.

Restaurant Brands’ shares have been trending downward since late July and have rejected off the $70 level twice over the last 30 days. Additionally, the stock hasn’t been able to surpass $78 a share over the longer term, suggesting a possible price cap around that price. Looking to the past, Restaurant Brands shares are up just 33.8% over the last five years and 153.1% since their IPO in 2014 (when factoring in dividends).

Additionally, despite the company’s long-term earnings and revenue growth, its net income margin runs about half that of McDonald’s, with the former hovering around 15% in 2021, 2022, and for the last 12 months. On the other hand, McDonald’s has seen net income margins between 27% and 33% over the same timeframes.

Finally, Restaurant Brands does pay an attractive dividend yield of 3.3%, making it a potential dividend play. However, it has only increased its dividends for the past seven years, which is not a very long track record.

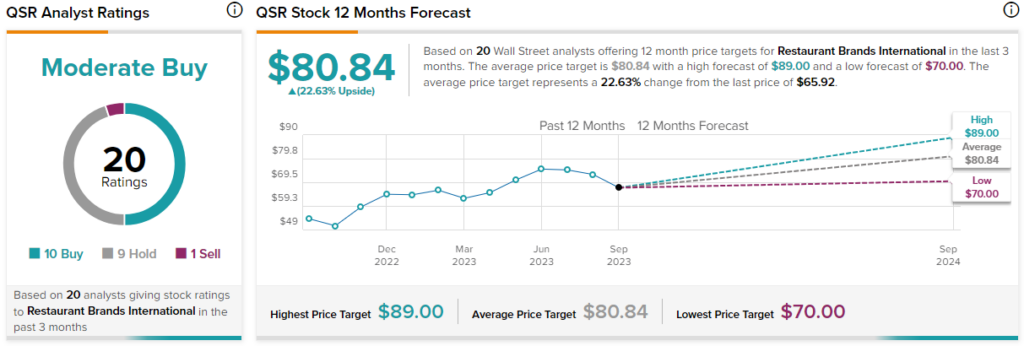

What is the Price Target for QSR Stock?

Restaurant Brands International has a Moderate Buy consensus rating based on 10 Buys, nine Holds, and one Sell rating assigned over the last three months. At $80.84, the average Restaurant Brands International stock price target implies upside potential of 22.6%.

Conclusion: Long-Term Bullish on MCD, Neutral on QSR

Both companies face potential reversals worth monitoring. For McDonald’s, the concern is the increased franchisee fee, which rose from 4% of sales to 5% of sales. The company hasn’t raised this fee in almost 30 years, so it will take time to see how much this increase affects its long-term results.

With Restaurant Brands, investors might want to watch for any potential breakout in its stock price. While McDonald’s is the clear winner due to its long-term track record and robust fundamentals, Restaurant Brands could become a buy at some point and may even be worth holding in a dividend portfolio.