In this piece, I evaluated two live entertainment stocks, Live Nation Entertainment (NYSE:LYV) and Eventbrite (NYSE:EB), using TipRanks’ comparison tool to determine which is better.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Live Nation Entertainment promotes, operates, and manages ticket sales for live entertainment in the U.S. and abroad. It was created from the merger of Live Nation and Ticketmaster. Eventbrite is an event management and ticketing website that enables users to browse, create, and promote local events.

Live Nation is up 41% year-to-date, erasing the plunge that started last fall and lasted until about May, and the stock is only up about 5.7% over the last year. Meanwhile, Eventbrite has gained 72.9% year-to-date, although it has yet to finish recovering from a similar plunge, as its shares are down 10.5% over the last year.

The U.S. movies and entertainment industry is trading at a price-to-sales (P/S) ratio of 2.4, which is significantly lower than the three-year average of 4.1. Live Nation is profitable and trading at a P/E of 146.4, but Eventbrite is not. Thus, we’ll look at the P/S to compare valuations.

Eventbrite’s P/S stands at 3.8, making Live Nation’s P/S of 1.25 look significantly undervalued. However, as with many pricing inefficiencies on Wall Street, there is more to the story.

Live Nation Entertainment (NYSE:LYV)

Live Nation’s five-year mean P/S is 4, so it also looks steeply undervalued versus its own history. However, it’s been dealing with angry concertgoers, bad press, and a class-action lawsuit. Additionally, Live Nation is carrying quite a lot of debt and is only barely profitable despite reporting $18 billion in revenue for the last 12 months. Despite the sell-off, a neutral view seems appropriate.

Of chief concern are the company’s debt and low net income. Live Nation recorded only $343 million in net income on $18 billion in revenue over the last 12 months. Meanwhile, it reported free cash flow of $1.39 billion for the last 12 months, and it issued $1.1 billion in debt over the last 12 months.

With the rising interest rates, this hasn’t been a particularly good time to take on new debt, although some companies have been forced to refinance some of their debt. Live Nation did have $9.4 billion in total current liabilities over the last 12 months.

The class-action lawsuit filed by concertgoers who accused the company of using its dominant market position was dismissed in February. An appeals court ruled that concertgoers had forfeited their right to sue when they purchased their tickets, forcing their complaints into private arbitration rather than open court. While this lawsuit may be over, it may be an indicator of a wider problem if more performers join Taylor Swift in catalyzing their fans against Ticketmaster.

What is the Price Target for LYV Stock?

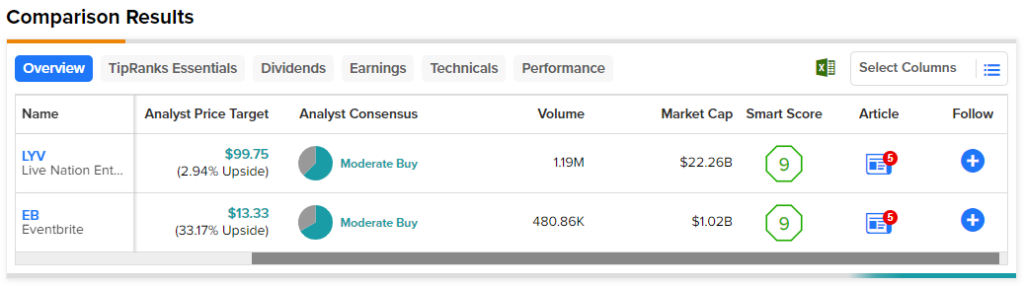

Live Nation Entertainment has a Moderate Buy consensus rating based on four Buys, two Holds, and zero Sell ratings assigned over the last three months. At $94.67, the average Live Nation Entertainment stock price target implies upside potential of just 1%.

Eventbrite (NYSE:EB)

Eventbrite is a much smaller company than Live Nation, and its focus on local events represents a massive difference. The company’s fundamentals are trending in the right direction, although its lack of profitability is a concern, suggesting a neutral view may be appropriate.

While Eventbrite looks overvalued versus its current industry P/S ratio, its current P/S of about four is in line with the industry’s three-year average, and it’s trading below its five-year mean P/S of 7.2. Critically, the company has little debt compared to Live Nation and hasn’t issued much new debt over the last 12 months. Eventbrite’s net income margin displays narrowing losses, improving from -74% in 2021 to -21% in 2022 and -18% in the last 12 months.

On average, analysts expect Eventbrite to post its final loss in 2024 and then generate a profit of $14 million in 2025, so this stock could be one to watch. If that timeline turns out to be accurate and the company’s fundamentals continue to move in the right direction with steadily narrowing losses, Eventbrite could earn a bullish view in another year or so.

What is the Price Target for EB Stock?

Eventbrite has a Moderate Buy consensus rating based on two Buys, one Hold, and zero Sell ratings assigned over the last three months. At $13.33, the average Eventbrite stock price target implies upside potential of 33%.

Conclusion: Neutral on LYV and EB

Although both companies earn neutral ratings, there are some critical differences between them. Live Nation is much larger and has a virtual monopoly with Ticketmaster, but its fundamentals and debt position are poor. In fact, Live Nation’s debt/equity ratio stands at over 1,060% for the last 12 months.

Meanwhile, Eventbrite is unprofitable, but its fundamentals are moving in the right direction, suggesting this stock could be one to watch over the next year.