Things have not gone too well for PayPal (NASDAQ:PYPL) recently. In a year when tech stocks have shined, the shares have declined by 17%, continuing a slide that began back midway through 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The depressed share price is a reflection of real-world woes with the business showing delectation in the post-Covid landscape as revenue growth and new active accounts adds have declined.

The company has also had to contend with finding a new CEO after Dan Schulman announced in February that he will be leaving the post he has held since 2014. C-suite shuffles often cause unrest amongst investors but as the company announced last month that Intuit exec Alex Chriss will become the new CEO on September 27, Deutsche Bank analyst Bryan Keane thinks attention can now “return to the multiple areas of PYPL’s business that need a course correction in order to get the stock to work again.”

As PayPal is facing headwinds not only from the rapid growth of low-margin unbranded volumes, but also from pricing pressure in the core Branded business, chief amongst those priorities, says Keane, will be reversing the drop in transaction take rates.

“We believe that ‘net transaction take rate’ (i.e., transaction revenues less transaction expense, normalized for hedges and merchant contractual compensation, over TPV) is the most representative metric of PYPL’s overall pricing power and has fallen precipitously over the past few years with a -12% Y/Y contraction to 0.79% in 2Q23,” Keane explained.

In fact, the result of the material decline in net take rate has been 6 straight quarters of negative growth in PayPal’s core transaction-based business.

Moreover, even as the company has reaped the benefit of better-than-anticipated eCommerce trends so far this year, the prospect of further market share loss is real and the new CEO will need to “find a way to stem these losses without conceding further on net take rates.”

So, what does it all mean for investors? Bottom-line, Keane must believe PYPL has what it takes to get back on track; his rating remains a Buy while his $80 price target suggests shares will generate returns of 29% over the one-year timeframe. (To watch Keane’s track record, click here)

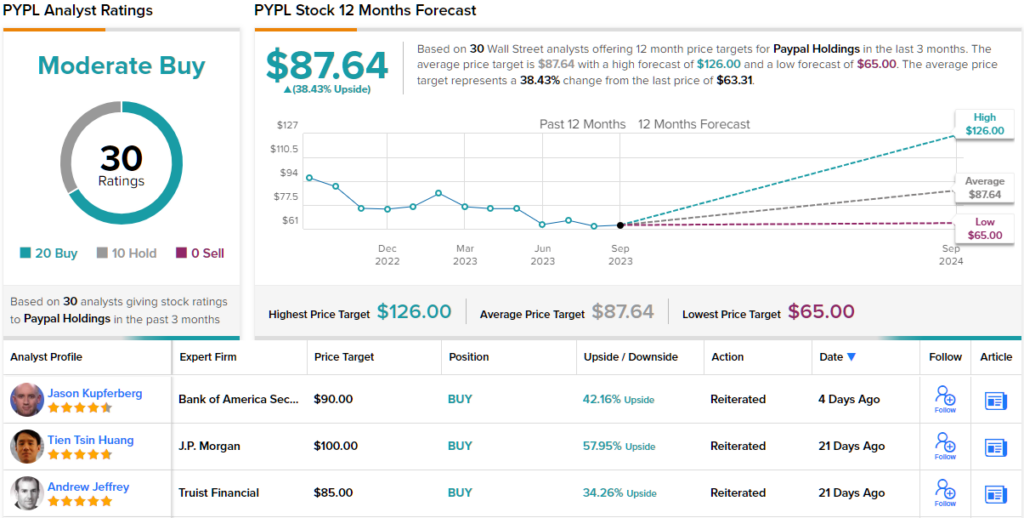

Overall, PayPal has no fewer than 30 recent analyst reviews on file. These break down 20 to 10 favoring the Buys over Holds, supporting the Moderate Buy consensus rating. The shares are selling for $63.32 and their $87.64 average price target suggests ~38% upside potential for the coming year. (See PayPal stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.