Investors planning to invest in stocks may consider Mastercard (NYSE:MA). Shares of this payment-processing company are the top pick of leading hedge fund expert Chuck Akre of Akre Capital Management LLC.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

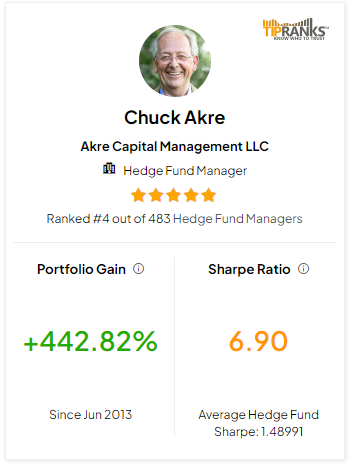

It’s worth mentioning that TipRanks provides a range of tools to help investors access expert insights for stock selection. One of them is the Top Hedge Fund Managers feature. This tool assesses hedge fund managers based on their average returns and success rates. According to the rankings, Chuck Akre is fourth among the 483 hedge fund managers evaluated by TipRanks.

Akre’s portfolio has demonstrated remarkable performance, gaining 442.82% since June 2013, with an average return of 19.15% in the last 12 months. Moreover, a significant portion of the hedge fund manager’s investments are concentrated in the financial sector (57.76%), followed by real estate (15.09%).

Given this context, let’s explore what the Street is saying about MA stock.

What is the Prediction for Mastercard?

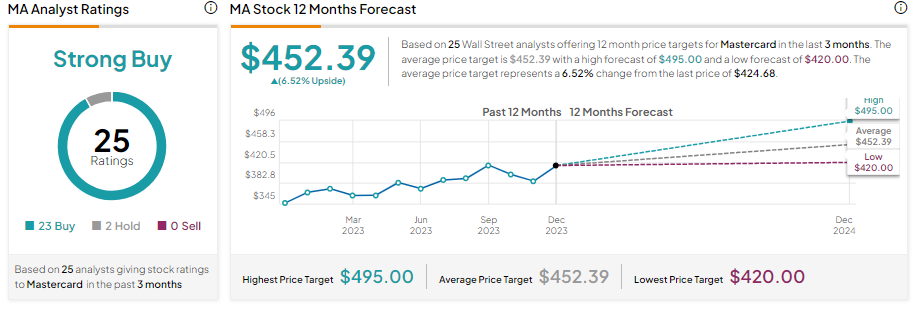

Despite macroeconomic and geopolitical uncertainty, Wall Street analysts are optimistic about Mastercard’s prospects. MA’s diversified business model positions it well to capitalize on the growth opportunities in the payments and services sector. Moreover, it continues to benefit from higher cross-border volumes due to the ongoing strength in travel and non-travel spending.

Tigress Financial analyst Ivan Feinseth reiterated a Buy on Mastercard stock on December 7. The analyst noted that consumer spending and global travel trends remain strong, which will drive growth in electronic payments. Moreover, increased demand for MA’s value-added services will drive its revenue, cash flows, and shareholders’ returns.

Including Feinseth, Mastercard stock has 23 Buys. Meanwhile, two analysts suggest Hold. Overall, MA stock has a Strong Buy consensus rating. Analysts’ average price target of $452.39 implies 6.52% upside potential.

Bottom Line

Akre’s success in delivering remarkable returns confirms the effectiveness of his portfolio allocation strategy, making him a valuable reference for investors seeking well-informed investment decisions. Furthermore, investors can use TipRanks’ additional valuable tools, including the Expert Center and Smart Score, for long-term investments.