Consumers have been hit by a non-stop storm of inflation and macro headwinds these days. Still, the following trio of “experiences” stocks — LYV, SEAS, and DRI — continues to be viewed favorably by most Wall Street analysts, even if recent action in the stocks suggests a consumer turnaround is still a long way off.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For investors with patience, I see real value to be had in some of the market’s top “experience” plays. At the end of the day, younger consumers (Millennials in particular) tend to value experiences over possessions, and once they’re ready to spend again, I’d look for the following consumer stocks to heat up the quickest.

Therefore, let’s use TipRanks’ Comparison Tool to have a closer look at these three Strong Buy-rated experiential consumer stocks.

Live Nation Entertainment (NYSE:LYV)

Live Nation is quite possibly the best experience play on the market. It’s a company that’s behind many of the biggest live entertainment events out there. The stock shed more than 47% of its value from peak to trough as a part of the brutal 2022 market sell-off. More recently, shares have been in recovery mode, surging around 46% before suffering a 12% correction.

I view the correction as a great opportunity to punch your ticket into the name as concert demand continues to stay hot, perhaps well after the summer season ends. For now, I remain bullish on LYV stock.

Undoubtedly, it’s been a great year for live music, with plenty of big-name artists on tour to help meet the pent-up demand that built up during the early years of the pandemic. Though many consumers have likely had a chance to scratch their concert itches over the past year, many bullish analysts don’t think experience-driven concert-goers are going into hibernation anytime soon.

Guggenheim Securities analyst Curry Baker — who has a $124.00 price target on LYV (implying 44% upside) — sees “no signs” of consumers pulling back.”

I’m with Mr. Baker on this one. Live Nation stock may be on the expensive side (87.5 times trailing price-to-earnings, well above the entertainment industry average of 41.4 times). That said, it’s where you want to be as consumer-spending looks to recover while a powerful secular tailwind (Millennials and their preference to spend money on great experiences) looks to regain the driver’s seat.

What is the Price Target of LYV Stock?

Live Nation is a Strong Buy, with 10 Buys and three Holds assigned by analysts in the past three months. The average LYV stock price target of $109.25 implies 26.9% upside potential.

SeaWorld Entertainment (NYSE:SEAS)

If Live Nation is the experience stock to play the strength of young consumers (Millennials and Gen Z), SeaWorld is the ultimate family-oriented experience play. The stock has been on a wild ride, now 30% off its all-time highs to lows not seen since 2021. Indeed, the underwhelming second quarter is acting as an overhang on the stock. The quarterly results were weighed down by unfavorable weather conditions, including horrid smoke blown in from Canadian wildfires.

As such transitory issues subside while consumer sentiment has a chance to improve, I view SeaWorld as a standout value play in the entertainment space. At writing, shares of SEAS trade at 12.9 times trailing price-to-earnings, substantially below the 41.4 times entertainment industry average. I stand with the many upbeat analysts and am staying bullish on the stock.

Though most analysts remain upbeat after the second-quarter flop, recent price target downgrades have been flowing in this month. Recently, Deutsche Bank (NYSE:DB) analyst Chris Woronka cut his price target to $77 from $84. The latest quarter, which saw earnings per share of $1.35 fall shy of the $1.68 estimate, was unencouraging. That said, a $77 target still entails a gain of more than 50% from current levels. That’s close to a Street high!

What is the Price Target of SEAS Stock?

SeaWorld is a Strong Buy on TipRanks, with seven Buys and one Hold. The average SEAS stock price target of $69.43 implies 40% upside potential.

Darden Restaurants (NYSE:DRI)

Darden is a dine-in restaurant operator that recently slipped 6% from its all-time high just north of $173 per share. Undoubtedly, fancy restaurants like Ruth’s Chris Steak House (a recent buy for Darden) and family-friendly eateries like Olive Garden make for a great night out for young consumers seeking a better experience than ordering takeout.

Like the other consumer discretionary plays in this piece, it’s not hard to imagine that there’s still plenty of pent-up demand for eating out in spite of mounting macro headwinds. As such, I’m staying bullish on DRI.

Looking ahead, I’d look for restaurant traffic to remain robust as the company beckons consumers with competitive prices. Previously, CEO Rick Cardens noted Darden is raising prices at a slower pace than inflation. The move may nibble away at margins over the medium term but could help the firm gain ground over its competitors.

With such great brands and the ability to turn inflation in its favor, I view the 20.2 times trailing price-to-earning multiple as well worth paying. The multiple is far lower than the restaurant industry average of 28.9 times.

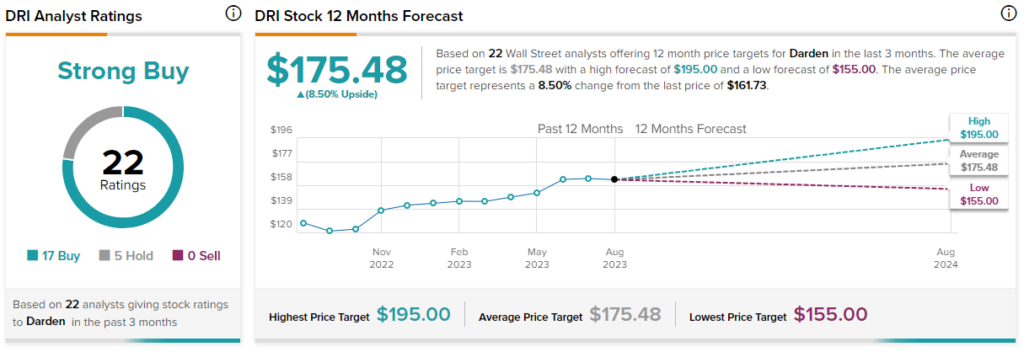

What is the Price Target of DRI Stock?

Darden is a Strong Buy on TipRanks, with 17 Buys and five Holds assigned by analysts in the past three months. The average DRI stock price target of $175.48 implies 8.5% upside potential from here.

Conclusion

The following trio of experience stocks are intriguing options to play a consumer comeback. Of the three names, analysts expect the most upside (40%) from SEAS stock.