Rising geopolitical tensions and increasing fears of potential disasters have sparked greater interest in what are called ‘debasement trades.’

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

While one immediate beneficiary is gold, as a commodity and as related stocks, cryptocurrencies, bitcoin especially, are also primed to gain. As the Ukraine war continues its slow simmer, as the Middle East war continues to burn, as China keeps rattling its saber over Taiwan, and as the US election predictions remain in the air, bitcoin stocks are looking more attractive.

The factor closest on the horizon is the election. No matter who wins, the fallout will give doomsayers on both sides reason to buy into perceived shelters such as crypto; from a regulatory perspective, a Trump win will likely be actively supportive of Bitcoin and its kin.

In the meantime, Wall Street analysts are looking at Marathon Digital (NASDAQ:MARA) and HIVE Digital Technologies (NASDAQ:HIVE), two of North America’s bitcoin mining firms, as potential gainers in the near term. Let’s take a closer look at them.

Marathon Digital Holdings

First up is Marathon Digital Holdings, the ~$5 billion bitcoin miner with operations in Texas, North Dakota, and Nebraska, as well as Paraguay and the UAE. Marathon, or Mara, boasts a total of 14 data centers in its operations, with 36.9 EH/s of energized computing capacity running on approximately 1 gigawatt of power. At its heart, this network is based on 267,798 bitcoin miner rigs.

On the financial side, Mara reported disappointing results in its last quarter, 2Q24. While revenues rose by 77.5% year-over-year to $145.1 million, the figure missed the forecast by almost $12 million. At the bottom line, Mara’s 72-cent EPS loss fell short of expectations by 63 cents per share.

This past month, however, the company reported sound operational gains. The 36.9 EH/s energized hash rate noted above reflects the 5% month-over-month increase recorded in the month of September. Also in September, Mara generated 705 bitcoins, up 5% from August, with an average production rate of 23.5 bitcoin per day. The company did not sell off any of its bitcoin holdings last month, and as of September 30 held 26,842 unrestricted bitcoin assets.

Mara’s combination of increasing revenue generation and consistent bitcoin production induced Cantor Fitzgerald analyst Brett Knoblauch to open his coverage of the stock with an upbeat stance. Knoblauch wrote of the company, “Like other publicly traded miners, MARA is a way to play Bitcoin. It owns more than 250k Bitcoin mining machines across its portfolio of owned and leased infrastructure totaling 1.1 GW. Historically, we viewed MARA as a sub-optimal way to play Bitcoin given its strategy of relying on third parties to host its machines. However, it has changed course and is now focused on owning and operating Bitcoin mining infrastructure, which we believe will allow MARA to meaningfully reduce its all-in cost to mine.”

The stock’s recent depreciation – MARA shares are down 28% this year – and its potential in an environment that favors increased bitcoin prices, lead Knoblauch to predict gain in the shares: “Ultimately, we see MARA benefiting from future Bitcoin price appreciation, and we believe the market under-appreciates profitability improvements MARA will deliver as it verticalizes the business, making shares attractive at current levels.”

With these upbeat comments, the analyst gives MARA shares an Overweight (i.e. Buy) rating, along with a $21 price target that points toward a one-year gain of 24% for the stock. (To watch Knoblauch’s track record, click here)

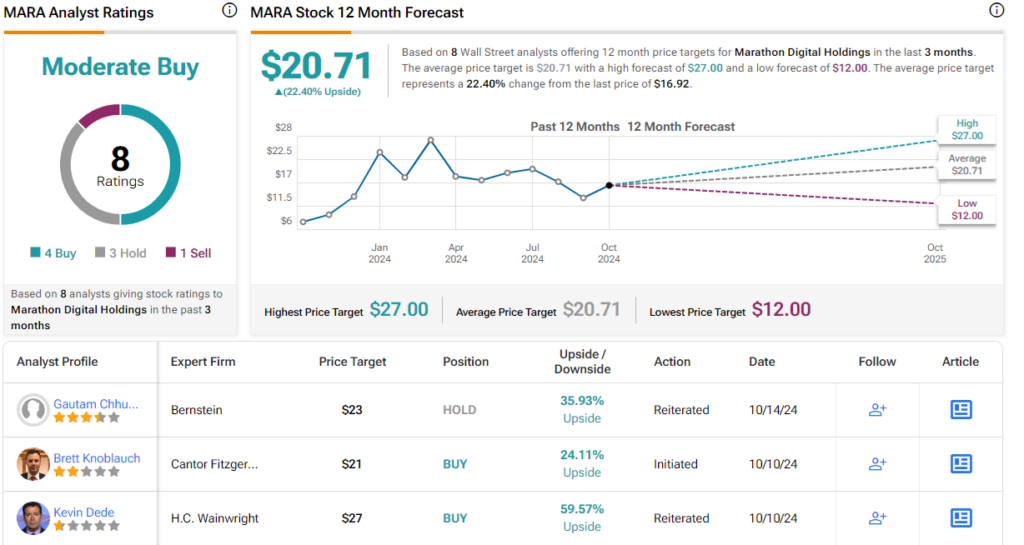

The Street’s consensus here is a Moderate Buy, based on 8 reviews that include 4 Buys, 3 Holds, and 1 Sell. The shares’ $20.71 average price target implies a 22.5% one-year gain from the $16.92 current trading price. (See MARA stock forecast)

HIVE Digital Technologies

The next stock on our list is HIVE Digital Technologies, a bitcoin miner that has found a key to diversifying the income stream – the tech needed to effectively mine bitcoin can be applied to other applications, such as high-capacity computing, cloud computing and AI, and can be leased out to third-party users. The company went public in 2017, making it the first crypto miner to do so.

HIVE operates its data centers in New Brunswick, Canada, in Sweden, and in Iceland. These locations all offer similar advantages: northern locations with cool, consistent climates, as well as ready sources of hydroelectric and geothermal power. The company has leveraged these advantages to build out data centers that combine high capacity with clean power. HIVE’s data centers operate a fleet of commercial-grade GPUs, approximately 38,000 strong and based on chip technology from Nvidia. HIVE rents out GPU servers to customers requiring high-performance computing and AI application capabilities.

In September, HIVE’s crypto mining operations generated 112 bitcoin, the same as in August, and held 2,604 bitcoin in its portfolio on September 30. The company had an average hash rate during the month above 5.3 EH/s, and finished the month with a rate of 5.6 EH/s.

HIVE’s total operations brought the company $32.2 million in revenue in fiscal 1Q25, the quarter ending on June 30 of this year. This was up 37% from the prior-year period, and was $5.16 million above the forecasts. The company’s EPS, 3 cents per share, was 4 cents better than expected. The company’s bitcoin mining ops generated $29.6 million in revenue, while the data center business brought in $2.6 million. HIVE mined 449 bitcoin during its first fiscal quarter.

For Northland analyst Mike Grondahl, HIVE offers a sound entry into high tech exposure. As he describes the company, “HIVE facilitates energy-efficient and sustainable Bitcoin mining operations via carbon-free energy sources (mainly hydroelectric) and is rapidly expanding into the HPC/AI/GPU data center space. We believe all segments operations (BTC Mining, GPU Rental, and HPC) are strategically positioned for continued growth building off recent notable announcements.”

This foundation gives HIVE sound potential for profitable operations, and Grondahl continues: “Using our FY26 revenue and adj. EBITDA estimates of $201.3M and $85.6M, respectively, HIVE trades at 1.0x EV/Revenue and at 2.1x EV/ Adj. EBITDA, while competitors are trading at much higher multiples. This presents an attractive investment opportunity. Given its consistent operational performance, low overhead, and industry-leading efficiency, HIVE’s current discount represents a nice entry point going into the second half of 2024 and into 2025. As the company gains more visibility with the Street and continues to deliver robust financial results, its valuation could improve, narrowing the gap with its higher-multiple peers.”

Quantifying his stance, the analyst puts an Outperform (i.e. Buy) rating on the stock, and complements that with a $5.50 price target, suggesting an upside potential of 65% on the one-year horizon. (To watch Grondahl’s track record, click here)

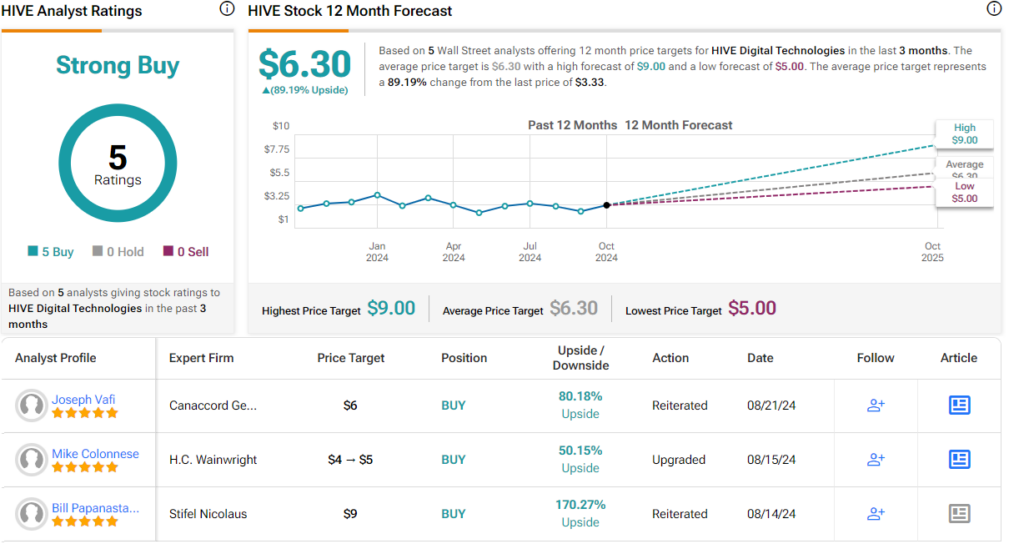

The Strong Buy consensus rating on HIVE shares is unanimous, based on 5 recent positive analyst reviews. The shares, priced at $3.33, have a $6.30 average price target suggesting an 89% upside potential for the next 12 months. (See HIVE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.